Gold market July 2025 overview and August 2025 preview: a monthly digest by the global broker Octa

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 8 August 2025 - Octa Broker is providing an in-depth overview of the week's key events and actionable insights to help traders navigate this high-stakes environment with confidence.

July was a relatively quiet month for gold, at least by the recent standards. XAUUSD, the primary financial instrument for trading bullion, fluctuated in a very narrow 30-dollar range between roughly 3,270 and 3,300 per ounce (oz). This sideways trend, which has been in place since May, reflects a state of continuing market uncertainty. While gold did not set a new high after a strong performance in April, it remained comfortably above the $3,000 mark and managed to stay above the critical 100-day moving average despite coming close to breaching it. The previous month was notably calm, with no single day's price change exceeding 1.6%, a rare occurrence for the typically volatile precious metal. Overall, investors and traders drove gold into a period of consolidation as they continued navigating a landscape of persistent geopolitical tensions, ongoing trade disputes, and shifting U.S. monetary policy expectations. Still, XAUUSD experienced its first monthly decline since December 2024, albeit a modest one of just 0.4%.

Although the general trading environment in the financial markets was anything but calm, XAUUSD offered a rather smooth ride for traders, as it was free from any significant market-moving events. We have singled out only a few significant ones:

Major market-moving events:

- 1 – 2 July. Gold surged over 1.6% in two days, as investors sought a safe haven following the U.S. Senate's passage of a major tax-cut and spending bill. This new legislation, which is expected to create a $3 trillion deficit over the next decade, is widely believed to be highly inflationary. In addition, gold prices firmed after a weaker-than-expected ADP employment report fueled hopes of the U.S. Federal Reserve (Fed) cutting rates sooner than anticipated.

- 11 July. XAUUSD gained more than 1% in a single trading day after U.S. President Donald Trump said that he would impose a 35% tariff on Canadian imports and announced plans to impose blanket tariffs of 15% or 20% on most other trading partners.

- 21 – 22 July. Over the course of two trading sessions, gold prices surged to a five-week high, gaining more than 2%. This climb was largely driven by rising market uncertainty ahead of an 1 August deadline, at which point the U.S. was scheduled to impose new tariffs on a number of countries.

- 23 – 30 July. Over a week-long period, gold prices declined steadily, primarily due to positive developments in international trade and a lack of anticipated interest rate cuts. Initially, the price of gold started to fall as progress was made on a trade deal between the U.S. and the European Union (EU), which followed a similar agreement with Japan. This easing of global trade tensions bolstered riskier assets like stocks and strengthened the U.S. dollar, making gold less attractive to investors. The decline was further exacerbated when the Fed, despite political pressure, held interest rates steady and offered no clear timeline for future cuts, which would have typically supported gold prices. Silver and other precious metals like platinum and palladium also experienced significant price drops throughout the week.

Although gold entered a period of consolidation, the broader, long-term trend is still decidedly bullish, as gold's price remains comfortably above key trendlines and MAs. Overall, chaotic U.S. trade policy, rising fears about the sustainability of the U.S. twin deficits (fiscal and trade), endless geopolitical tensions and political instability, and solid structural demand on the part of central banks helped keep the bullion's price near all-time highs. Still, traders that continue to bet on future price increases should be cautious as record-high prices seem to have already started to dent physical demand for bullion.

China

As the world's leading gold consumer, China's purchasing activities can influence global gold markets significantly. The latest statistic on physical demand has been somewhat bearish. According to Reuters[1], net gold imports by China through Hong Kong dropped by nearly 60% in June compared to May, totaling 19.37 metric tons (mt). The import data aligns with a reported 3.5% decrease in China's overall gold consumption during the first half of 2025.

India

India, the world's second largest gold consumer, has also been under stress lately, as record-high prices are significantly reducing demand for gold jewelry. The World Gold Council (WGC) forecasts[2] Indian consumption will fall to a five-year low in 2025 and reach between 600 and 700 mt, a notable drop from the 802.8 mt consumed in 2024. Despite the overall decline, investment demand for gold is seeing a boost, with inflows into Indian gold Exchange-Traded Funds (ETFs) surging tenfold in June.

