why the Ukraine crisis could help it become the world's number one aircraft maker again

- Written by Joseph Mellors, Associate lecturer, Northumbria University, Newcastle

Boeing has faced a lot of bad press in recent years, and deservedly so. After two Boeing 737 Max[1] crashes killed 346 people, the American aerospace giant was criticised[2] for its “slow” and “defensive” handling of the crisis, and nearly 400 planes[3] were grounded for 20 months following a temporary ban by the US authorities. The company has also been plagued with problems[4] at its South Carolina plant, which makes 787 Dreamliners.

However, Boeing has got a lot right too – and this is becoming apparent as events in Ukraine unfold.

New aircraft rely heavily on lightweight materials, including titanium. Titanium has other key properties too, including its high strength and heat resistance, making it ideal for use in the body of the plane (the airframe), the parts that hold the structure together (the fastening elements), and the wheels and undercarriage (the landing gear). Unfortunately, titanium is scarce – and 16% of its supply[5] comes from Russia and Ukraine.

Following the 2014 Crimean crisis, Boeing began[6] stockpiling titanium and started diversifying[7] its arrangements for sourcing metals. In a statement on March 7, the company sought to reassure its stakeholders about its position with regards to raw materials:

Our inventory and diversity of titanium sources provide sufficient supply for airplane production, and we will continue to take the right steps to ensure long-term continuity.

Interestingly, Boeing suspended buying titanium[8] from Russia earlier in March, even though the metal is not yet covered by US sanctions. Airbus may also[9] have been stockpiling titanium since Crimea, but it continues[10] to rely on Russia for its supply, citing its compliance with EU sanctions.

Thanks to its diversification, Boeing now relies[11] on Russia for about 35% of its supply, whereas different sources put Airbus somewhere between 50% and 65%. Incidentally, smaller manufacturers are even more reliant: Brazilian aircraft maker Embraer relies on Russia for 100% of its supply.

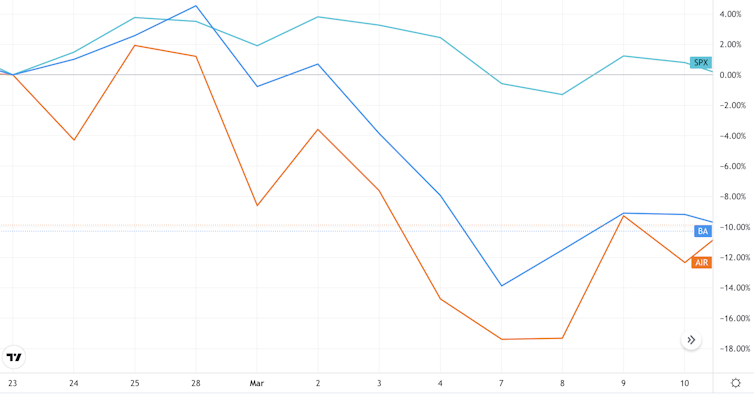

Both Boeing and Airbus have taken a hit in the stock market since Russia’s invasion of Ukraine on February 24, because of the prospect of decreased demand for aircraft in affected markets and potential disruption to financing arrangements. Boeing has performed marginally better at the time of writing, having generally underperformed Airbus in recent years. And should sanctions be placed on Russian titanium, Airbus and other manufacturers would find themselves in a difficult (perhaps impossible) position. For Boeing, the threat is much less significant.

Boeing vs Airbus

The 747-8 – a plane that failed well

The Boeing 747 might be about the most successful plane of all time, but the 747-8, launched in 2005, has been described as a “flop”[12] for the company. Boeing’s final punt in the jumbo era sold 138 planes[13], compared to 249 by main rival, the Airbus A380.

Yet Airbus’ success over the 747-8 was pyrrhic. The fact that Boeing developed the 747-8 lured Airbus into mobilising huge resources into the A380, having not previously had the infrastructure to build such a vehicle. Boeing, which obviously did not have this problem, was able to spend elsewhere. The 747-8 programme cost US$4 billion[14] (£3 billion) after adjusting for inflation, while the A380 cost six or seven times[15] more.

