CPA Australia: Hong Kong SMEs eager to innovate amid tougher financing conditions

HONG KONG SAR - Media OutReach Newswire – 10 April 2025 - CPA Australia's latest Asia-Pacific (APAC) Small Business Survey 2024-25 reveals that the outlook for business growth this year for Hong Kong's small and medium enterprises (SMEs) has slowed, though their hiring intentions remain strong.

To combat uncertainties and rising competition, many are focusing on innovation and increasing their investment in artificial intelligence (AI).

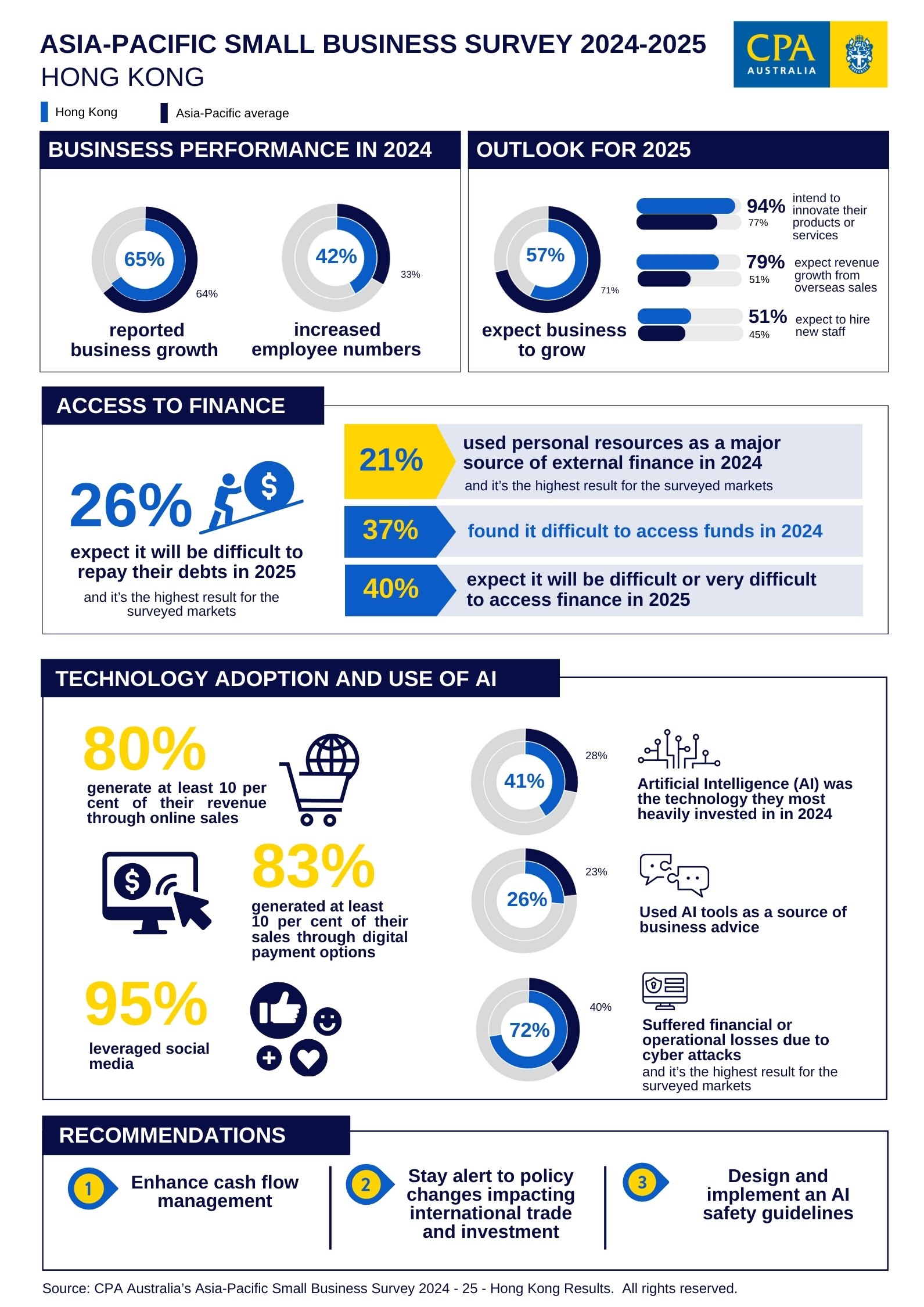

The annual survey collected views from 4,236 small businesses in 11 markets across the Asia-Pacific region (including Singapore, Mainland China and Australia) to understand their business performance and outlook. The survey included 306 respondents from Hong Kong, with 65 per cent of the businesses surveyed reporting business growth in 2024, a notable rise from 57 per cent in 2023 and the strongest performance since 2017.

