ROKiT HOMES ADDRESSES GROWING NEED FOR QUICKLY ACCESSIBLE, AFFORDABLE AND SUSTAINABLE HOUSING

- Written by Business Daily Media

As global communities grapple with homelessness, the need for accessible, affordable, and sustainable housing has never been greater.

California-based ROKiT Homes, a division of ROKiT Industries, has stepped up to answer the call, designing reliable and low-cost housing for those devastated by circumstances in the U.S. and beyond.

Jonathan Kendrick, Co-Founder and Chairman, said “ROKiT Homes was born out of a desire to lighten the burden for those struggling with housing dilemmas and communities with compelling needs.”

Whether it be those who lost their homes in disasters, such as the recent Los Angeles wildfires, hurricanes and tornadoes across the U.S. (such as in North Carolina, South Carolina, Mississippi, Alabama, Georgia and Florida), congested neighborhoods that are placing a strain on local resources, or cities in-need of more medical buildings, ROKiT Homes is here to address it all while ensuring comfort.

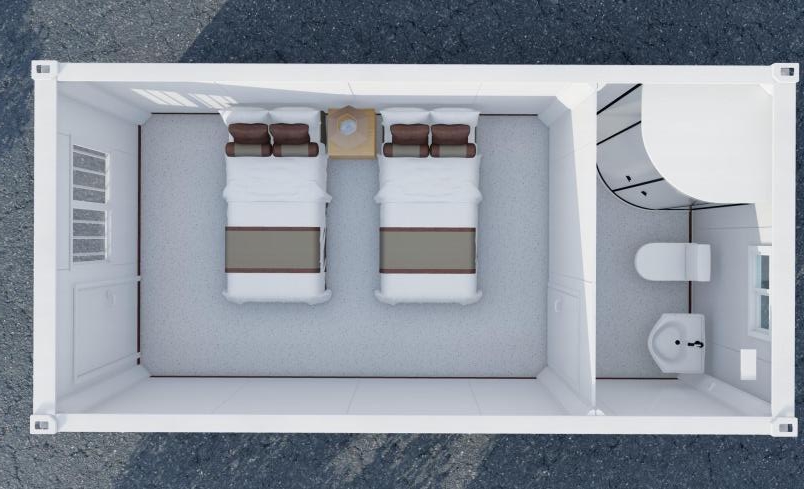

ROKiT Homes currently offers five different models, which share:

Easy transportation

Quick assembly (typically within hours or days)

High quality: life expectancy 25 years

Strong: made of welded structure with galvanized steel

Modular: design allows individual units to be joined and stacked to build larger units.

Environmentally friendly: use no concrete and less than 50% of the energy needed to build the temporary housing solutions

Resistant against flooding, cyclones, hurricane force winds, and made of flame-retardant grade A materials

Easily-customizable

Kendrick added, “Our goal from the start has been to change people’s perception of housing solutions. An affordable shelter can truly feel like a home even if it's temporary, and our team of innovative visionaries, talented builders, and designers have brought this dream to life. We are rapidly expanding our reach within the housing sector, and the future is just getting started.”

ROKiT Homes is currently developing programs to help those impacted by the LA wildfires, as well as have made units available in Austin, Texas, within U.S. Native American reservations, and overseas in Africa. Additionally, plans for a housing program in El Salvador are in motion.

“We are proud of all we have accomplished thus far, and are looking forward to a bright future. We are already seeing the impact of our initiatives, and we are grateful for the opportunity to provide for often-ignored communities.”

Learn more: https://rokithomes.com/