What a Labor Government means for housing affordability and the Australian property market

- Written by Corelogic

Housing was a defining issue of this month’s Federal Election and the Labor party’s win brings with it a raft of policy measures designed to address the property market’s biggest issues.

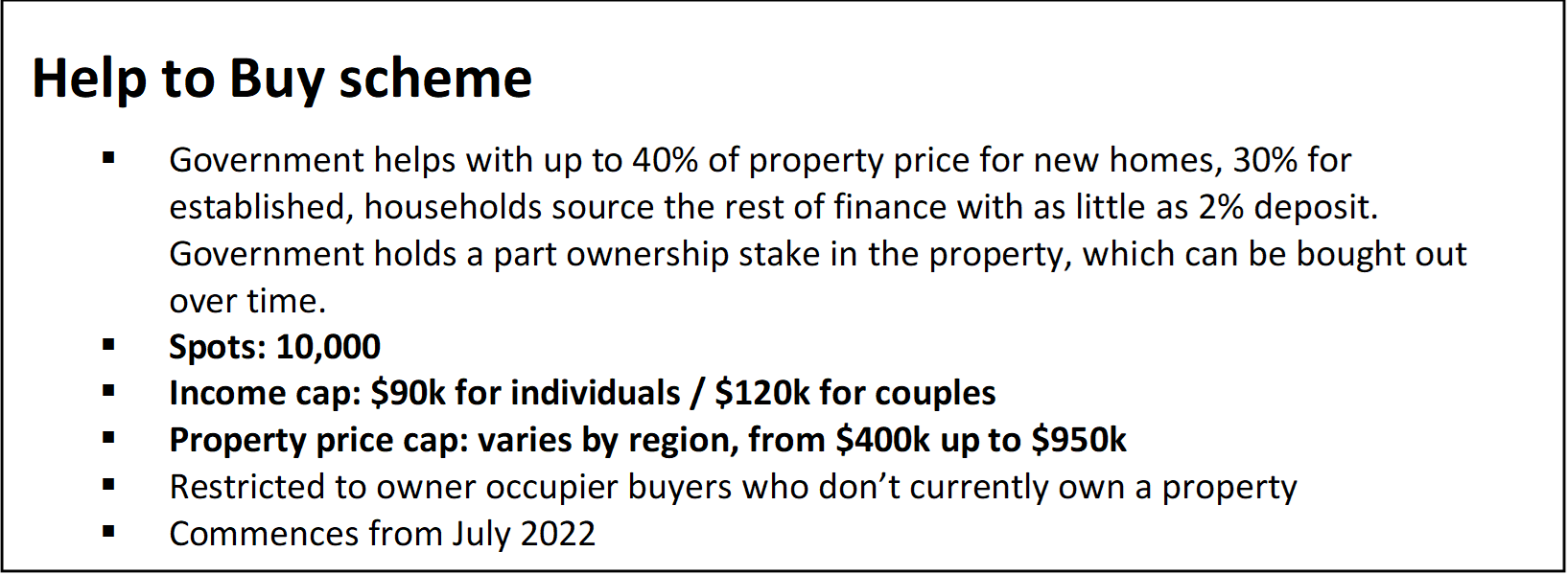

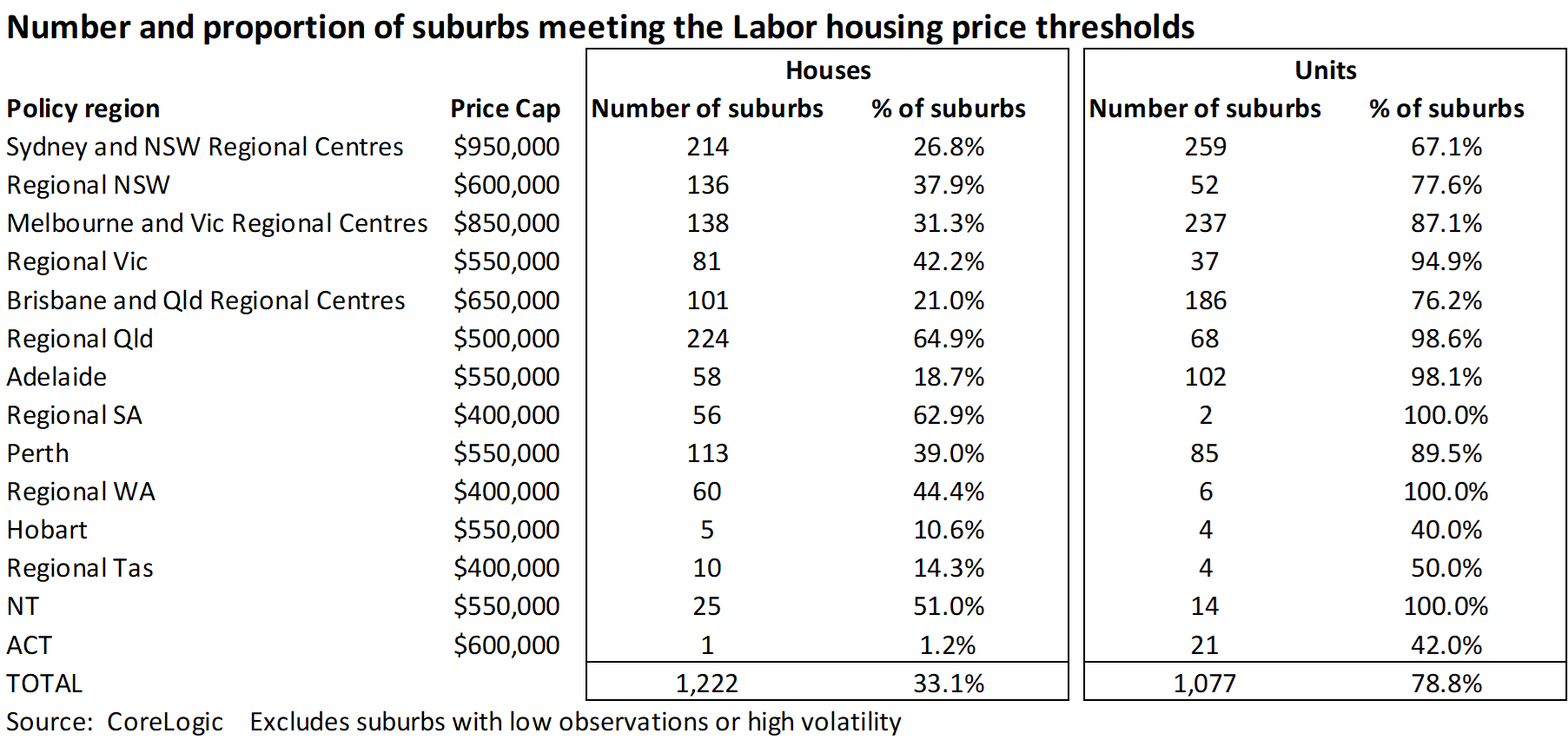

In wrapping up the Labor Government’s initiatives, CoreLogic’s Research Director Tim Lawless says the headline ‘Help to Buy’ scheme is likely to be popular with prospective home buyers, as it provides a more affordable entry point to the Australian housing market for those individuals on low-to-mid level incomes.

Mr Lawless said this will contribute to more equality in rates of home ownership across income cohorts, and could create more opportunities for key workers to live in more central areas.

“Being able to share up to 40% of the purchase price with the government, along with only a small deposit and opportunity to save on lenders mortgage insurance, helps to overcome several of the hurdles of home ownership,” he said.

“Keeping in mind buyers will still have to fund their transactional costs, including stamp duties, legal costs and bank fees.”

With a cap of 10,000 places, the scheme could be quickly oversubscribed as prospective Australian home buyers take advantage of the leg up into the housing market.

Mr Lawless highlights the First Home Loan Deposit scheme, which saw the first 10,000 places of the scheme allocated within six months. He notes however places for new homes were not taken up as quickly, and building constraints/high construction costs could deter the uptake of a shared equity scheme for new homes.

