NZ Budget 2025: tax cuts and reduced revenues mean the government is banking on business growth

- Written by Adrian Sawyer, Professor of Taxation, University of Canterbury

Not a lot is known about the government’s plans for taxes in the 2025 budget. Few tax policies have been announced so far, and what has been revealed involves targeted tax cuts for business interests.

This is a big change from last year’s tax announcements, which were largely focused on individuals[1].

So far this year, the government has announced tax policies to encourage overseas investment[2] and to make employee share schemes for start-ups and unlisted companies more attractive.

This week, the government also announced the demise of the Digital Services Tax[3] – which Treasury estimated would be worth more than NZ$100 million a year – after threats of retaliation from US President Donald Trump.

But each of these policies would result in a drop in tax revenue. That raises a key question: where will the money to run the government come from when two successive budgets have included tax revenue cuts?

Overseas money for investment

This month, the government announced a commitment of $75 million over the next four years[4] to encourage foreign investment in infrastructure and make it easier for startups to attract and retain high quality staff.

Broken down, this would be $65 million for a change to the rules around “thin capitalisation”, pending the outcome of consultation on the details. At a basic level, this policy is targeting how much debt companies with overseas subsidiaries can have when investing in New Zealand infrastructure.

The other $10 million is earmarked as a deferral of tax liability for some employee share schemes to help startups and unlisted companies.

The goal of both policies seems to be to encourage international investment in New Zealand to boost growth in our otherwise sluggish economy.

No digital services tax

The demise of the digital services tax is the other big tax policy to be announced ahead of today’s budget.

Left over from the previous Labour government, the policy would have applied a 3% tax on digital services revenue earned from New Zealand customers by global tech giants such as Meta, X and Google (many of which are based in the US).

But Donald Trump has been highly critical of these sorts of levies, describing them as overseas extortion. Revenue Minister Simon Watts has admitted Trump’s objections were part of the decision[6] to scrap the tax.

While the government will save the money set aside in last year’s budget for administrative costs, the potential tax revenue will be a big loss. Treasury had previously forecast New Zealand would gain $479m in tax revenue from the levy[7] between 2027 and 2029.

But Watts said, “the forecast revenues from the introduction of a Digital Services Tax no longer meet the criteria for inclusion in the Crown accounts”.

A hole in revenue

When it comes to tax, the pre-budget announcements will all involve costs to the government or drops in revenue.

There are rumours the budget will include changes to the companies tax. But, if anything, this will be a drop in the amount of tax companies pay. So again, a drop in tax revenue.

The challenge facing the government is where the money to operate comes from. And the choices it has are limited.

Firstly, it could increase tax elsewhere. But that would require either a reversal of last year’s income tax cuts, or the long-standing policy not to target wealth – such as with a capital gains tax.

Or, the government could make drastic cuts to spending. And, considering the announcement that this year’s budget would be tight[8], with over a $1 billion cut from the government’s discretionary operating spending (known as an operating allowance), this seems to be the path they have taken, at least partially.

The final option would be to borrow now to boost infrastructure and business investment in the hope that resulting economic growth will generate greater revenue later.

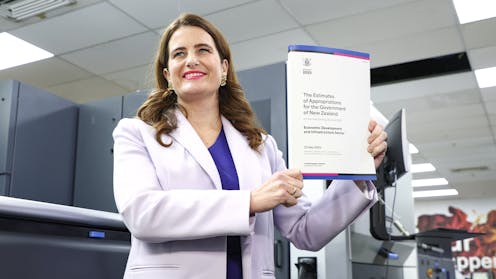

We won’t know the answers to these questions until Budget 2025 is released, and there have been a lot of mixed messages. Considering Finance Minister Nicola Willis has dubbed this a “Growth Budget”, however, it seems likely the focus will be on encouraging investment and growth through business activity, rather than any tax increases.

References

- ^ focused on individuals (budget.govt.nz)

- ^ encourage overseas investment (www.beehive.govt.nz)

- ^ Digital Services Tax (www.nzherald.co.nz)

- ^ $75 million over the next four years (insidegovernment.co.nz)

- ^ Hagen Hopkins/Getty Images (www.gettyimages.com.au)

- ^ Trump’s objections were part of the decision (www.newstalkzb.co.nz)

- ^ gain $479m in tax revenue from the levy (www.nzherald.co.nz)

- ^ this year’s budget would be tight (theconversation.com)

Authors: Adrian Sawyer, Professor of Taxation, University of Canterbury