who's the better economic manager?

- Written by Mark Crosby, Professor, Monash University

In 1995 I co-authored a paper with Diane Brown and Louise Malady which examined economic outcomes under Labor and Liberal governments[1] in Australia to that time.

We found very little difference in the economic performance of the two sides of politics, once proper controls had been put in place for the state of the world economy and other things that affect Australia.

Despite the Liberals making much of their economic credentials, I don’t think we’ll see any difference in economic outcomes such as the unemployment rate, GDP growth, or inflation under a Labor or a Liberal government, and in other writings in this outlet Anne Garnett and I have argued that government spending[2] and government debt and deficit[3] are typically little different under either side of politics.

Little difference then, little difference since

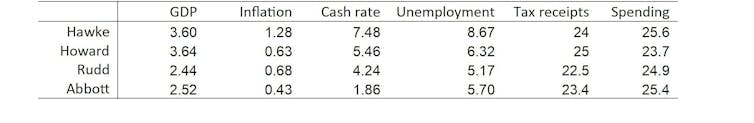

The table below shows some data relevant to questions about economic outcomes under different governments since the Hawke government won the federal election in March 1983.

It shows clearly a drop in the rate of growth of Australia’s gross domestic product since the Howard government left office, but there’s little difference between the rates under Rudd/Gillard (RG) and Abbott/Turnbull/Morrison (ATM).

Economists would explain the drop in the rate of growth since Howard more by pointing to the the global financial crisis and the end of the mining boom than by weaker economic management by either side.

Note: The columns show averages of growth in real GDP, CPI inflation, the RBA target cash rate, the unemployment rate, tax receipts and government spending as a share of GDP over each term in office. (Only the first PM is listed, though they should not be given sole credit/responsibility for the outcomes!)

Sources: RBA Bulletin Database, ABS, and MYEFO

Note: The columns show averages of growth in real GDP, CPI inflation, the RBA target cash rate, the unemployment rate, tax receipts and government spending as a share of GDP over each term in office. (Only the first PM is listed, though they should not be given sole credit/responsibility for the outcomes!)

Sources: RBA Bulletin Database, ABS, and MYEFO

The rest of the table provide little evidence of better macroeconomic management by one political party or the other.

Inflation and the Reserve Bank’s cash rate were higher under Hawke/Keating (HK), but that was a time of globally high inflation and interest rates. The “recession we had to have” in the early 1990s brought the inflation rate down, and also explains the high unemployment rate average under HK.

As far as unemployment goes, it is the state of the world economy that would explain most of the differences between the governments in the table.

On spending and tax, the Howard government benefited greatly from the mining boom and were able to keep spending below tax revenue on average. Since then the ATM Liberals have had no more success than the RG Labor government in keeping spending below tax.

Success has many fathers

Hawke and Keating have recently been claiming responsibility for Australia’s recent strong economic performance on the grounds that they initiated many of the reforms that have put Australia in good stead since the last recession in the 1990s.

I think they are overstating their case a little. Earlier reforms such as the Whitlam tariff cut in the 1970s and later reforms such as Howard government’s labour market changes and the introduction of the goods and services were also important.

Australia has been fortunate to have had a well managed economy over much of the past 40 years and prime ministers and treasurers on both sides of politics who have been equally up to the job and responsible for our relatively good outcomes.

Labor (and Liberals) can manage money

Currently I would be equally comfortable with the ability of the incumbent (Josh Frydenberg) and his shadow (Chris Bowen) to deliver solid economic outcomes as treasurer over the next three years. I would be much more comfortable if either of them showed a stronger commitment to further economic reform.

Of course we will see different decisions under a Labor or a Liberal government leading to different economic outcomes. Labor’s proposed tax and other reforms will benefit some and hurt others, but the point here is the differnce in their overall impact on the macroeconomy is likely be minimal.

Read more: Vital Signs: When it came to the surplus, both Bill and Scott were having a lend[4]

Things are much more interesting when it comes to their effects on income inequality. But even on that front it isn’t clear to me which party’s policies will deliver better outcomes.

So who should you vote for on Saturday? I’ll leave that to you, but don’t make your decision on the basis that it will make any difference to the state of the economy.

References

- ^ economic outcomes under Labor and Liberal governments (www.deepdyve.com)

- ^ government spending (theconversation.com)

- ^ government debt and deficit (theconversation.com)

- ^ Vital Signs: When it came to the surplus, both Bill and Scott were having a lend (theconversation.com)

Authors: Mark Crosby, Professor, Monash University

Read more http://theconversation.com/trick-question-whos-the-better-economic-manager-116968