Bitcoin is now a 'safe-haven coin' of the crypto market, Octa broker says

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 28 May 2025 - According to Coinbase's April 2025 Monthly Outlook, the total crypto market capitalisation (excluding Bitcoin) has fallen by 41% from $1.6 trillion in December 2024 to $950 billion in early April 2025.

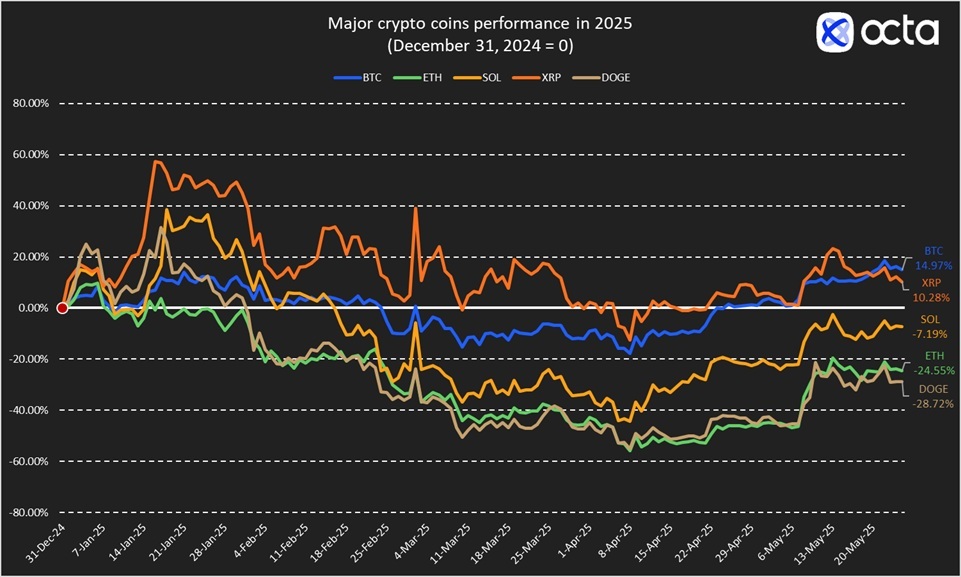

This was the sharpest decline in over two years, pulling valuations below levels seen throughout most of the 2021–2022 cycle. However, the sell-off was far from uniform. While Bitcoin has shed less than 20% at the beginning of April, altcoins have experienced a 41% wipeout, underscoring a distinct capital flight towards more established digital assets.

Most recently, Bitcoin has managed to recover and even set a new all-time high, surpassing the critical $110,000 mark on 21 May. At the same time, other crypto majors—notably, Ethereum and XRP—continue to trade substantially below their recent peaks (see the chart below). As capital retreated from riskier altcoins, investor sentiment has soured, prompting Coinbase to warn of an emerging 'crypto winter' scenario. Global broker Octa, active in digital asset transactions, sees this as a decisive phase of risk reallocation, with traders seeking clarity before any meaningful return to risk.

Several stress points are converging:

- Venture capital (VC) funding, though up from Q4 2024, remains 50–60% below 2021–22 levels.

- Liquidity conditions are tightening, particularly for smaller projects.

- Macro headwinds—including rising global tariffs and macroeconomic uncertainty—have paralysed risk appetite.

Kar Yong Ang, a financial market analyst at Octa broker, explains: 'As of right now, the market clearly sees more value in Bitcoin vs the rest of the crypto universe. The global macroeconomic situation is highly unstable, with tariffs drama still unfolding and rising protectionism potentially threatening the U.S. dollar's reserve currency status. As a result, investors' capital has migrated from high-risk crypto space like alt-coins into relatively low-risk Bitcoin. In fact, Bitcoin has become a sort of "safe-haven coin" of the crypto market'.

Indeed, broader financial markets have become increasingly concerned about the deteriorating U.S. twin deficits (fiscal and trade), both of which are on an unsustainable trajectory. The yields on the U.S. 20-year government bonds rose above 5.15% on 22 May, almost a two-year high, while the U.S. Dollar Index (DXY) dropped below the critical 100 mark, reflecting eroding confidence in the USD's safe-haven status. Furthermore, ratings agency Moody's downgraded the U.S. sovereign rating, one notch down from 'Aaa' to 'Aa1' due to concerns about the nation's growing debt. Concurrently, most cryptocurrencies continue to act as high-beta proxies for global sentiment, and in today's global macroeconomic environment, that sensitivity is proving to be a significant headwind. Tariff disputes between the U.S. and China, macroeconomic uncertainty, and declining equity market performance are all contributing to a reduction in overall risk appetite, thereby negatively impacting most cryptocurrencies. However, Bitcoin appears to be a major exception in this regard.

Kar Yong Ang explains: 'At first, the BTC rally appeared to be highly speculative: the market had positively reacted to Trump's softer stance towards the Federal Reserve (Fed) Chairman and U.S.-China trade deal. Later, however, Bitcoin became the only major crypto coin to set a new all-time high. It suggests a continuing flight to perceived safety within the crypto universe, while alt-coin flows remain diminished'.

Still, the ongoing macroeconomic uncertainty and potential failure of the U.S. to resolve its trade tensions with China and the European Union (EU) could act as an immediate catalyst, potentially triggering a renewed bearish phase for Bitcoin. Just recently, U.S. President Donald Trump's threat to impose 50% tariffs on the EU triggered a classical risk-off move—a sell-off in BTCUSD and a rally in XAUUSD.

Traders and long-term investors should keep a close eye on:

- the total market cap, excluding BTC

- fluctuations in VC funding

- headlines impacting regulatory frameworks in the U.S., EU, and Southeast Asia

- any news related to the ongoing trade disputes and the possibility of trade negotiations.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities.

In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.