During the cold war, US and Europe were just as divided over Russia sanctions – here's how it played out

- Written by Kirill Shakhnov, Lecturer in Economics, University of Surrey

It’s impossible to predict how the crisis in Ukraine will progress, but the rupture in relations between Russia and the west is unlikely to heal any time soon. At the very least, trade between these two sides is going to be badly affected for a long time. To get a sense of how the global economy might function in the coming months and years, it makes sense to look at what happened during the cold war.

It’s difficult to make exact comparisons, but the relative economic power of the two sides was very different in that era. In 1979, just before the start of the Soviet-Afghan war, the Soviet Union accounted[1] for 9% of world GDP. In contrast, western Europe, the US, Canada, Australia and New Zealand accounted for about half.

Today, Russia accounts for about 3% of world GDP, while the EU (now incorporating much of eastern Europe) plus those other countries account for 40%. So while both sides have clearly been squeezed in overall global economic importance by the rise of particularly China, Russian interests have fallen further.

Russia and Europe

Russia and Europe have much closer economic links than Russia and the US. Russia is the fifth largest[2] export destination for the EU after China, the US, UK and Switzerland; and the EU is Russia’s largest[3] export destination – followed closely by China. On the other hand, Russia doesn’t even break into America’s top 25[4] largest export destinations, while America only buys 5%[5] of Russian exports. This is broadly similar to how things were during the cold war.

The trading relationship between Russia and Europe has a similar composition to during the cold war era[6]. Raw materials move west and manufactured products like cars, heavy machinery and pharmaceuticals move east.

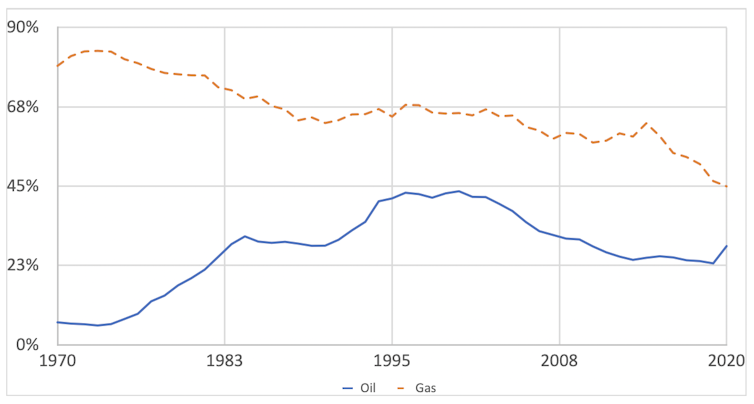

Western Europe has been dependent on Russia/USSR for oil and natural gas throughout the fossil fuel era. The chart below shows to what extent western Europe has been self-sufficient in oil and natural gas since 1970. As you can see, its natural gas supplies (in orange) have steadily declined throughout this period, while oil (in blue) has been moving in the same direction since the mid-1990s.

Western Europe’s self-sufficiency in oil and gas (%)