how they are swallowing city centres like Manchester one block of flats at a time

- Written by Adam Leaver, Professor of Accounting & Society, University of Sheffield

The housing prospects for young people in the UK were completely changed by the global financial crisis of 2007-09. While the government largely succeeded in rescuing the banks and the housing market, it created an environment where house prices remained high and mortgages were only available to those who could afford hefty deposits. As a result, many young people who might have got a foot on the property ladder were forced[1] to keep renting.

While this has prompted much concern in recent years about the prospects for “generation rent”, the flipside is that it created an investment opportunity. To meet the demands of this demographic, property investors started putting billions of pounds into a new housing class known as build-to-rent (BTR).

To understand this shift, we’ve been researching[2] the rise of these properties in one of the UK’s leading cities, Manchester. It demonstrates a change in the kinds of organisations that own UK homes, and some difficult implications for those who rent them.

The new property boom

The residential rental market used to be mainly made up of buy-to-lets, which are typically owned by small-scale landlords who have a relatively small number of properties in their portfolios. Build-to-rent, on the other hand, refers to large blocks of housing units owned by institutional investors such as pension or investment funds.

This housing class has grown significantly over the past ten years: by the end of 2022, it accounted for over 240,000 units[3] built or under construction in the UK. Property group Savills predicts that this will increase fivefold[4] over the next decade.

These new corporate landlords were attracted by the fact that they could earn a high yield on their investment from rents (at least when interest rates were low). There were also valuable economies of scale in marketing, managing and maintaining multiple blocks of flats that were all in the same area.

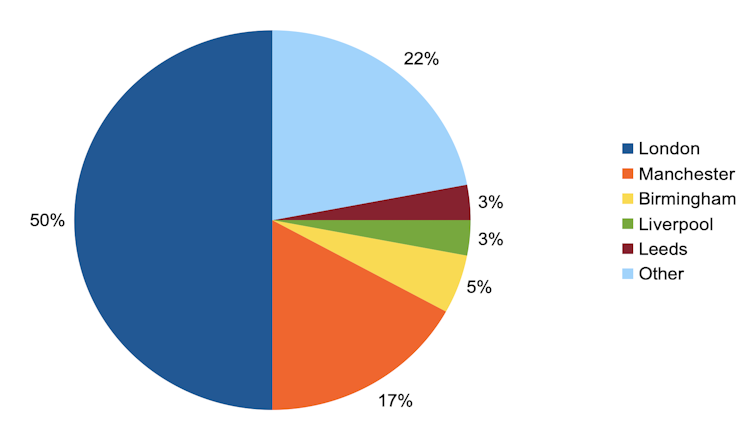

London is the largest market for this kind of property in the UK, accounting for about 50%[5] of completed BTR properties. But as our recent paper[6] shows, its presence is growing in cities like Manchester. In the city regional centre, which includes Manchester city centre, Salford Quays, central Salford and the Pomona area of Trafford, out of 45,000 new housing units built between 2012 and 2020, 22,984 were BTR. That’s just short of one-fifth of the national total.

UK build to rent by city