How Made.com went from a pandemic-era business superstar to a failed company in just 18 months

- Written by John Wood, Lecturer in Law, Lancaster University

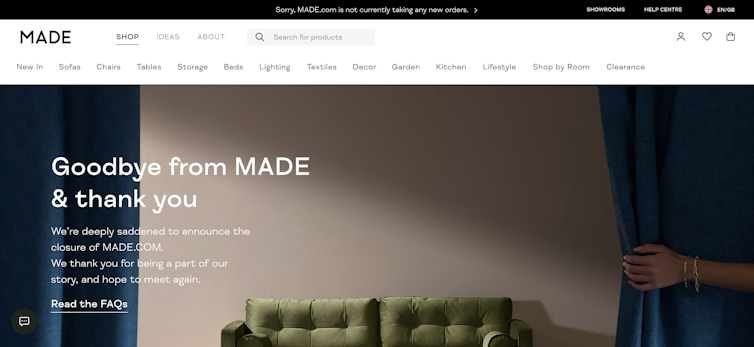

Formed in 2011, Made.com offered affordable high-end furniture online with the ambition to one day rival Swedish furniture giant Ikea[1]. Fast forward 11 years and the British brand, which excelled during the pandemic and was valued last year at £775 million[2], has collapsed.

A last-ditch attempt to rescue the company by a former owner of Made.com was rejected[3], showing that even rising stars aren’t immune to the spiralling costs of living and doing business. This comes at a difficult time for the retail industry, with British clothing company Joules[4] also collapsing recently.

In 2020, Made.com sales hit £315 million[5], a 30% increase from the previous year, as COVID-era lockdowns saw people spruce up their surroundings with online purchases. A further 63% sales boost over the first three months of 2021 convinced the company to list its shares on the London Stock Exchange in June 2021. At this time, the idea that the company could fail just 18 months later was inconceivable. So, what went wrong?

By 2022, the supply chain difficulties[6] experienced by many businesses as the global economy rushed to reopen after pandemic-era lockdowns had reportedly left some customers waiting months for their orders. While some cancelled out of frustration, orders also fell as the cost-of-living crisis[7] discouraged people from buying large items like furniture.

This sharp decline in sales[8] left Made.com with a lot of money tied up in unsold stock. With no immediate answer to its problems, the company was forced to stop taking orders and find a buyer. After this tactic failed, it entered administration on November 9.

What is ‘administration’?

To protect a troubled company from further decline, it can appoint administrators to place the company into administration. This is a corporate procedure that differs from bankruptcy which, in the UK, applies only to individuals. Once a company is placed into administration, the next steps will be to find a way to rescue it from total collapse.

In practice, it is often only aspects of the business that are rescued in this kind of situation. In Made.com’s case, UK retailer Next[9] has bought the furniture company’s intellectual property (its furniture designs), domain names and brand name for £3.4 million.

Other assets such as its warehouse inventory, which includes sofas, sideboards, beds and soft furnishings, will be sold to other buyers[10] to raise cash to pay back the company creditors. While asset rich, the business model of Made.com came unstuck as supply chains became less reliable[11] in recent years, which meant it simply could not deliver to customers in a timely manner.

Unfortunately, even this rescue could result in hundreds of job losses and bring uncertainty to Made.com suppliers in the UK and abroad. And for customers, around 12,000 UK orders[12] are thought to be outstanding with no refunds offered. It may be possible for customers to rely on section 75[13] of the Consumer Credit Act 1974 and make a claim against their credit provider, if they bought an item for more than £100 on a credit card which hasn’t arrived before November 25[14].

When rescue isn’t an option

There are a number of ways other than administration in which a company can be rescued from failure – but some options will only work in certain circumstances. For example, a firm could enter into a company voluntary arrangement[15] with its creditors, but this means it still has to pay creditors (albeit a reduced amount) if they agree to the proposal. Alternatively, management could propose a restructuring plan[16], but the company must be able to continue operating as well as being able to afford what is a costly process.

Even when a rescue is possible, it could significantly change a company – for example, downsizing the business, cutting staff or implementing a more limited business model. Rescues also tend to rely on securing additional finance (Made.com failed to obtain[17] such funding) and in some cases the approval of certain creditors.

While an offer to rescue Made.com was made by the former owner, the proposal was likely declined by creditors hoping that a better result existed elsewhere. Unfortunately, this did not lead to the rescue of the company but instead its break-up.

Efforts to address corporate failure during COVID-19 resulted in the Corporate Insolvency and Governance Act 2020[19]. This provided new measures to assist rescue strategies, such as a standalone moratorium that temporarily stops creditor action against the company so it can devise a plan to survive. And as well as the new restructuring mechanism mentioned above, the act also prevents “ipso facto[20]” clauses that suppliers were previously able to use to terminate contracts upon insolvency.

Despite some positive findings[21], however, these measures all remain relatively untested. This is mostly because of other initiatives the UK government introduced to ease the impact of the pandemic, such as bounce back loans[22] and the furlough scheme[23].

The act’s measures, specifically the moratorium and the restructuring plan, are also subject to certain criteria. If rescue is not viable then the chosen procedure would not be approved by either the insolvency practitioner (with the moratorium) or the courts (with a restructuring plan).

Retail and the rising cost of living

These new government measures could be particularly important in the months to come. Made.com is not alone in struggling following the end of lockdown restrictions and the emergence of the cost-of-living crisis.

Online retail sales peaked during the height of the pandemic and have been on a downward trend[24] since. Online retailers Asos[25] and Boohoo[26] have also experienced sharp falls in their share prices this year. Even high-street stalwarts like Marks & Spencer[27] are seeing the effects of the rising costs on their profits.

While not all companies will meet the same fate as Made.com, these tough trading conditions caused by the cost-of-living crisis are, according to the Bank of England[28], likely to continue for UK retailers until mid-2023 at the earliest.

References

- ^ rival Swedish furniture giant Ikea (www.retail-week.com)

- ^ £775 million (www.ft.com)

- ^ rejected (www.bbc.co.uk)

- ^ Joules (www.theguardian.com)

- ^ sales hit £315 million (www.bbc.co.uk)

- ^ supply chain difficulties (www.theguardian.com)

- ^ cost-of-living crisis (www.ft.com)

- ^ sharp decline in sales (www.ft.com)

- ^ Next (www.telegraph.co.uk)

- ^ other buyers (www.bbc.co.uk)

- ^ supply chains became less reliable (theconversation.com)

- ^ 12,000 UK orders (www.theguardian.com)

- ^ section 75 (www.which.co.uk)

- ^ November 25 (www.bbc.co.uk)

- ^ company voluntary arrangement (www.gov.uk)

- ^ restructuring plan (www.thegazette.co.uk)

- ^ failed to obtain (www.telegraph.co.uk)

- ^ T. Schneider / Shutterstock (www.shutterstock.com)

- ^ Corporate Insolvency and Governance Act 2020 (www.legislation.gov.uk)

- ^ ipso facto (www.bdo.co.uk)

- ^ findings (www.gov.uk)

- ^ bounce back loans (www.gov.uk)

- ^ furlough scheme (www.gov.uk)

- ^ downward trend (www.ons.gov.uk)

- ^ Asos (www.telegraph.co.uk)

- ^ Boohoo (www.theguardian.com)

- ^ Marks & Spencer (www.theguardian.com)

- ^ Bank of England (www.bankofengland.co.uk)