However, 57 per cent of respondents expect their business to grow in 2025, marking a sharp decline from last year's 69 per cent growth projection. Confidence in Hong Kong's broader economy mirrors this trend, with 68 per cent expecting economic expansion this year, down from 73 per cent in 2024.

Mr Cliff Ip, a councillor on CPA Australia's Greater China Divisional Council, said: "2024 was a positive year for most Hong Kong SMEs, thanks to an improving economy and various government support measures. However, this year, many SMEs are facing multiple challenges, including economic pressures, tightening financing conditions and increased market competition. As a result, business sentiment has become more cautious.

"Some sectors are still adapting to changes in consumer behaviour, such as the rise in online shopping and spending outside of Hong Kong. For SMEs to achieve sustainable development, it's important to adopt a more proactive approach in embracing these trends."

To remain competitive, Hong Kong SMEs are keen to innovate and expand into overseas markets. In 2025, 94 per cent of respondents intend to innovate their products or services, surpassing their regional counterparts for the second consecutive year. Additionally, 79 per cent expect revenue growth from overseas sales this year, the highest among the markets surveyed.

"It is encouraging to see that many Hong Kong SMEs are looking to grow their business through alternative sources, such as overseas sales. They should actively leverage government support programs such as E-commerce Express and SME Export Marketing Fund to accelerate business transformation. Meanwhile, given heightened geopolitical risks, SMEs need to stay alert to the risks and opportunities from policy changes, such as tariffs," Mr Ip said.

The challenging financing conditions are noteworthy. In 2024, over 80 per cent of Hong Kong's small businesses required external finance. However, 37 per cent found it difficult to access funds, up from 8 per cent in 2023. Additionally, the number of small businesses struggling to repay their debts rose from 9 per cent in 2023 to 22 per cent in 2024. The financing and solvency issues are likely to persist this year. In 2025, 40 per cent anticipate difficulty accessing finance, while 26 per cent expect they may struggle to repay debts.

"While banks remain the main source of external funding, many SMEs used their personal resources last year, marking a five-fold surge from 2023, due to tightened lending requirements. We therefore welcome the measures, announced this week by the Hong Kong Monetary Authority (HKMA) and the banking sector, to support SMEs obtain bank financing. To further assist SMEs in managing their liquidity needs, we suggest the Hong Kong government and financial institutions extend the Pre-approved Principal Payment Holiday Scheme for 12 months," Mr Ip said.

"To sustain growth, SMEs should continuously innovate to stay competitive, closely monitor their cash flow, focus on high-growth business opportunities, diversify revenue streams, and seek professional advice on cost-saving measures. These strategies will help businesses navigate economic uncertainties and strengthen their long-term competitiveness."

Employment trends in the SME sector remain strong. Last year, 42 per cent reported an increase in headcount, and 51 per cent expect to hire new staff this year.

The survey also highlights robust technology adoption among Hong Kong's small businesses. In 2024, 80 per cent sold online, 83 per cent offer digital payment options and 95 per cent leverage social media. Notably, 41 per cent reported making a major investment in AI last year, marking it as a significant investment among other technologies. Another 26 per cent sought advice from AI tools.

Mr Davy Leung, Deputy Chairperson of CPA Australia's Small and Medium Enterprises Committee – Greater China, said: "Hong Kong SMEs are facing labour shortages and talent competition issues, especially because many business owners are keen on hiring. This might be prompting them to invest heavily in advanced technologies such as AI and conversational platforms to interact with potential customers, improving efficiency and saving costs.

"It's interesting that AI tools have become a popular source of advice for many SMEs in Hong Kong. There are pros and cons of consulting AI on doing business. While leveraging advanced technologies like AI reflects a positive attitude and open mindset towards trying new methods, it also increases cyber risks. Additionally, SMEs should not rely solely on AI and should seek advice from reliable professionals, especially on technical issues such as financing and taxation.

"Last year, 72 per cent of SMEs suffered financial or operational losses due to cyberattacks, ranking highest among all markets. This highlights urgent cybersecurity gaps that must be addressed. To safeguard SMEs from escalating cyber threats, the government should strengthen support programs by providing more funding for cybersecurity investments, offering practical training on cyber risk management, and enhancing information-sharing platforms."

Hashtag: #CPAAustraliaHongKong

https://www.cpaaustralia.com.au/

https://www.linkedin.com/school/cpaaustralia/

The issuer is solely responsible for the content of this announcement.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with nearly 175,000 members in over 100 countries and regions, including more than 22,500 members in Greater China. CPA Australia is celebrating its 70th anniversary in Hong Kong this year. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on issues affecting the accounting profession and the public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au