Top Mistakes Small Businesses Make When Managing Their Cash Flow

- Written by Angus Sedgwick

It’s a tough time for SME’s at the moment. Rising overheads, supply chain issues, high staff turnover and an increase to the minimum wage – it’s no wonder many are struggling with the day to day running costs. Here at business cash flow finance company OptiPay, we’ve had a two-fold increase in inquiries as a lot of businesses start to realise they have a cash flow problem and they look to solutions.

Whilst invoice financing can be a huge help to many businesses it’s important to realise where cash flow issues stem from and the most common mistakes SME’s make when managing it.

- Delayed Payments

It’s a simple fact of life that customers fail to pay on time. More than $76billion of outstanding invoices are weighing on the shoulders of Australian SME’s. Delays in payments make it harder for you as a business owner to prepare for an accurate cash flow forecast. How can you plan an expense or ongoing payment when you don’t know when your next incoming payment is coming in? Cash flow forecasting is vitally important as it helps make the important decisions that keeps the business going in the right direction.

- Fast Expansion

This is one of the most common causes for Australian SME’s cash flow complications - the temptation to move too quickly and grow too fast. Without enough cash flow, businesses lose the ability to control their working capital requirements. Growth and progression is vital for every business but make sure your cash flow is up to the task before you expand.

- Poor Inventory Management

This is another common cause of cash flow problems, where excess stock is lying around leaving assets that tie up valuable cash for months on end. In addition to holding back cash which you could be using to fund your business, keeping too much stock means you run the danger of it becoming outdated and obsolete, which could land you in further trouble.

- No Sales Leads

Poor cash flow can also be the result of low sales and a lack of new leads. It may be a seasonal demand issue, or an overall slowdown of business but many organisations can hit a sales roadblock from time to time. Freshening your marketing campaigns can be one way of getting around this problem or renewing your focus on digital marketing and new sales people.

If you find yourself experiencing cash flow problems the most important thing is that you address them quickly and it would be wise to engage the services of a financier like OptiPay to discuss the solutions available to you to provide your business with the extra cash it needs to keep up with its growth and working capital requirements.

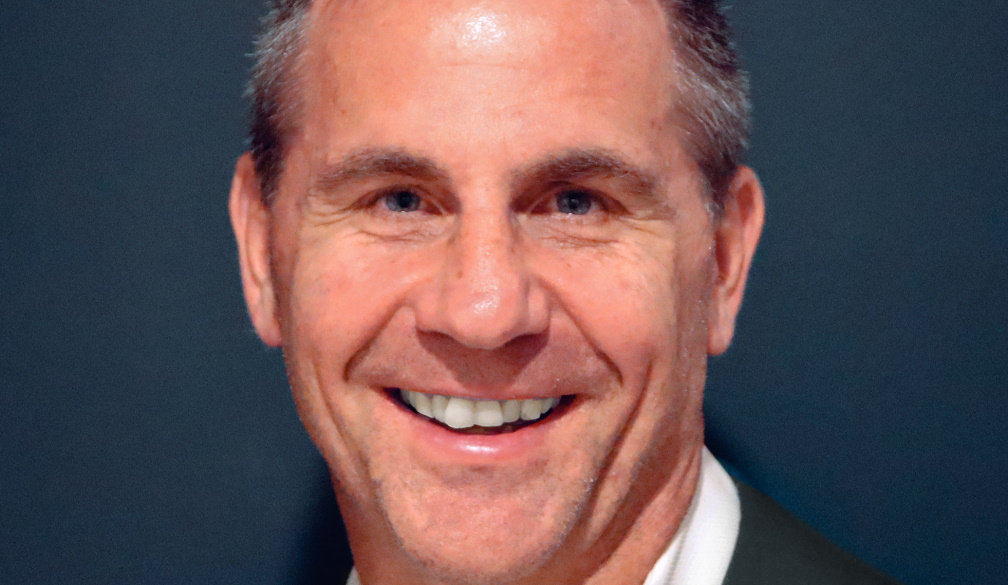

About Angus Sedgwick

Angus Sedgwick is the CEO of OptiPay, formerly TIM Finance, which provides Australian SMB businesses cash flow they need to grow. Funding solutions include invoice finance, trade finance inventory finance and lines of credit. Their range of fast, flexible and affordable financing solutions help businesses solve their cash flow challenges, without the need for property security. Find out more at https://optipay.com.au