A budget for the ‘squeezed middle’ – but will it be the political circuit-breaker Labour wants?

- Written by Richard Shaw, Professor of Politics, Massey University

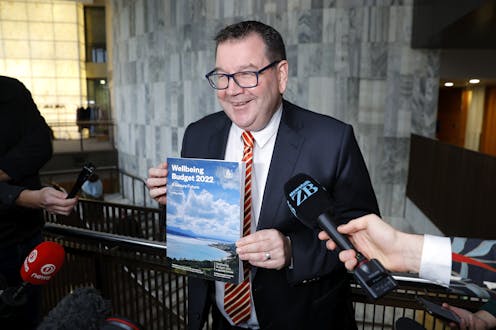

Getty Images

Getty ImagesOne way to make sense of Finance Minister Grant Robertson’s fifth budget speech was to see it as a political performance working on different levels.

First, Labour needs this budget to do an immediate job – address concern with the cost of living. Following two years of pandemic-dominated politics, Robertson had to tell a...