How can Australia pay $368 billion for new submarines? Some of the money will be created from thin air

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Australia’s decision to buy three nuclear-powered submarines and build another eight is so expensive that, for the A$268 billion to $368 billion price tag, we could give a million dollars to every resident of Geelong, or Hobart, or Wollongong.

Those are the sort of examples used by former NSW treasury secretary Percy Allan on the Pearls and Irritations[1] blog, “in case you can’t get your head around a billion dollars”.

Such multi-billion megaprojects[2] almost always go over budget.

For instance, when Prime Minister Malcolm Turnbull announced the Snowy Hydro 2.0 pumped hydroelectricity project in 2017, it was supposed to take four years and cost $2 billion[3]. The latest guess is it’ll actually take 10 years and cost $10 billion[4].

So to pay for those two megaprojects alone, there’s an awful lot of money we will need to find from somewhere. Or will we?

‘No simple budget constraint’

In the first year of the pandemic, Australians were given a glimpse of a truth so unnerving that economists and politicians normally keep to themselves.

It’s that, for a country like Australia, there is “no simple budget constraint” – meaning no hard limit on what we can spend.

“No simple budget constraint” is the phrase used by Financial Times’ chief economics commentator Martin Wolf[5], but he doesn’t want it said loudly.

The problem is, he says, “it will prove impossible to manage an economy sensibly once politicians believe there is no budget constraint”.

A quick look at history shows he is correct about there being no simple budget constraint, despite all the talk about the need to pay for spending.

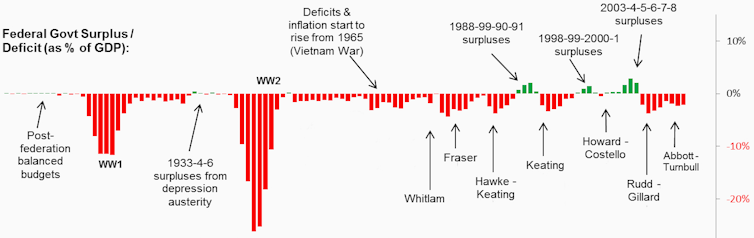

As you can see below, Australia’s Commonwealth government has been in deficit (spent more than it earned) in all but 17 of the past 50 years. The US government has been in deficit for all but four[6] of the past 50.

Commonwealth government surpluses and deficits since 1901