Retail trade doubles down on omnichannel integrations to increase consumer value

Omnichannel strategies are set to scale drastically, with almost eight in ten (79%) Australian marketing decision-makers in the retail and consumer goods industries looking to implement or further invest in seamless customer experiences, according to new research released today.

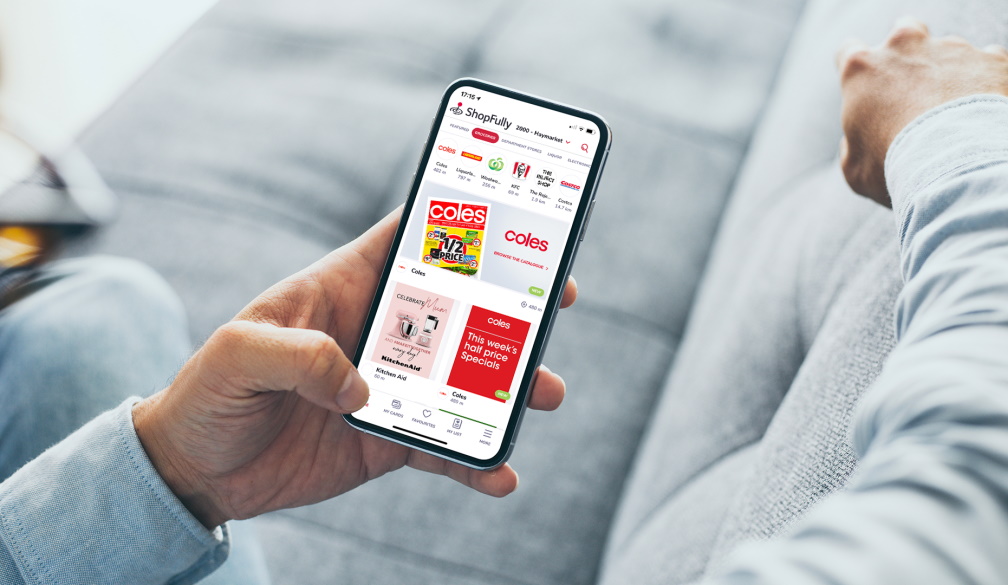

The commissioned survey into the marketing investments of Australian retailers, brands and marketing agencies from ShopFully—the leading tech company in Drive to Store that connects millions of shoppers with the stores around them—and Nielsen Media Analytics, found that 95% of respondents believe brick-and-mortar storefronts will continue to have a future, despite the evolution of digital shopping channels.

While the physical store remains a priority, almost half (49%) of marketing decision-makers surveyed will increase their spending on digital platforms such as websites, cross-media marketing and mobile apps by more than 25% in the next three years to better share information and build relationships with consumers.

Dean Vocisano, ShopFully’s Country Manager of Australia, said the findings demonstrate how the retail industry is set to embrace the rise of the unified shopping experience.

“Australian retailers and brands were quick to adopt and optimise digital mediums throughout the pandemic, with Click & Collect, delivery on instore and online purchases, and online stock checks among the most adopted features. The challenge now is to better integrate outdated, multichannel marketing models to support a seamless checkout experience for Aussie consumers who are making fewer shopping trips but with larger baskets,” Vocisano said.

Catching up to the rest of the world with proximity marketing

More than seven in ten (73%) of the retail industry professionals surveyed find app prompts or notifications to be an effective proximity marketing tool. Respondents across all three industry streams (in-house retail, brand and agency) identified social media ads as the most effective proximity marketing tool (78%), followed by personalised emails (73%), and Google ads (74%).

Unanimously, increased foot traffic (51%), increased customer loyalty (47%) and better efficiency in targeting consumers close to the physical store (47%) were identified as the most important reasons for implementing proximity marketing activities. In fact, nine in ten (90%) brands, and seven in ten (71%) retailers said geo-personalised messages are effective.

“Retailers and brands across Europe have been successfully connecting with local customers through proximity marketing for years, and it’s exciting to see the Australian industry follow suit. By narrowing in on where shoppers are in real-time, retailers and brands can direct them into physical stores to make a purchase,” said Vocisano.

Marketers are boosting investment in digital catalogues

81% of brand marketers surveyed attribute a significant portion of their revenue to catalogues. However, investment in paper catalogues is set to decline, with over one-quarter of retail (26%) and agency (28%) respondents stating they are unlikely to invest in the physical medium over the next three to five years.

Instead, the industry is increasing its spend on digital catalogues more than any other media channel, with four in five (78%) respondents currently investing in this format. Specifically, the retailer and brand marketers surveyed spend, on average, over 20% of their overall marketing budget on digital catalogues, making it the biggest budget voice alongside television advertisements. Boosting the frequency of consumer purchases (24%) and driving foot traffic in-store (22%) were respondents’ top reasons for this investment.

82% of retail marketers and 95% of agency professionals on behalf of clients and who are likely to continue investing in digital catalogues, anticipate spend will increase by 10-50% in the next three to five years. Almost two-thirds (64%) of brand marketers who plan to spend more on the medium expect their investment will increase by more than 25% in the same period.

Digital channels see the largest allocation of marketing spend

Unsurprisingly, the retail industry is spending more on digital channels, with three-quarters (75%) of survey respondents having increased their investment in digital platforms over the past three years.

Only 76% of retail and 71% of brand marketers revealed their organisation is present on social media. According to the research, retailers rely more on Google display and search (63%), while brands choose to maintain a stronger presence via online stores (49%) and marketplaces (47%).

Reaching more customers is the top reason for investment in digital channels among three in five (60%) brands, with over half (54%) preferring digital as it provides a more personalised experience. Similarly, retailers’ digital investment is to expand their user base (54%) and due to consumers favouring these channels (51%).

“In a fast-evolving industry, Australian brands and retailers run the risk of losing consumers before they convert if they’re operating without an understanding of how each customer touchpoint feeds into the next. It’s essential to marry the physical and digital worlds to capitalise on the moments in which consumers are the most likely to fulfil a brand or retailer’s desired outcomes,” Vocisano said.

“Looking at these insights, it’s clear the in-store experience is not going anywhere, and digital technologies will only continue to expand in breadth and in capability. To gain a competitive edge in an already oversaturated sector, Australian professionals must act on the opportunity to enhance connections with customers and stand out from the crowd.”

To learn more about the research and discover how ShopFully is working with Australian retailers and brands to drive traffic in-store, visit corporate.shopfully.com.