“Having said that, a higher interest rate environment, which may see lower prices, could make people more cautious of buying, reducing demand for the scheme in the short term,” he said.

“Historically, residential transaction activity correlates with property price movements. Additionally, we have just been through a period of significantly elevated transaction activity, including from the first home buyer cohort, where many home purchasing decisions were likely brought forward to take advantage of the swathe of home buying grants and incentives over 2020 and 2021.”

The added flexibility of buyers being able to ‘top up’ their ownership stake once in a better financial position is another advantage of the scheme, although any change in the proportion of ownership would presumably be accompanied by a paydown in the share of equity that has accrued in the property back to the government.

Associated risks

Although the scheme is expected to be popular among buyers, Mr Lawless warned anyone considering the scheme should be aware of the risks associated with buying on such a small deposit.

“With the housing market probably heading into a downturn over the coming year or years, some buyers may find their home is worth less than the debt held against it,” he said.

“It’s important to know if the government will share in the downside risk if the property is sold while in a negative equity situation.”

KeyStart Loans in WA is a good example of what can happen to a shared equity scheme in a declining market. According to the WA government, the portion of KeyStart loan accounts in default did rise between January 2017 and September 2019, from 0.92% to 1.21% of KeyStart accounts, in the midst of a long, large housing downturn across WA.

However, Mr Lawless said the default rate is still relatively low and the scheme has helped thousands of people into home ownership.

“The nature of the housing and economic downturn in WA has posed a lot more risk to serviceability than the relatively tight labour market conditions we see in Australia at the moment.”

Underlying issues

Importantly, the ‘Help to Buy’ scheme is only addressing the symptoms of housing affordability rather than aim to actually fix the underlying issues. Similar to the First Home Loan Deposit Scheme, Mr Lawless said the new Labor Government appears to be adjusting from ‘housing affordability’ solutions to more pragmatic policies that target home ownership, avoiding any downward pressure on housing prices.

It is also worth considering any demand-side incentives can add upward pressure to home prices. For this reason, the limited number of places in this particular scheme, along with price caps and income caps, should help to contain some of the excess demand that could result in upward pressure on prices.

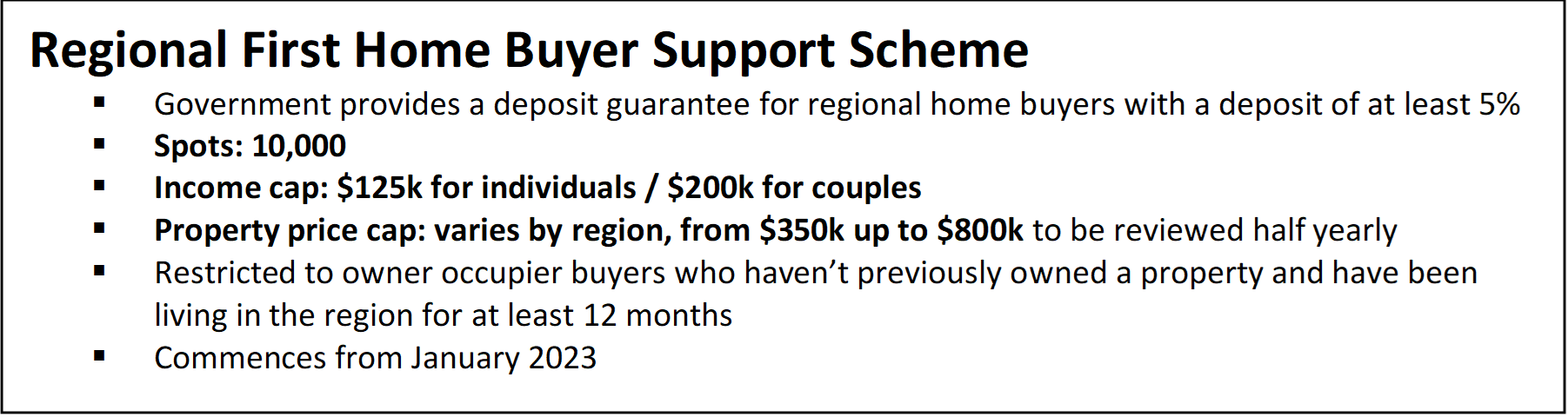

The Regional First Home Buyer Support Scheme extends the existing First Home Loan Deposit Scheme by providing an additional 10,000 places specifically for regional first home purchases.

