Gold market shows screaming buy signals at the start of 2023

Increased demand for jewellery in mainland China and Malaysia will cause gold to soar above $2,000 in 2023.

KUALA LUMPUR, MALAYSIA - Media OutReach - 21 March 2023 - 2022 was a tough year for gold, but in the last three months of 2022 the situation changed radically: net short position in gold was on the low side; banks began to buy gold into foreign exchange reserves; the U.S.economy began to signal a slowdown in inflation, which in turn contributed to a softening of the Fed's rhetoric. As a result, gold gained bullish momentum and added 13% by the end of the year.

For now, the gold market looks like a picture of a perfect storm in front of us—with a strong bullish rally and a moderate bearish correction. But to be more confident, gold investors need to dive into the specifics and study the fundamentals, such as supply and demand dynamics, significant political and economic factors.

The OctaFX experts examined supply and demand data, as well as the weight of other factors that have an impact on the gold price.

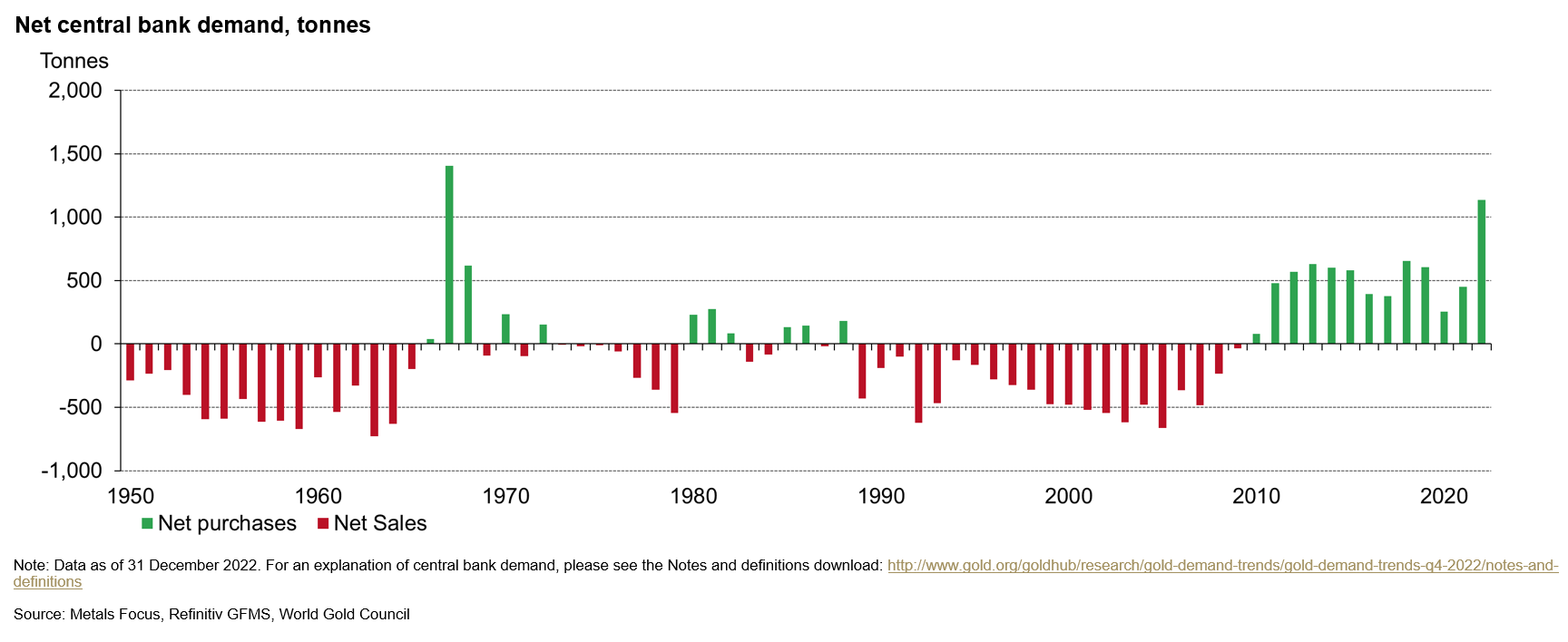

Central bank purchases are the main driver

At the end of 2022, demand for gold jumped 18% to 4,741 tonnes. The key driver of this growth was enormous purchases by central banks. In 2022, central bank demand was 1,136 tonnes (152% y/y), which is a record (see pic).

Pic. Net central bank demand in tonnes.

The reason for the increased demand on the part of the central banks is in the geopolitics and significantly correlates with the events in Eastern Europe. During the conflict, information about the freezing of U.S. Treasuries purchased by Russia appeared in the information field. This fact is a precedent showing that the traditional system of foreign exchange reserves does not work. It is therefore quite logical that the central banks of the world have revised the risks: they reduced the share of U.S. Treasuries and dollar cash in favour of physical gold.

Kar Yong Ang, a financial market analyst at OctaFX, believes that 'due to continued geopolitical tensions and a virtually non-operational foreign exchange reserve system, central bank purchases will remain high throughout 2023 at 1,000–1,200 tonnes'.

