The cost of living crisis has been many years in the making – but politicians on both sides ignore this

- Written by Kevin Albertson, Professor of Economics, Manchester Metropolitan University

Fears over the cost of living have reached new highs in the UK after power regulator Ofgem confirmed[1] that the energy price cap will nearly double from October to cost the average household £3,549 a year. There has been much discussion about what the government needs to do to help people and businesses this winter, but the crisis is still being presented as a short-term problem that will ease in due course.

This is a misdiagnosis. We are actually living through a slow-motion crisis which has been decades in the making and is set to continue. Understanding what is really happening is a vital first step to finding a way out.

We are prone to blame today’s economic mess on short-term factors such as austerity, Brexit, COVID and the war in Ukraine. In fact, global economic headwinds have been gathering strength for years: according to[2] a study reported in the New Scientist a few years ago, 1978 was the best year the world economy ever saw.

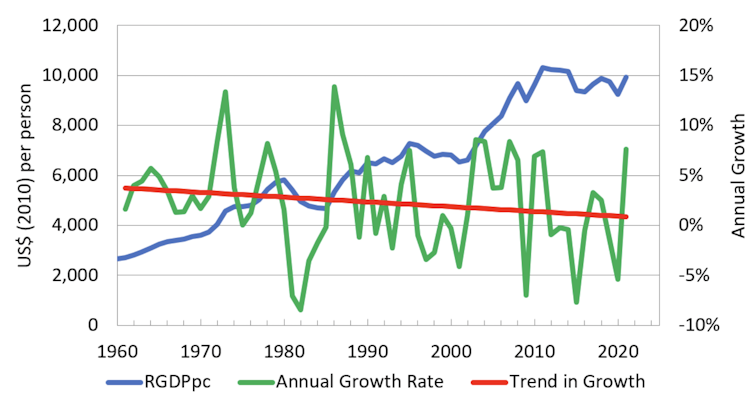

That study argued that growing inequality and environmental degradation have sent progress into reverse, but you can also see decline using traditional economic measures. Global growth in GDP per capita[3] and productivity[4] have been steadily weakening. In the UK, once you take inflation into account, GDP per capita growth[5] has been declining since the 1970s and the average wage[6] is little different than in 2008. In the US, inflation-adjusted median wages peaked in the 1970s[7].

Real global GDP per capita and growth rate 1960-2021

Some argue that the underlying cause of this global problem is a long-term weakness[8] in the US economy[9]. According to[10] influential US think tank the National Bureau of Economic Research (NBER), much of what has passed for growth has simply been a reallocation of resources from workers to shareholders.

Not only that, it has been achieved by accumulating debt[11]. Financial debt[12] has more than doubled as a percentage of GDP since the early 1970s, while there has also been a build-up of ecological debts[13] by overusing natural resources.

Many leading experts on this so-called “secular stagnation[14]” think it may be here to stay. It is also likely to be more keenly felt in Europe[15], which has less favourable demographics than the US and fewer natural resources. In 2023, for instance, the OECD is forecasting[16] zero growth in the UK, although a recession (two quarters of negative growth) is probably more likely.

UK not OK

One reason why the UK cost-of-living crisis is so devastating is that many, if not most, people had already seen their standard of living decline[17] before the Ukraine war and COVID. Back in the days of Theresa May (remember the good old days?), there was much talk of “just about managing” households or JAMs, defined as[18] working households with below-average income.

This reflected the fact that well before 2020, many of life’s necessities were increasingly beyond the reach of the average household. Ironically, gas and food were the only necessities whose prices increased by less than median wages from 2009 to 2019. The amount of money that the average household had to spend on discretionary items was falling throughout the decade after adjusting for inflation.

The rising cost of necessities in the 2010s