AllianceBernstein: ESG Investing Still Has Merits Despite Headwinds

Climate Change and Pandemic Fuel Greater Investor Awareness for ESG Considerations into Investment Strategies

AllianceBernstein Actively Engages Companies in ESG Discussions for Positive Outcomes

Sustainable portfolios have taken a beating this year amid investor concerns over a global recession, inflationary pressures and the conflict in Ukraine. Despite this, AllianceBernstein (AB), a leading global investment management and research firm, says ESG (Environment, Social and Governance) investing still has its merits.

With climate change and the health and social impact of the pandemic sweeping across the world, investors have become increasingly aware that assessing ESG issues in investment processes is no longer something that is ‘nice to have’ but is essential to delivering better risk-adjusted returns and outcomes.

Performance figures bolster the evidence that investments that use ESG ratings and metrics to select securities and structure portfolios can deliver competitive returns. Between 2017 and 2021, 88 of the 110 Morningstar ESG indices with five-year histories outperformed their non-ESG equivalents. Meanwhile, the S&P 500 ESG Index rose 32% in US dollar terms in 2021, beating the S&P 500’s 27% gain.

Engagement for Insight and Better Outcomes

AB believes that ESG research, engagement and integration help to better assess risks and identify opportunities, ultimately leading to enhanced decision-making and improving outcomes for clients. Which is why the firm has stepped up its engagement with company leadership.

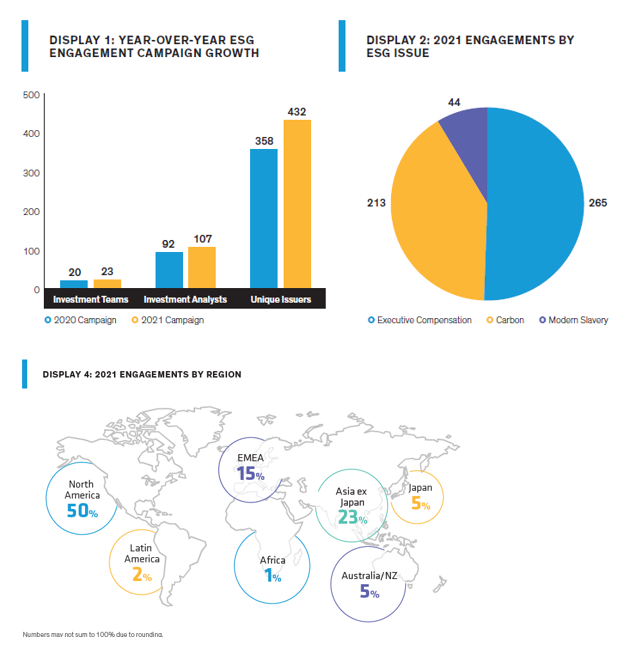

In its latest ESG engagement campaign in 2021, AB’s 107 investment analysts across 23 teams engaged with 432 unique issuers on carbon emissions, executive compensation and modern slavery. Engagement results were encouraging. On climate goals and disclosures, for example, about half of the 213 issuers - 46% - had some climate targets or disclosures, and almost all of the issuers that did not have climate goals or disclosures were receptive to adopting them. Regarding issues such as modern slavery, which can be a sensitive topic of discussion to some issuers, AB found that 82% of companies were receptive or very receptive to the conversations focused on reducing modern slavery risks in their supply chains. While most companies engaged during that period were based in North America (50%), Asia including Japan closed in at the second spot, with 28% of all the engagements, as shown in Appendix A.

These figures mark an increase from 2020, when 92 investment analysts engaged with 358 unique issuers, while the percentage of companies engaged in North America and Asia including Japan stood at 48% and 22%, respectively.

AB sees a potential for future engagements to increase further amid growing awareness of social responsibility and sustainability. Says Michelle Dunstan, Chief Responsibility Officer at AllianceBernstein, “As active investors, engagement with company management is central to our philosophy on ESG issues. By engaging with executive teams, we aim to influence company behavior, which in turn can make a positive impact on investment returns.”

