CPA Australia: Nearly seven in ten Hong Kong small businesses expect growth amid cybersecurity threats

HONG KONG SAR - Media OutReach Newswire - 23 April 2024 - CPA Australia's Asia Pacific (APAC) Small Business Survey 2023-24 shows Hong Kong small businesses have growing confidence in their business and the economy, while facing increased cybersecurity risks.

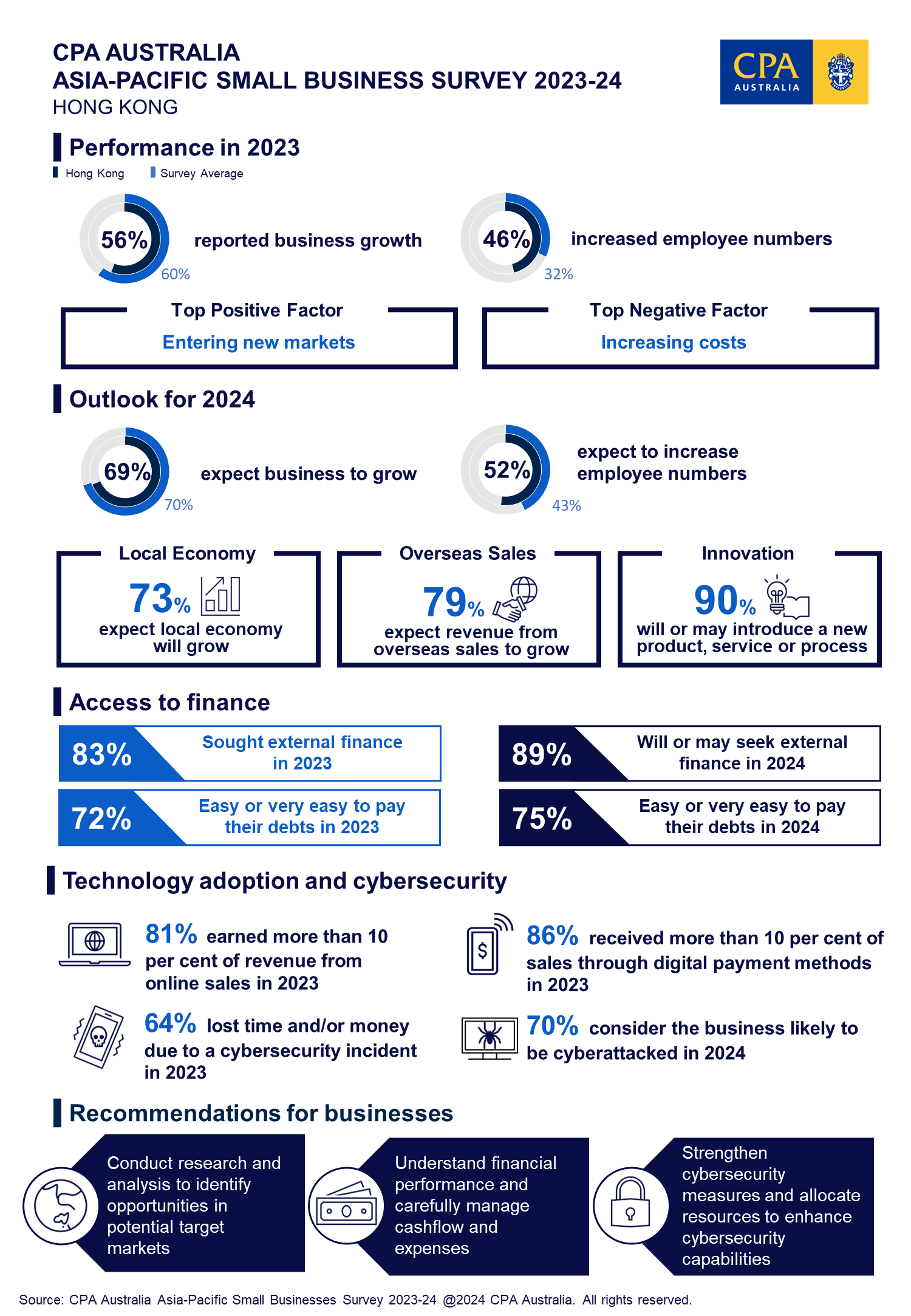

The survey results show that 69 per cent of small businesses in Hong Kong anticipate growing in 2024. The survey further reveals increased confidence in the local economy, with 73 per cent expecting it to grow this year. However, Hong Kong ranked top among surveyed APAC markets on the expected threat of a cyber-attack.

