what to expect, what they're not saying, and the traps for Labour

- Written by Steve Schifferes, Honorary Research Fellow, City Political Economy Research Centre, City, University of London

Chancellor Jeremy Hunt’s budget on Wednesday, November 22 will put into place a major piece of the Conservative party’s strategy for the general election – the plan to turn the economy around and tackle the cost of living crisis. But with just over a year to go before an election must be called, will the measures be too little, too late?

The government certainly derived some satisfaction from last month’s fall in the UK rate of annual inflation to 4.6%[1], with Prime Minister Rishi Sunak quickly taking credit[2] for meeting his target to halve the rate in 2023. Nonetheless, economic prospects look grim.

The Bank of England is predicting[3] growth of just 0.5% this year, zero next year and just 0.25% in 2025. To some extent, this is likely to be self-inflicted, with the bank saying it will keep interest rates high for at least another year to ensure inflation falls to its target of 2%.

Neither will people’s incomes make up the difference. Wage growth has just caught up with inflation, but this has far from compensated[4] for the fall in real incomes since the pandemic. And with taxes the highest in decades[5] as a share of the economy, there is growing pressure within the Conservative party for a pre-election tax cut.

Reviving the economy

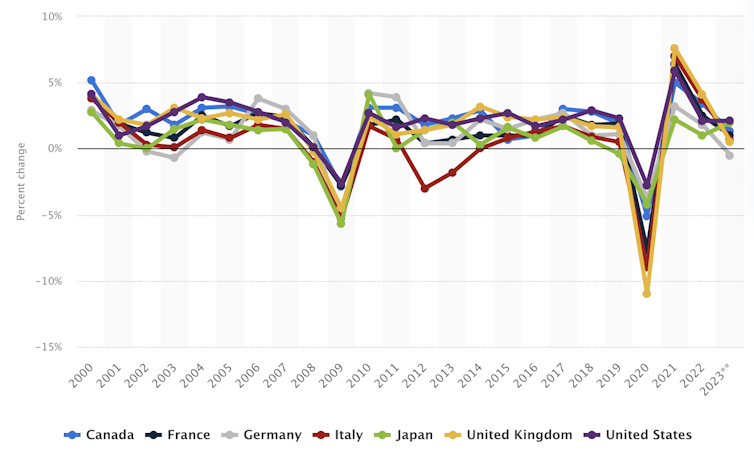

The UK economy has in fact been flatlining for a decade, with low growth and little increase in household incomes. Relative to[6] competitor countries, there is less business investment, a less well-trained workforce[7], and failure to complete big infrastructure projects such as HS2 - all leading to lower productivity.

GDP growth of G7 major economies