Commitment Drives Action

Besides engaging with issuers on climate-change risks and opportunities, AB has also partnered with clients, regulators, and other stakeholders to push for progress on climate issues since it signed on to the Principles for Responsible Investment in 2011.

The firm’s commitment to investing responsibly extends to academia. AB has collaborated with Columbia University’s Climate School on climate-policy work in addition to training programs to shape the next generation of professionals striving to address the impact of climate change and develop solutions.

More recently, AB announced that it is working towards achieving net-zero emissions and aligning its business operations and a range of investment strategies with a 1.5-degree Celsius pathway by 2050, in support of the Paris Agreement. As part of its net-zero transition plan, AB also joined the Net Zero Asset Managers Initiative (NZAMI), an international body of over 270 signatories managing more than US$61 trillion of assets (as of 31 May 2021) that is committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner.

“Our net zero strategy is a result of years of collaboration with peers, clients, issuers and industry leaders,” says Dunstan. “Research has continually informed our approach, while policy has helped shape our strategy and how we engage on behalf of our clients. AB’s net zero journey is well under way, and we’re excited for its next stage—translating our strategy into a systematic approach to fulfilling our commitment.”

Details of the ratio of companies engaged across countries and by sectors is provided in Appendix A.

For more information on AB’s corporate responsibility and ESG solutions, visit alliancebernstein.com/

For other information, visit abfunds.com.sg

About AllianceBernstein

AllianceBernstein (Singapore) Ltd is a wholly owned subsidiary of AllianceBernstein L.P. (“AB”)

AB is a leading global investment-management and research firm, operating in 26 countries and jurisdictions, with US$667 billion in assets under management globally (as of 31 August 2021). We’re fully invested in being a firm that clients can trust to deliver better outcomes, whether they’re individual investors or the world’s biggest institutions. We bring together a wide range of insights, expertise and innovations to advance the interests of our clients. And we’re doing it responsibly—from how we act to how we invest—because outcomes mean more than financial returns. By tapping a global network of diverse perspectives, we design innovative solutions tailored to meet investors’ unique needs and engineered to deliver the performance they expect.

Further details on AllianceBernstein can be found here abfunds.com.sg

Investment involves risk. The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed here may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor's personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer of solicitation for the purchase or sale of, any financial instrument, product or service sponsored by AllianceBernstein or its affiliates.

NOTE TO SINGAPORE READERS:

This document has been issued by AllianceBernstein (Singapore) Ltd. (“ABSL”, Company Registration No. 199703364C). AllianceBernstein (Singapore) Ltd. is regulated by the Monetary Authority of Singapore. This advertisement has not been reviewed by the Monetary Authority of Singapore.

APPENDIX A

COMPANIES THAT ALLIANCEBERNSTEIN ENGAGED WITH IN 2021

Source for Displays 1, 2 and 4: AB 2021 ESG Engagement Report. As of March 2022.

MICHELLE DUNSTAN’S BIOGRAPHY

Michelle Dunstan is AllianceBernstein’s Chief Responsibility Officer and a member of the firm’s Operating Committee. In this role, she oversees AB’s corporate responsibility practices and responsible investing strategy, including integrating environmental, social and governance (ESG) considerations throughout the firm’s research, engagement and investment processes. Dunstan also oversees the firm’s ESG thought leadership and product development. She is Senior Investment Advisor for AB’s Global ESG Improvers Strategy, which focuses on engaging with and investing in companies that are advancing along ESG dimensions. Dunstan was AB’s global head of responsible investing from 2020 to 2021. From 2012 to 2020, she was a portfolio manager for the Global Commodity Equity Fund. She joined AB in 2004 as a research analyst and covered commodities in emerging markets and North America for several years. Prior to joining the firm, Dunstan was an engagement manager at the Monitor Group (now Monitor Deloitte). She holds a BCom from Queen’s University in Canada and an MBA from Harvard Business School, where she graduated with high distinction as a Baker Scholar. Location: New York