world financial markets have not broken sweat since the Russian escalation – why?

- Written by Daniele Bianchi, Associate Professor of Finance, Queen Mary University of London

The economic consequences of armed conflicts have received widespread attention at least as far back as when John Meynard Keynes wrote about them in 1919[1] in relation to the first world war. Yet as the world braces for a possible war in Ukraine, we still know relatively little about the interplay between conflicts and financial markets.

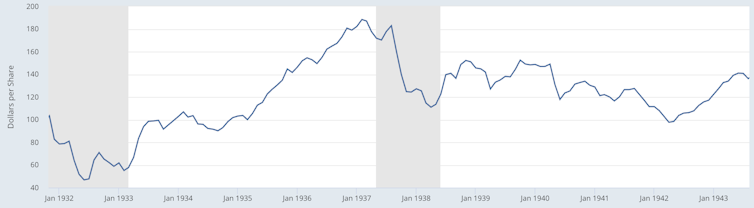

One thing we can say is that even during major armed conflicts, financial markets have often operated relatively smoothly. A clear example is the second world war. Most people would probably think there would have been a sharp dive in the stock market in September 1939 with the invasion of Poland, or after the bombing of Pearl Harbor in December 1941. Yet as you can see from the following chart of the Dow Jones Industrial Average, that is not what happened.

Dow Jones Industrial Average, 1932-43