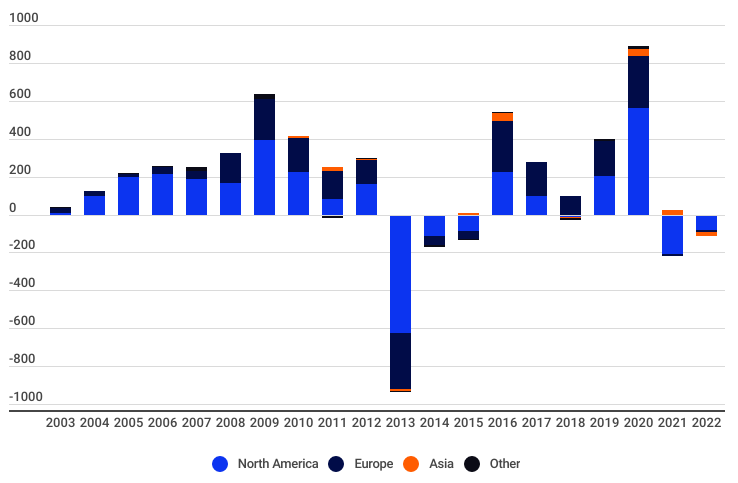

Investment demand—potential driver to boost the gold price higher

Growth in demand from the central banks is confirmed by increased investment demand, which rose to 1,107 tonnes in 2022 (+10% YoY) mainly due to higher interest in physical gold. At the same time, withdrawals from gold funds continued in 2022, but were more moderate relative to 2021.

Pic. Gold ETF yearly flows (in tonnes).

There has been no clear participation of global gold ETFs over the past two years. But now the situation is changing. Comparing monthly flows between US and Europe ETFs, it appears that the outflow of gold from European ETFs masked the incipient positive flows into US ETFs. Futures dynamics have a statistically significant impact on ETF flows with a time lag of two months. Based on this statement, the 13% gold value increase in December 2022—January 2023 is not yet embedded in the current flows and will have a positive impact on investment demand over the next 1–3 months.

'Considering the positive dynamics of the gold price, the growing demand from North American ETFs (50% of world holdings) and the absence of an inflation shock as well as softer monetary policy, total ETF demand will stop being negative and approach its median value for the last 12 years, reaching 124 tonnes by the end of 2023 (vs -110 tonnes in 2022),' the OctaFX expert Gero Azrul commented.

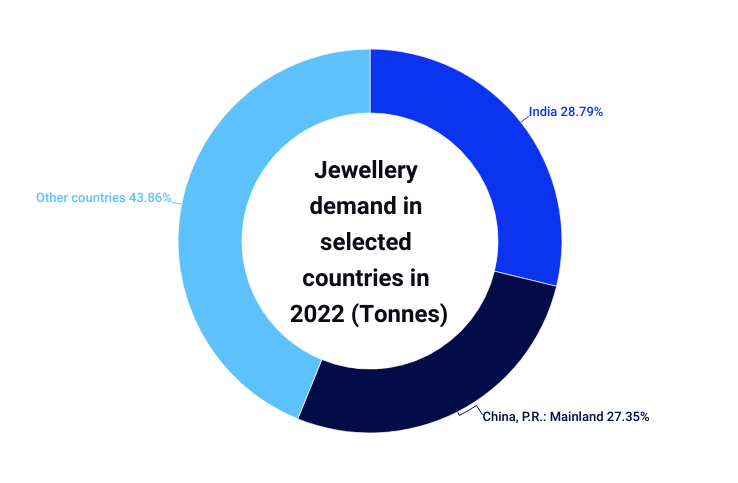

Jewellery consumption in China has a significant impact

Jewellery consumption, the largest component of demand, dropped 3% to 2,086 tonnes in 2022. The decline was due to a lack of appetite mainly from the jewellery markets of China and zero-COVID policy—demand in China dropped 15% to 598 tonnes (vs. 699 tonnes in 2021). Chinese demand for gold jewellery accounts for one-third of global demand.

Pic. Jewellery demand in selected countries (2022).

Currently, a key blocker of industrial cycle recovery problems related to COVID lockdowns has disappeared—in early 2023, the Chinese government announced the abolition of zero-COVID policy.

The additional factor in favour of APAC demand growth is the growing demand in local markets. Thus, jewellery demand in Malaysia grew by 24%, in Singapore by 30%, and in Vietnam by 51%. In fact, business cycles in the APAC are moving into an early cycle in which gold mining companies (materials sector) are growing moderately over a 1–2 year interval.

In this regard, Kar Yong Ang expects the economic recovery of mainland China and PRC in particular to boost demand in 2023 by 17% year-on-year (up to 700 tonnes).

Gold supply is stable over years

Overall, gold supply shows a fairly stable picture. Even supply-chains and geopolitical disruptions of 2020–2022 had no statistically significant impact. The compound annual growth rate (CAGR) over the last 13 years is 2.1%. The gold supply increased by 2% in 2022 to 4,755 tonnes, coming very close to the 2018 peak.

Opportunity cost and uncertainty are the key tailwinds for gold in 2023

Apart from the information above, investors need to consider four groups of additional fundamental factors: economic expansion; risk and uncertainty; opportunity cost; momentum / impulse.

From a macro perspective, a good portion of last performance can be attributed to the opportunity cost (weaker US dollar, followed by a drop in the US 10-year Treasury yield).

Conclusion:

- According to the OctaFX expert calculations, total physical gold demand in 2023 will increase by 6.3% to over 5,000 tonnes (vs. 4,740 tonnes in 2022).

- Gold price has an upside trend due to the opportunity cost factor—amid the continued weakening of the dollar and a moderate decline in the US 10-year Treasury yield.

- Extremely strong support for gold quotes in 2023 will be due to the risk and uncertainty factor, which will manifest itself in increased demand for physical gold from central banks.

- All these drivers allows forecasting the gold price over $2,000/oz by the end of 2023, which corresponds to a potential increase of +8.3% at the time of writing.

Hashtag: #OctaFX

The issuer is solely responsible for the content of this announcement.

About OctaFX

OctaFX is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and a variety of services already utilised by clients from 180 countries who have opened more than 21 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, OctaFX managed to capture the 'Best Forex Broker Malaysia 2022' award and the 'Best Global Broker Asia 2022' from Global Banking and Finance Review and International Business Magazine, respectively.