CPA Australia's annual survey collected views from 4,222 small businesses in 11 markets across the Asia-Pacific region, including Singapore, Mainland China and Australia to understand their business performance and outlook. The survey included 324 respondents from Hong Kong. With 56 per cent of surveyed businesses reporting growth in 2023, many Hong Kong small businesses are confident and benefiting from the gradual revival of the local economy.

Mr Cliff Ip, Divisional President of CPA Australia 2024 in Greater China explained, "Bolstered by an improving economy and various government support programs, ranging from an accommodating financing environment to schemes promoting digitalisation and marketing, Hong Kong small businesses made a steady recovery last year and most project a mild expansion in 2024."

Hong Kong respondents were most likely to nominate entering new markets as the factor that made the most positive contribution to their business in 2023. This pioneering spirit is expected to continue this year, with 79 per cent of respondents expecting revenue from overseas sales to grow, compared to the survey average of 50 per cent.

"An increasing adoption of e-commerce and digital tools enabled many small businesses in Hong Kong to capitalise overseas opportunities," Ip said, "Besides, Hong Kong small businesses have developed a strong innovation culture in recent years, giving them a competitive advantage to promote and sell their new products and services outside Hong Kong."

Business growth and market expansion created new jobs in the small business sector. Forty-six per cent of Hong Kong small businesses increased their number of employees last year, beating the survey average of 32 per cent. This strong hiring intention is expected to persist into 2024, with 52 per cent expecting to add to their headcount.

However, increasing costs to cover activities in new markets and local operations became the most detrimental factor to their businesses last year, which most likely contributed to their strong demand for external financing. Eighty-three per cent of surveyed small businesses sought funds in 2023. The most common reasons were to purchase capital assets and support business growth. Eighty-nine per cent will or may seek external funds this year, with covering increasing expenses the most cited reason.

Ip stated, "The main purposes of financing shifted from survival in 2022 to purchase capital assets and buttress growth in 2023. This change illustrated that many resilient SMEs had overcome the economic downturn and rebounded at full speed after normalcy."

Seventy-six per cent of respondents perceived obtaining external financing as an easy task in 2023, and 74 per cent expect this favourable financing condition to persist in 2024.

"HKSAR Government's effort to ease the financing conditions such as the SME Financing Guarantee Scheme ("SFGS") have made it relatively easier for eligible applicants to obtain financing from banks. In this year's Budget, the government has further extended the application period for the 80 per cent and 90 per cent Guarantee Product under the SFGS. The recent measures introduced by the Hong Kong Monetary Authority also prioritise expediting applications for these products, assisting small businesses in obtaining the necessary funding for their further development."

Prevalence of technology adoption among small businesses in Hong Kong is another growth driver. Last year, 81 percent of Hong Kong's small businesses received over 10 per cent of their revenue from online sales, outstripping counterparts in other markets and up enormously from 43 per cent in 2019. Another 86 per cent of respondents indicated that over 10 per cent of revenue were received through digital payment methods, a remarkable increase of over 30 percentage points compared to 2019.

"Changing consumer behaviour and a series of government schemes supporting digitalisation such as Technology Voucher Programme have undoubtedly driven this transformation. The offering of E-consumption vouchers in each of the past three years, alongside the gradual adoption of online shopping and food ordering habits, has compelled small businesses to undergo digital transformation to stay relevant and competitive in the market."

Yet, rapid digitalisation has triggered cybersecurity risks. Alarmingly, 64 per cent of surveyed businesses indicated that they had lost time and/or money due to cybersecurity incidents last year and seven-in-ten concerned about the potential cyberattacks in 2024, both results were the highest of the APAC surveyed markets.

"Threats from cyberattacks such as phishing attacks have caused direct losses. Though two-third of surveyed respondents have recently reviewed their cybersecurity protections, business owners must keep allocating resources on enhancing tools to protect data and information, providing staff training, and consult with IT experts." Ip reminded.

Hashtag: #CPAAustralia #HongKong #Business #Economic #SMEs #Technology #Cybersecurity #HR

https://www.cpaaustralia.com.au/

The issuer is solely responsible for the content of this announcement.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with more than 172,000 members in over 100 countries and regions, including more than 22,200 members in Greater China. CPA Australia has been operating in Hong Kong since 1955 and opened our Hong Kong office in 1989. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on issues affecting the accounting profession and the public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au