How bonds work and why everyone is talking about them right now: a finance expert explains

- Written by David McMillan, Professor in Finance, University of Stirling

The Bank of England is buying bonds again[1]. Just as it was about to start selling the debt it had accumulated as part of its last effort to support the economy during the COVID-19 pandemic, the central bank has been forced to announce a new scheme to shore up investor confidence.

The bank’s £65 billion short-term spree[2] aims to address the slump[3] in bond prices caused by investors rushing to sell after the government’s recent mini-budget[4]. This led to a surge in bond yields that hiked borrowing costs for the government and spread to pensions, housing and the general economy. So far, it has had a limited initial impact[5] on the markets.

We asked an expert in finance to explain what’s going on in bond markets.

What is a bond and what is the difference between bond prices and yields?

A bond is essentially a tradeable IOU. It’s a loan that investors make to issuers such as companies or governments (UK government bonds are often called gilts). A bond has a price at which it can be sold and a yield, which is an annual amount the investor receives for holding the bond, a bit like interest on a savings account, and is expressed as a percentage of the current price.

When the price of a bond falls, it signals less demand for the bond because fewer investors want to own it. At the same time, the yield rises, which represents a higher cost of borrowing for companies or governments that issued the bond because this is what they have to pay to investors.

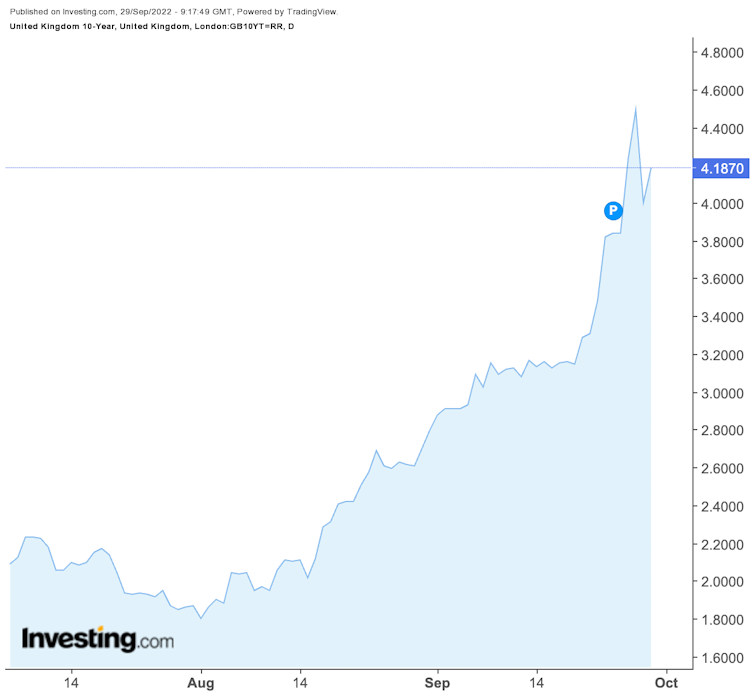

In the days since the government’s mini-budget, yields on 10-year Treasury bonds – which are issued by the UK government – increased from approximately 3.5% to 4.52% – the highest since the 2007-2008 global financial crisis. The expectation of continued increases prompted the recent intervention by the Bank of England.

UK government 10-year bond yields

What causes bond yields to move?

To understand this, it is important to bear in mind that, while people often talk about the interest rate, there are actually a number of rates. This includes the rate at which the central bank lends to commercial banks (the base rate), the rate that banks lend to each other (the interbank rate), the rate that the government borrows at (Treasury yields) and the rate at which households and firms borrow (commercial loans and mortgages).

When the Bank of England changes the base rate, this cascades through all these rates. As such, the Bank of England carefully considers the state of the economy – that is, growth and inflation – when deciding on the base rate.

When an economy is growing, interest rates and bond yields tend to rise. The occurs for several reasons. Investors sell bonds to buy riskier assets with better returns. Firms and households also look to borrow more money in a growing economy, for example, to invest in new machinery or to move home. More demand for borrowing means lenders can charge higher interest on their loans.

Higher inflation often accompanies economic growth because of the increase in demand for goods and services. This tightens supply and causes prices to rise (including wages for labour). The Bank of England, which is mandated by the government to try to keep inflation as close to 2% as possible, will respond to higher inflation by raising base rates, which, as noted, feeds through to the different rates.

Investors will often anticipate the increase in base rates and look to act before it goes up by selling Treasury bonds and buying alternative, higher return, assets. This causes bond yields to rise further. As a result, the Treasury bond yield is often seen as a predictor of future Bank of England base rate changes.

So, if yields are rising, does this mean that investors are expecting future economic growth in the UK?

No, not at the moment. When the government raises money by issuing bonds, it does so over a range of time periods (called maturities), from one day to 30 years. When an economy is expected to grow, the yield on longer-term bonds will be higher than the yield on shorter-term bonds.

This relationship between yields across different maturities is referred to as the term structure or yield curve. An upward sloping yield curve implies a growing economy. At the moment, the UK yield curve is flat, or even downward-sloping across some maturities. My research[7] shows that a falling yield curve is a good predictor of a coming recession[8].

Yield curve for UK government bonds

It’s important to remember that these different yields act as a benchmark for commercial lending rates of equivalent lengths. The approximate jump to 4.5% in 2-year and 5-year yields has been reflected in mortgage rates, which is why some lenders have pulled available mortgage deals[10] recently while they reassess the lending rates charged to households.

Read more: Is the UK in a recession? How central banks decide and why it's so hard to call it[11]

But if the UK economy is not expected to perform well, why have bond yields been rising after the chancellor’s mini-budget announcement?

The rising bond yields we are seeing relate to an additional factor: the amount of government debt. The mini-budget introduced tax cuts and increased spending and investors know the government will need to increase borrowing to meet these commitments. Some estimates put potential government borrowing at £190 billion[12] due to this plan.

An increase in the amount a homeowner borrows versus the value of their home (called the loan-to-value) causes the mortgage rate charged to the borrower to rise. Similarly, an increase in the amount of bonds that the government will be looking to sell (the amount it wants to borrow) will push down the price of existing bonds, increasing yields. More importantly, more debt without growth raises the risk level of the UK economy.

Anticipating this, investors triggered a large-scale bond sell-off after the government’s mini-budget announcement. This contributed to the fall in the value of the pound as investors selling UK Treasury bonds bought US bonds instead, essentially swapping pounds for dollars.

So will the Bank of England’s plan work?

The intervention will have a short-term positive impact, which started as soon as it was announced[13]. But the bank is really only buying time. Any ultimate success depends on the government restoring investor confidence in its economic plans.

Unfortunately, rising yields and borrowing costs for the UK economy is the price we are now paying for the government’s recent fiscal announcement.

References

- ^ buying bonds again (www.theguardian.com)

- ^ £65 billion short-term spree (www.bankofengland.co.uk)

- ^ address the slump (www.bbc.co.uk)

- ^ mini-budget (www.bbc.co.uk)

- ^ limited initial impact (www.theguardian.com)

- ^ Investing.com / Tradingview (uk.investing.com)

- ^ My research (papers.ssrn.com)

- ^ a coming recession (papers.ssrn.com)

- ^ Bloomberg Finance L.P., Tradeweb and Bank of England calculations (www.bankofengland.co.uk)

- ^ pulled available mortgage deals (uk.finance.yahoo.com)

- ^ Is the UK in a recession? How central banks decide and why it's so hard to call it (theconversation.com)

- ^ £190 billion (ifs.org.uk)

- ^ it was announced (www.bloomberg.com)