Switzerland

Switzerland's crucial role in the global gold market is in refining and trading. The country is home to some of the world's largest gold refineries, which process a significant portion of the world's newly mined and recycled gold. Therefore, its customs data on gold exports may shed light on the overall demand situation.

Last month, Swiss Customs reported[3] that gold exports from the country surged 44% in June, reaching their highest level since March. This increase was primarily driven by a significant flow of gold from the U.S. to the UK, with the bullion passing through Swiss refineries. According to Swiss customs data, exports to the UK alone jumped to 83.8 mt in June from just 16.0 mt in May. This trend of gold returning to London vaults comes after billions of dollars worth of the metal were sent to the U.S. earlier in the year to hedge against potential tariffs that were ultimately not imposed. The London Bullion Market Association also reported a 2.1% month-on-month increase in gold held in London vaults in June, reaching the highest level since August 2023.

Central Banks

Central banks have been purchasing gold to diversify their reserves, lessen reliance on the U.S. dollar while also protecting against inflation and economic instability. Currently, there are no reasons to expect this trend to discontinue.

According to Bloomberg[4], the Peoples Bank of China (PBoC), China's central bank added gold to its reserves in June for an eighth consecutive month. Other central banks, notably the Reserve Bank of India (RBI) and Bank of Russia (BoR), also continued to stockpile gold. Overall, central banks around the world bought over 400 mt of gold in the first half of 2025, according to estimates from Octa, a global broker. While this is a substantial amount, it's actually about 20% less than what they purchased during the same period in 2024. Still, central banks continue to be net-buyers of gold and in total provide the largest source of demand for the bullion.