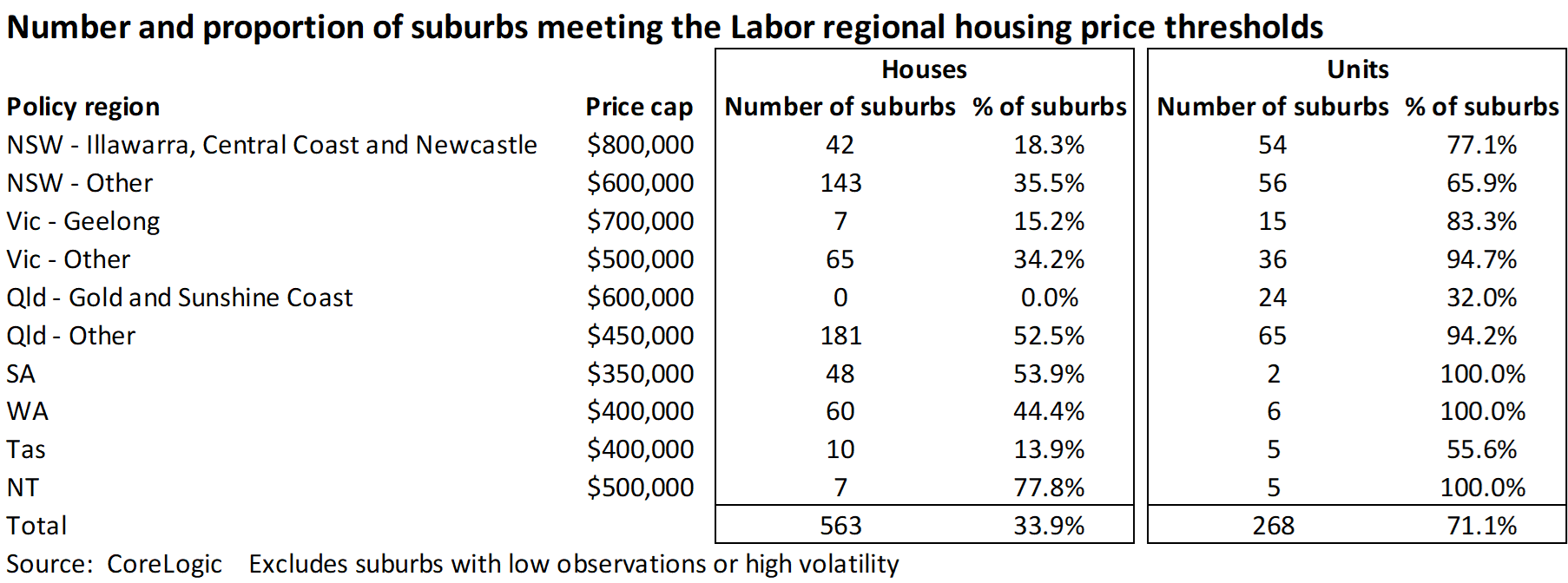

Mr Lawless said based on the property price caps, the scheme is likely to be most popular for those buyers targeting a unit purchase, or lower priced regional markets where detached housing values are more affordable.

CoreLogic’s analysis of regional Australian suburbs shows roughly one third (33.9%) recorded a median house value equal to or under the Regional First Home Buyer Support Scheme price cap, and 71.1% recorded a median unit value equal to or less than the price cap.

The Labor party notes ‘the housing crisis is hitting regional Australia the hardest’, which isn’t necessarily true from a purchasing perspective, Mr Lawless said.

