Negative gearing reforms could save A$1.7 billion without hurting poorer investors

- Written by Helen Hodgson, Associate Professor, Curtin Law School and Curtin Business School, Curtin University

Reforming negative gearing could save the federal government A$1.7 billion without hurting “mum and dad investors”, according to our new modelling[1], by focusing tax deductions on investors with smaller property portfolios and removing them for richer investors.

Combined with changes to capital gains tax, reforming negative gearing could make the Australian housing market more sustainable and equitable.

Negative gearing [2]allows investors to claim a tax deduction if their rental income is less than their expenses. It cost the federal government A$3.04 billion in 2013-14, according to our calculations.

Our report also confirms[3] that negative gearing and the capital gains tax discount incentivise housing investors to take on debt. This potentially makes the housing market less stable and crowds out first home buyers.

Read more: FactCheck: are average earners the main beneficiaries of negative gearing?[4]

According to Treasury modelling[5], the Labor Party’s plan[6] to limit negative gearing deductions on newly acquired rental housing would put relatively modest downward pressure on house prices. Preliminary research from Melbourne University[7] has found that eliminating negative gearing would result in an increase in home ownership.

Nevertheless, there are concerns[8] that reforming negative gearing would harm the financial wellbeing[9] of mum and dad investors.

But using data on the distribution of property and incomes makes it possible to differentiate between poorer and wealthier investors, allowing the government to target reforms to cushion the blow for investors on lower incomes.

Targeted negative gearing reform

In our example, investors in the bottom half of the income and property distributions could be allowed to claim tax deductions for all allowable rental expenses. Those in the 51st–75th income percentiles could deduct 50% of those expenses, while negative gearing would be eliminated for those in the top 25% of incomes.

Our modelling of this scenario shows this would save the federal government A$1.7 billion, or 57.3% of the current cost to the budget, each year. If negative gearing deductions were limited based on property values, the saving would be A$1.5 billion (or 48.3%).

Given this reform would be less likely to hurt poorer investors, they would be less likely to withdraw from the rental market than if negative gearing was eliminated. This would also mitigate the impact of negative gearing reform on renters.

Most experts agree[10] that negative gearing is linked to housing market activity[11]. However there is no consensus on just how significantly negative gearing affects housing prices[12] or rental market activity[13].

Our modelling does not focus on the impact negative gearing reform might have on the housing market, house prices, rents, or how investors might respond, but our modelling does show the impact of changing who can claim negative gearing deductions, as well as capping it at different levels.

Who benefits from capital gains tax?

Our research also identified that the capital gains tax discount has been a significant factor in the growth of negative gearing since 1999, as investors are able to claim a rental loss but do not pay full tax on later capital gains[14].

Home owners who also own at least one rental property receive the highest capital gains tax benefits. Our analysis showed this group has an average property portfolio valued at over A$730,000.

These home owners also have an average taxable income of A$82,000 per person, which is more than 250% of the average taxable income of renters (A$31,000).

Read more: Treasury memo misses the real impact of Labor's negative gearing policy[15]

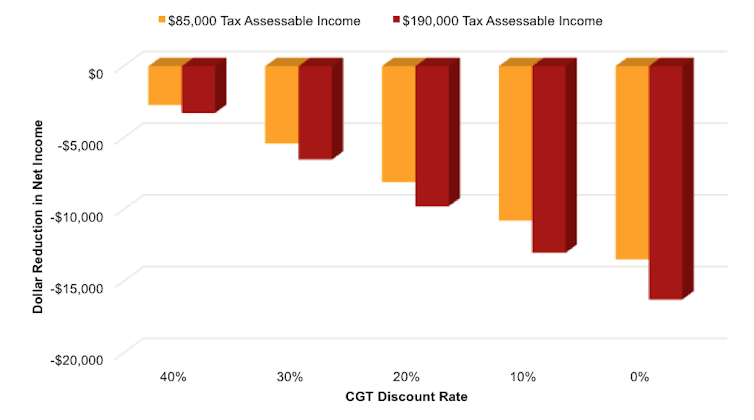

We modelled some alternative capital gains tax scenarios reducing the discount – which would increase the tax payable on net capital gains. Our calculations show that reducing the discount would lead to higher income earners paying more capital gains tax.

This would reduce the difference between the tax payable by higher and lower income rental investors, and therefore reduce inequities in the current system.

Author provided, Author provided

Our modelling[16] shows benefits of negative gearing are skewed towards more affluent investors in middle age and in full-time employment. Investors aged over 55 or who aren’t in the labour market (those who are unemployed, retired or not working) benefit the least from negative gearing.

We need to change the way we tax housing to create a more equitable and sustainable housing market. But this needs to be done (and communicated to investors[17]) in a way that limits the risk of a shock to the market if investors exit the housing market.

Policymakers have been reluctant[18] to change the fundamental settings of the tax system, but our modelling shows it can be done in a way that limits the impact on poorer investors.

The main limitation on this reform is behavioural, determining how investors will react to the effects of tax changes. Housing reform is complex, involving a range of market factors as well as the tax drivers.

Author provided, Author provided

Our modelling[16] shows benefits of negative gearing are skewed towards more affluent investors in middle age and in full-time employment. Investors aged over 55 or who aren’t in the labour market (those who are unemployed, retired or not working) benefit the least from negative gearing.

We need to change the way we tax housing to create a more equitable and sustainable housing market. But this needs to be done (and communicated to investors[17]) in a way that limits the risk of a shock to the market if investors exit the housing market.

Policymakers have been reluctant[18] to change the fundamental settings of the tax system, but our modelling shows it can be done in a way that limits the impact on poorer investors.

The main limitation on this reform is behavioural, determining how investors will react to the effects of tax changes. Housing reform is complex, involving a range of market factors as well as the tax drivers.

References

- ^ new modelling (www.ahuri.edu.au)

- ^ Negative gearing (theconversation.com)

- ^ also confirms (www.ahuri.edu.au)

- ^ FactCheck: are average earners the main beneficiaries of negative gearing? (theconversation.com)

- ^ Treasury modelling (treasury.gov.au)

- ^ Labor Party’s plan (www.alp.org.au)

- ^ research from Melbourne University (www.rba.gov.au)

- ^ concerns (theconversation.com)

- ^ harm the financial wellbeing (www.propertycouncil.com.au)

- ^ Most experts agree (www.abc.net.au)

- ^ linked to housing market activity (theconversation.com)

- ^ affects housing prices (thenewdaily.com.au)

- ^ rental market activity (theconversation.com)

- ^ investors are able to claim a rental loss but do not pay full tax on later capital gains (theconversation.com)

- ^ Treasury memo misses the real impact of Labor's negative gearing policy (theconversation.com)

- ^ Our modelling (www.ahuri.edu.au)

- ^ and communicated to investors (theconversation.com)

- ^ Policymakers have been reluctant (theconversation.com)

Authors: Helen Hodgson, Associate Professor, Curtin Law School and Curtin Business School, Curtin University