ETFs

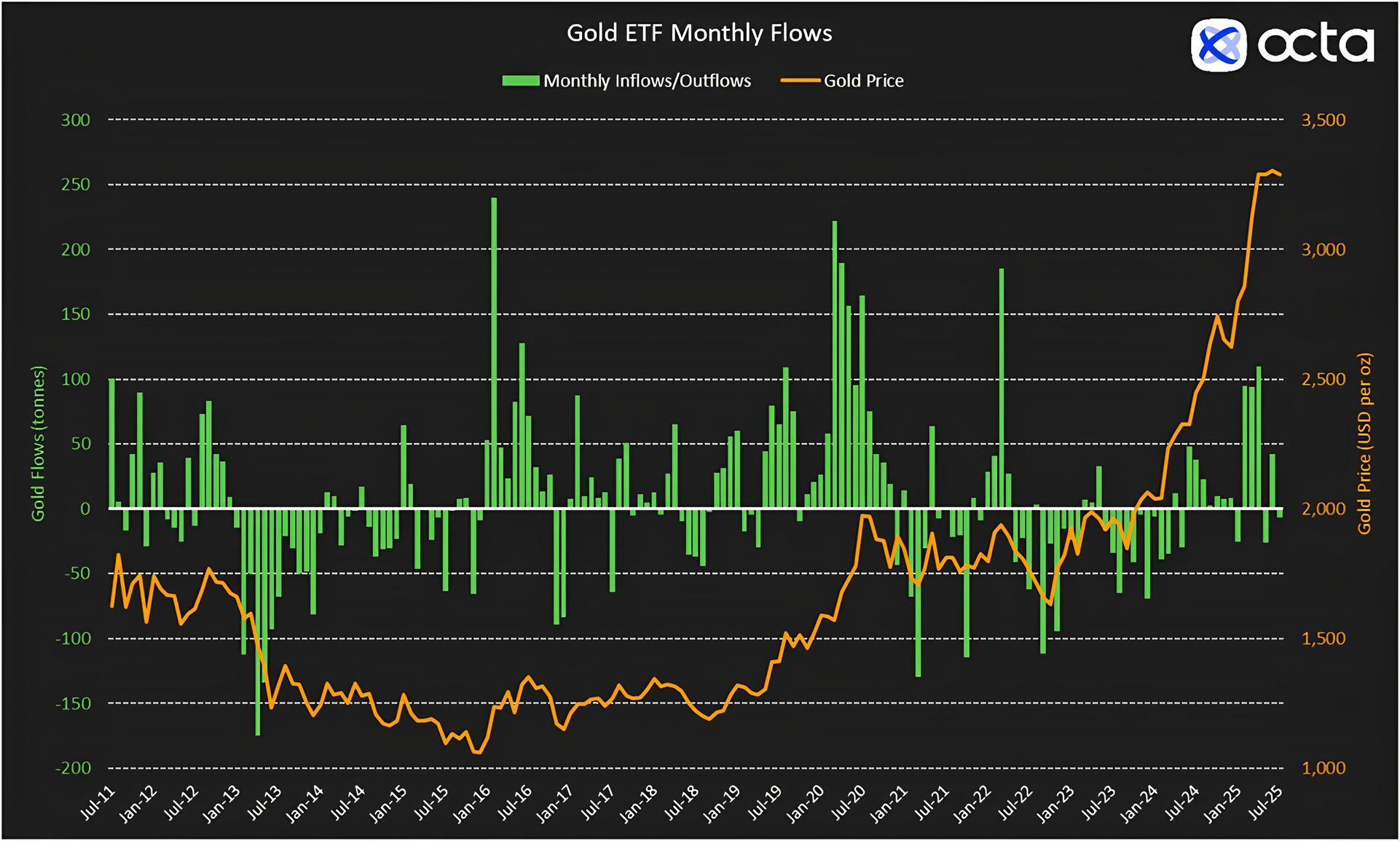

Investors, both big and small, often buy gold-backed ETFs as a way to easily add gold to their portfolios for diversification. These funds are a key driver of demand in the gold market. Based on recent reports from the WGC[5], gold ETFs globally experienced a total inflow of 74.56 mt, with funds in North America accounting for nearly 60% of that increase (the date for July has not been released yet). According to LSEG, a financial firm, flows into physically-backed gold exchange-traded funds stood at just above 40 mt year-to-date with monthly outflows recorded only in January and May. However, there was also a minor outflow in the first week of July (see the chart below).