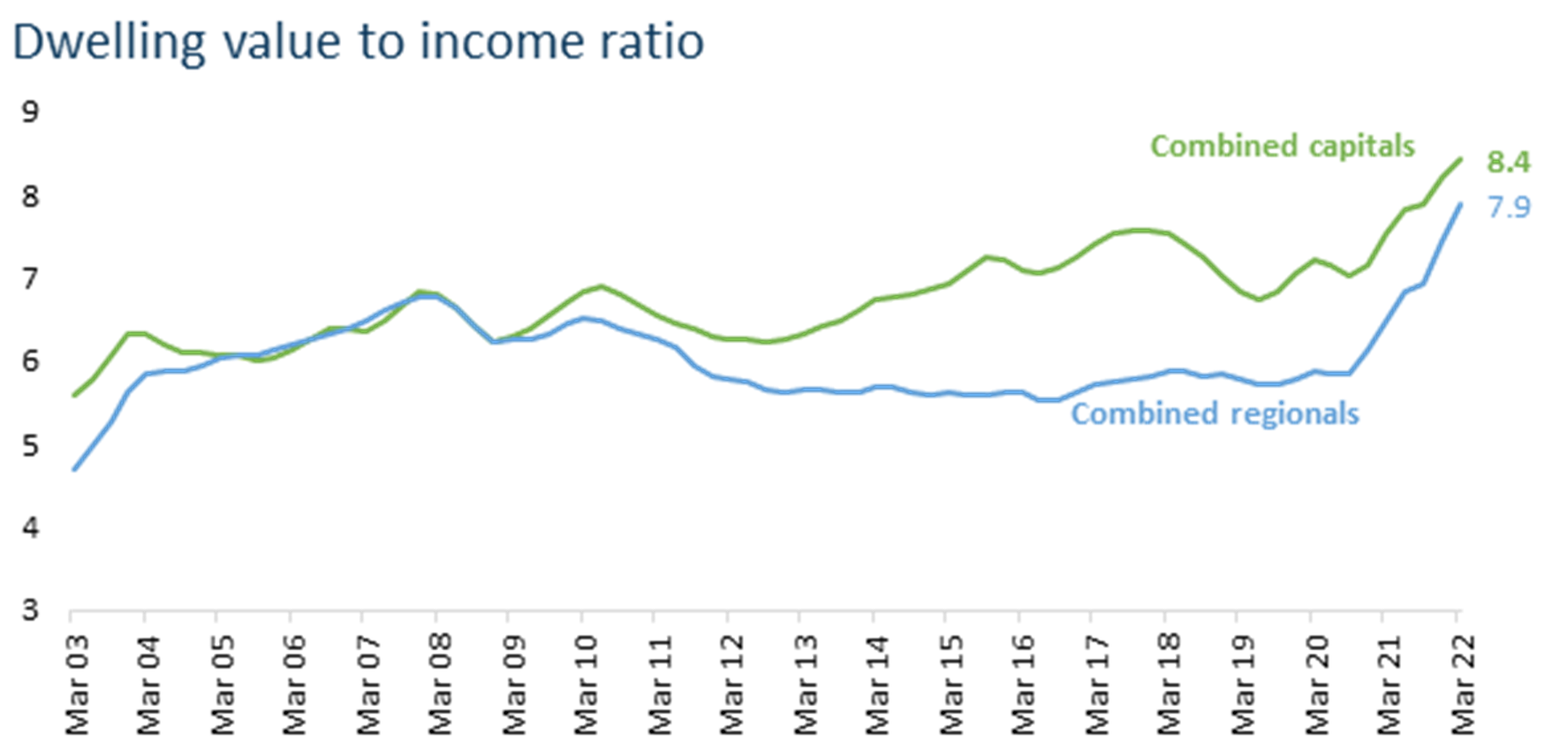

“Although regional housing values have risen faster than capital city housing values over the past few years, we are still seeing the dwelling value to household income ratio across regional Australia (a ratio of 7.9 in March 2022) lower than the capitals (a ratio of 8.5),” he said.

“Although from a rental perspective, regional renters have been dedicating a larger proportion of their incomes towards rent than the capital cities since 2017.”

Source: CoreLogic, ANU