AIA is the first to bring a bespoke sustainable thematic fund from Robeco to the Singapore ILP market

AIA Sustainable Multi-Thematic Fund is differentiated by its focus on delivering measurable and positive impact

SINGAPORE - Media OutReach - 24 November 2022 - AIA Singapore today launched the AIA Sustainable Multi-Thematic Fund, making it the first bespoke sustainable thematic fund in Singapore for investment-linked products (ILPs).The sustainability fund will be available to customers through AIA's comprehensive ILP offerings. It is also the first sustainability fund AIA has launched in Singapore.

Liu Chun Yen, Chief Investment Officer, AIA Singapore and member of the Sustainability in Insurance Committee (SIC) in Singapore says, "We are seeing increasing understanding on the importance of integrating sustainability factors into customers' portfolio selection and investment decisions. The AIA Sustainable Multi-Thematic Fund is managed by Robeco, a leading Netherlands-based investment firm that has been at the forefront of sustainable investing. Robeco stands out for its commitment to driving real-world impact across key sustainable themes while delivering long-term financial returns."

Robeco is recognised for their leading expertise in sustainable and thematic investing[1]. Robeco actively collaborates with financial institutions as part of their commitment to making financial markets more sustainable.

Nayan Patel, CEO of Robeco Singapore says, "We are delighted to work with AIA in launching the AIA Sustainable Multi-Thematic Fund for the Singapore ILP market. Robeco has been a leader in sustainable investing since 1995. In the past years, we have seen the growing number of investors adding impact goals to their financial objectives in their investment portfolios. Robeco is among the first asset managers to consider the real-world impact while capturing the investment opportunities from sustainable themes. In working with partners such as AIA, who are also committed to a more sustainable world, we will help to bring diversified impact investing to more ILP investors."

Colin Graham, Head of Multi-Asset Strategies Robeco says, "The AIA Sustainable Multi-Thematic Fund offers investors a genuinely ambitious way of gaining exposure to the most significant sustainability themes of our time. All this in one diversified global equity portfolio. Robeco have been pioneers in thematic investing since the launch of our Sustainable Water Equities fund in 2001, one of the world's first sustainable water strategies. So, our thematic fund range brings a new dimension to traditional wealth managers' equity fund selection, focusing on value chains and product life cycle. AIA, in partnership with Robeco, is thinking beyond the traditional sector/region equity framework and are offering diversification through a combination of high conviction thematic strategies."

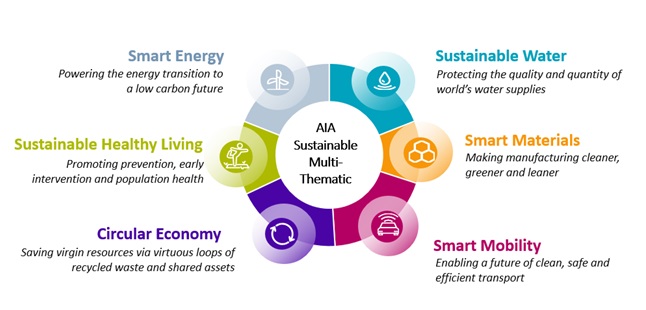

The sustainability fund aims to outperform the MSCI World Index (Net Return) by pursuing investable themes that benefit from sustainability megatrends and which actively address social and environmental challenges, taking into account their real-world positive impact. The fund is focused on companies that contribute positively to one or more of the six themes, which include Sustainable Healthy Living, Smart Energy, Sustainable Water, Smart Materials, Smart Mobility and Circular Economy. The fund also seeks to manage market volatility through portfolio construction that optimises risk-adjusted return to provide stable long-term performances.

The bespoke multi-thematic fund consists of underlying strategies focused on sustainable outcomes.

Growing interest in sustainable investing

Sustainability is increasingly factored into investment-making decisions as more Singaporeans are beginning to understand the importance of environmental, social and governance (ESG) principles. In a recent survey conducted by the industry, it was found that 82 per cent of Gen Z and about 65 per cent of young millennial investors have ESG investments[2]. More and more investors are seeking financial products and services that are aligned to their personal values.

In a 2022 Singapore survey by WealthLens™ [3], it was revealed that nearly four in five of respondents (86 per cent) have sustainable investing and/or ESG funds in their investment portfolio. The survey also shared that close to half of respondents (47 per cent) are only interested to invest in companies with good ethical policies.

Commitments to the local community

AIA Singapore has also been ramping up its sustainability efforts in the local community. The company established the AIA Better Lives Fund in 2021 to help raise funds for children, youths, and families in need. The funds raised will go toward creating greater access and opportunities for education, growth, and development. These initiatives are part of the AIA One Billion movement which aims to engage a billion people across the region to live Healthier, Longer, Better Lives by 2030.

In 2021, AIA Singapore pledged S$5 million to the National Parks Board's (NParks) registered charity and Institution of Public Character (IPC), the Garden City Fund, with the goal of planting 16,666 trees in Singapore's parks and nature areas over five years. This is the largest contribution by an organisation to the OneMillionTrees movement and Garden City Fund's Plant-A-Tree programme, to date.

As part of AIA Singapore's Green Pledge to help create more urban green spaces across the city, the company will plant a tree for each customer who purchases from a select range of AIA investment-linked products[4] from 24 November 2022 to 31 December 2023 and invests in the AIA Sustainable Multi-Thematic Fund for a period of at least six months.

For more information on the AIA Sustainable Multi-Thematic Fund, please visit: https://www.aia.com.sg/en/help-support/funds-information/aia-sustainable-multi-thematic-fund.html

Hashtag: #AIA

The issuer is solely responsible for the content of this announcement.

About AIA

The business that is now AIA was first established in Shanghai more than a century ago in 1919. It is a market leader in Asia (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$330 billion as of 30 June 2021.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia, AIA serves the holders of more than 39 million individual policies and over 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code "1299" with American Depositary Receipts (Level 1) traded on the over-the-counter market (ticker symbol: "AAGIY").

About Robeco

Robeco is a pure-play international asset manager founded in 1929 with headquarters in Rotterdam, the Netherlands, and 16 offices worldwide. A global leader in sustainable investing since 1995, its integration of sustainable as well as fundamental and quantitative research enables the company to offer institutional and private investors an extensive selection of active investment strategies, for a broad range of asset classes. As at 30 June 2022, Robeco had EUR 178 billion in assets under management, of which EUR 171 billion is committed to ESG integration. Robeco is a subsidiary of ORIX Corporation Europe N.V.

1. Hong Kong SAR refers to Hong Kong Special Administrative Region.

2. Macau SAR refers to Macau Special Administrative Region.