GOLD ETF MONTHLY FLOWS VS GOLD PRICE

Commitment of Traders

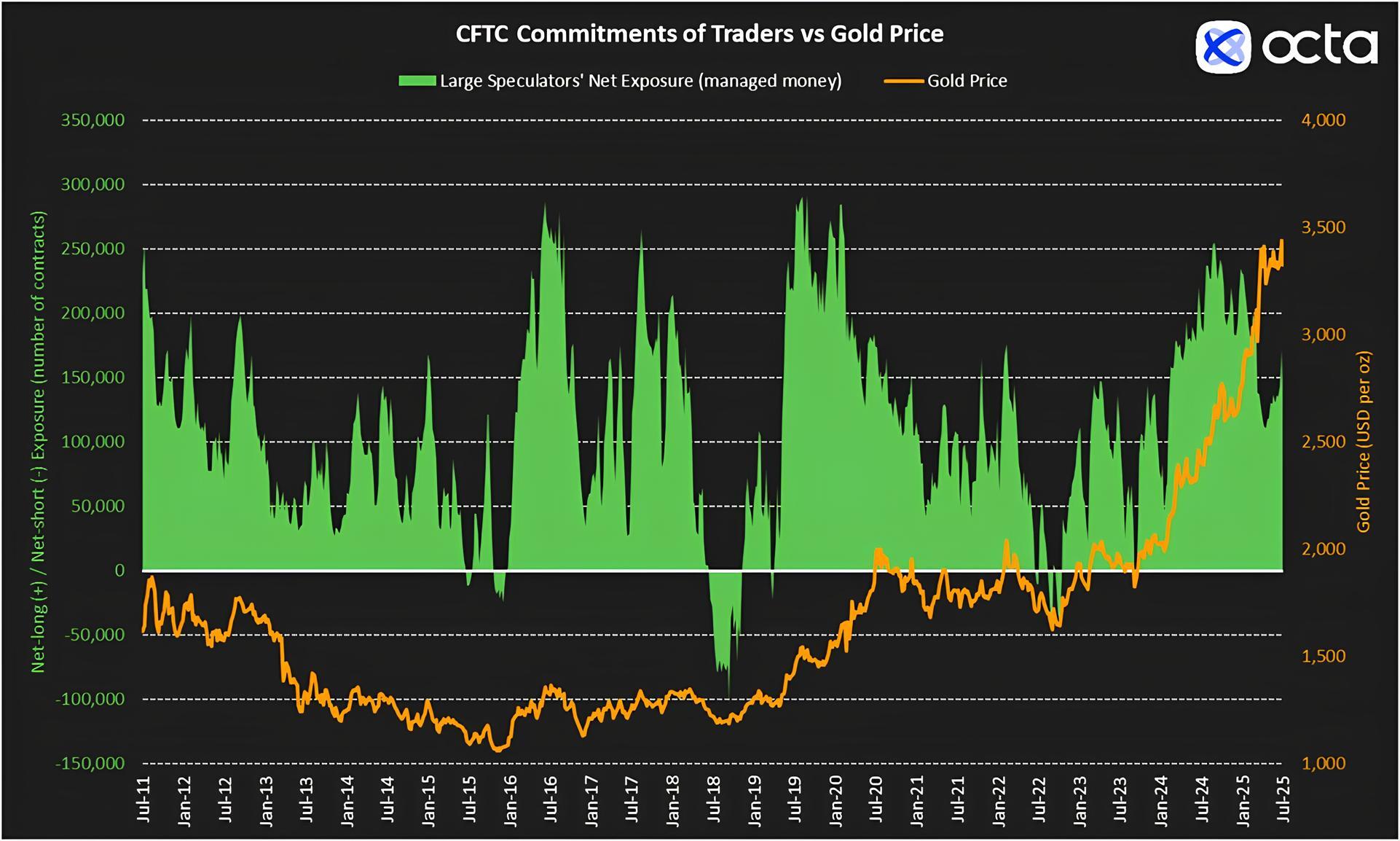

Apart from central banks, global investors have also remained quite bullish on gold. According to the Commodity Futures Trading Commission (CFTC)[6], large speculators (leveraged funds and money managers) were still net-long COMEX gold futures and options as of 29 July, 2025. Long positions totalled 178,435 contracts vs only 35,589 short contracts, translating into a net-long position of 142,846 contracts (see the chart below).

CFTC COMMITMENTS OF TRADERS VS GOLD PRICE

'Although large speculators remain net-long, the size of their exposure is substantially smaller compared to what it was back in September 2024, when the uncertainty around the U.S. Presidential elections fuelled bullish bets', says Kar Yong Ang, a financial market analyst at Octa broker. 'Still, while long positions may have been cut, short positions are not being added. Nobody wants to be caught shorting gold during these turbulent times'.

Outlook

Fundamentally, the outlook for gold looks bright, but there are important caveats. We have singled out three important factors that will continue to play out in August and the rest of 2025.

U.S. Monetary Policy

Given how strongly the market reacted to the recent NFP report, it is clear that investors' expectations regarding the U.S. monetary policy continue to be the dominant factor driving gold prices. Until recently, investors were growing increasingly sceptical about the Fed's willingness and indeed its ability to deliver additional rate cuts. However, the latest NFP report, which showed a much smaller-than-expected increase in new payrolls in July as well as a major downward revision in jobs creation for June, essentially cemented dovish expectations for the rest of the year. Investors now widely expect a 25-basis point (bps) rate cut by the Fed in September. They also price in a roughly 60% probability of an additional rate cut in October and a 47% probability of another rate cut in December.

'With these dovish expectations in place, XAUUSD is likely to remain supported in the weeks ahead', argues Kar Yong Ang. 'However, inflation is a major concern and the Fed is yet to communicate its readiness to cut the rate. Tariff-related price increases are yet to be felt, and although U.S. consumer 1-year and 5-year inflation expectations have eased, they remain very high by historical standards. I think some central banks, and maybe even the Fed, will prefer to wait until trade tensions are resolved before committing fully to rate cuts.'