The problem for Airbus was that the market pivoted from jumbos towards mid-sized widebody aircraft like the Boeing 787 Dreamliner. The industry has for years been shifting towards[16] “point-to-point” flying between two places, as opposed to via a hub like London Heathrow, and COVID accelerated this trend. This favours the operational agility of mid-size aircraft. Consequently, many airlines including Air France, KLM and Virgin Atlantic have prematurely retired their A380 and 747 fleets. Production of A380s was wrapped up in 2021 after Emirates cancelled its final orders, while Boeing 747 production ceases this year.

Launched in 2004, the Dreamliner boasts unprecedented fuel efficiency[17] and comfort[18]. It soon became the fastest selling widebody aircraft of all time. Airbus put everything into the A380 – a plane for which Boeing knew[19] there was little demand.

Even when Airbus did get the A330neo to market to compete with the Dreamliner in 2014, its development was a modified version of a pre-existing airframe, so it cannot match the 787 in terms of fuel efficiency and comfort. In any case, the 787 had already cemented itself as the preferred plane in its market. Boeing has delivered[20] 1,006 of them to customers and has orders for about 900 more, whereas the A330neo has done 67 deliveries and a total of 348 orders.

Airbus has been more successful with its A350, which is a larger widebody aircraft more suited to long haul that began passenger flights in 2015. Boeing’s competition, the 777X, is due for its first delivery in 2023 (having been delayed by the problems with the 737 Max). In terms of orders[21], the A350 is ahead, but the 777X has been on sale for less time and is picking up orders. Boeing is also launching[22] a larger version of the Dreamliner to compete with the A350, so there is the potential for the A350 to be squeezed from both sides.

Where next

The question is whether Boeing can repeat its success with the Dreamliner in other segments of the market. We eagerly await news on its new mid-sized aircraft for medium-haul flights (currently referred to as the 797), which has also been delayed by the 737 Max problems. Designed to replace the narrowbody 757 and compete with the Airbus A321XLR, which is due to enter service in 2023, this aircraft may be critical to Boeing’s success.

In the narrowbody market, which is for shorter flights, the Airbus A320 family recently inched ahead[23] of Boeing’s 737 in terms of sales, though the 737 retains the lead for aircraft delivered. It is uncertain how potential supply chain issues may disrupt this balance. The ongoing Russian invasion of Ukraine has the potential to be hard, particularly on Airbus.

The future of aircraft manufacturing is uncertain. But by thinking forwards, in terms of sourcing arrangements and travel demand, Boeing has been shrewd. So long as Boeing learns lessons from its recent past, it may finally be back in the ascendant.

References

- ^ two Boeing 737 Max (www.nbcnews.com)

- ^ was criticised (journals.sagepub.com)

- ^ nearly 400 planes (www.flightglobal.com)

- ^ plagued with problems (www.bizjournals.com)

- ^ 16% of its supply (pubs.usgs.gov)

- ^ Boeing began (www.bizjournals.com)

- ^ started diversifying (www.reuters.com)

- ^ suspended buying titanium (www.businesstoday.in)

- ^ may also (www.reuters.com)

- ^ it continues (www.reuters.com)

- ^ now relies (mentourpilot.com)

- ^ a “flop” (airwaysmag.com)

- ^ 138 planes (modernairliners.com)

- ^ cost US$4 billion (seekingalpha.com)

- ^ six or seven times (simpleflying.com)

- ^ shifting towards (simpleflying.com)

- ^ fuel efficiency (simpleflying.com)

- ^ comfort (simpleflying.com)

- ^ Boeing knew (simpleflying.com)

- ^ has delivered (modernairliners.com)

- ^ In terms of orders (modernairliners.com)

- ^ also launching (www.aviacionline.com)

- ^ recently inched ahead (modernairliners.com)