Andrew Leigh maps the drivers of history’s big breakthroughs — and why they still matter

- Written by Martie-Louise Verreynne, Professor in Innovation and Associate Dean (Research), The University of Queensland

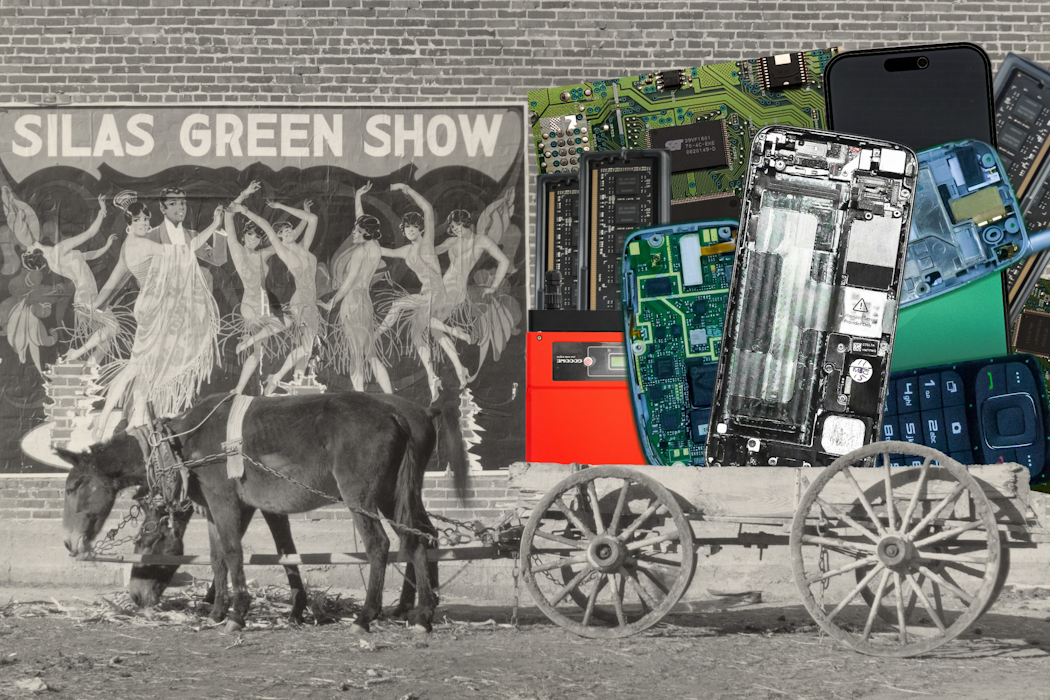

Suraj Rai & Digit, CC BY

Suraj Rai & Digit, CC BYInnovation is one of the most celebrated yet misunderstood ideas of our time. It is invoked in policy speeches, corporate strategy decks and university mission statements. But strip away the buzzword and what remains?

In The Shortest History of Innovation, economist and federal MP Andrew Leigh offers an accessible,...