Geopolitical uncertainty

Lingering global economic and geopolitical risks continue to play out, with the ongoing trade negotiations between the United States and the rest of the world, particularly China, being the most critical factor affecting the gold market and the global financial system.

The conflicts in the Middle East, such as the Israel-Hamas hostilities, brief spats between India and Pakistan, Israel and Iran, Thailand and Cambodia, and the ongoing conflict between Russia and Ukraine, have destabilised world politics and raised many fears ranging from oil and food supply disruptions to the prospect of a worldwide conflict. Gold, considered a 'safe-haven' asset, typically sees increased demand during political uncertainty and instability. While it is extremely difficult to project the resolution of geopolitical conflicts, let alone to forecast the emergence of new ones, peace negotiations in the hottest regions have already commenced. 'Conflicting parties seem to have at least started to talk. A cease-fire in the Middle East and Eastern Europe is now more likely than it was only a month ago, but a lasting peace may take years to achieve. Either way, any progress in negotiations or even a temporary cessation of hostilities will improve risk sentiment and have a bearish impact on gold,' says Kar Yong Ang, global broker Octa analyst.

Technical Picture

Kar Yong Ang comments: 'At the end of July, it appeared like gold was getting under heavy bearish pressure and it looked like it was about to finally escape its two-month trading range and break below the 100-day moving average. With some big trade issues sorted out and the Fed being cautious about inflation, a price drop seemed pretty likely. But then, a surprisingly weak jobs report came out and completely flipped everything around.'

Indeed, trade-related risk premium may have started to leave the market, but last Friday's weaker-than-expected U.S. payrolls data boosted Fed rate cut expectations, which, in turn, substantially weakened the U.S. dollar and thus pulled XAUUSD higher. The short-term technical picture for gold now looks bullish again.

Kar Yong Ang offers his perspective on the technicals: 'In case XAUUSD rises above the critical 3,395 level and holds above it, traders will then almost certainly attempt to pull it towards the 3,426 level, where short-term consolidation may begin to take place again. However, a confident rise above 3,460 will open the way towards new all-time highs. Alternatively, only a drop below 3,300 will invalidate the underlying bullish trend'.

Octa broker offers a proprietary trading platform to facilitate trading activities. Gold traders can expect fast execution and small spreads and also benefit from the company's dedicated analytical support, which includes daily trading ideas and educational materials.

XAUUSD DAILY TECHNICAL CHART

Key Macro Events in August (scheduled)

| 5 August | U.S. ISM Services Purchasing Managers Index |

| 7 August | Bank of England Interest Rate Decision |

| 7 August | U.S. Jobless Claims |

| 12 August | Reserve Bank of Australia Interest Rate Decision |

| 12 August | U.S. Consumer Price Index |

| 14 August | U.S. Producer Price Index |

| 14 August | U.S. Jobless Claims |

| 15 August | U.S. Retail Sales |

| 15 August | U.S. Import Prices |

| 15 August | U.S. Consumer Sentiment |

| 19 August | Canada Consumer Price Index |

| 20 August | Peoples' Bank of China Interest Rate Decision |

| 20 August | Reserve Bank of New Zealand Interest Rate Decision |

| 20 August | UK Consumer Price Index |

| 20 August | FOMC Meeting Minutes |

| 21 August | S&P Global Flash Purchasing Managers Index |

| 21 August | U.S. Jobless Claims |

| 21-23 August | Jackson Hole Symposium |

| 26 August | U.S. CB Consumer Confidence |

| 27 August | Australia Consumer Price Index |

| 28 August | U.S. Gross Domestic Product |

| 28 August | U.S. Jobless Claims |

| 29 August | Germany Consumer Price Index |

| 29 August | U.S. Personal Consumption Expenditure Price Index |

Disclaimer: This press release does not contain or constitute investment advice or recommendations and does not consider your investment objectives, financial situation, or needs. Any actions taken based on this content are at your sole discretion and risk—Octa does not accept any liability for any resulting losses or consequences.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools. The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities. In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.

[6] https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa broker

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools. The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities. In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.