CPA Australia proposes policy ideas to support Hong Kong’s long-term competitiveness

HONG KONG SAR - Media OutReach Newswire – 21 August 2025 - As Hong Kong continues to navigate global economic shifts and rapid technological transformation, CPA Australia has today submitted a series of recommendations to the Hong Kong Government for the Policy Address 2025 consultation.

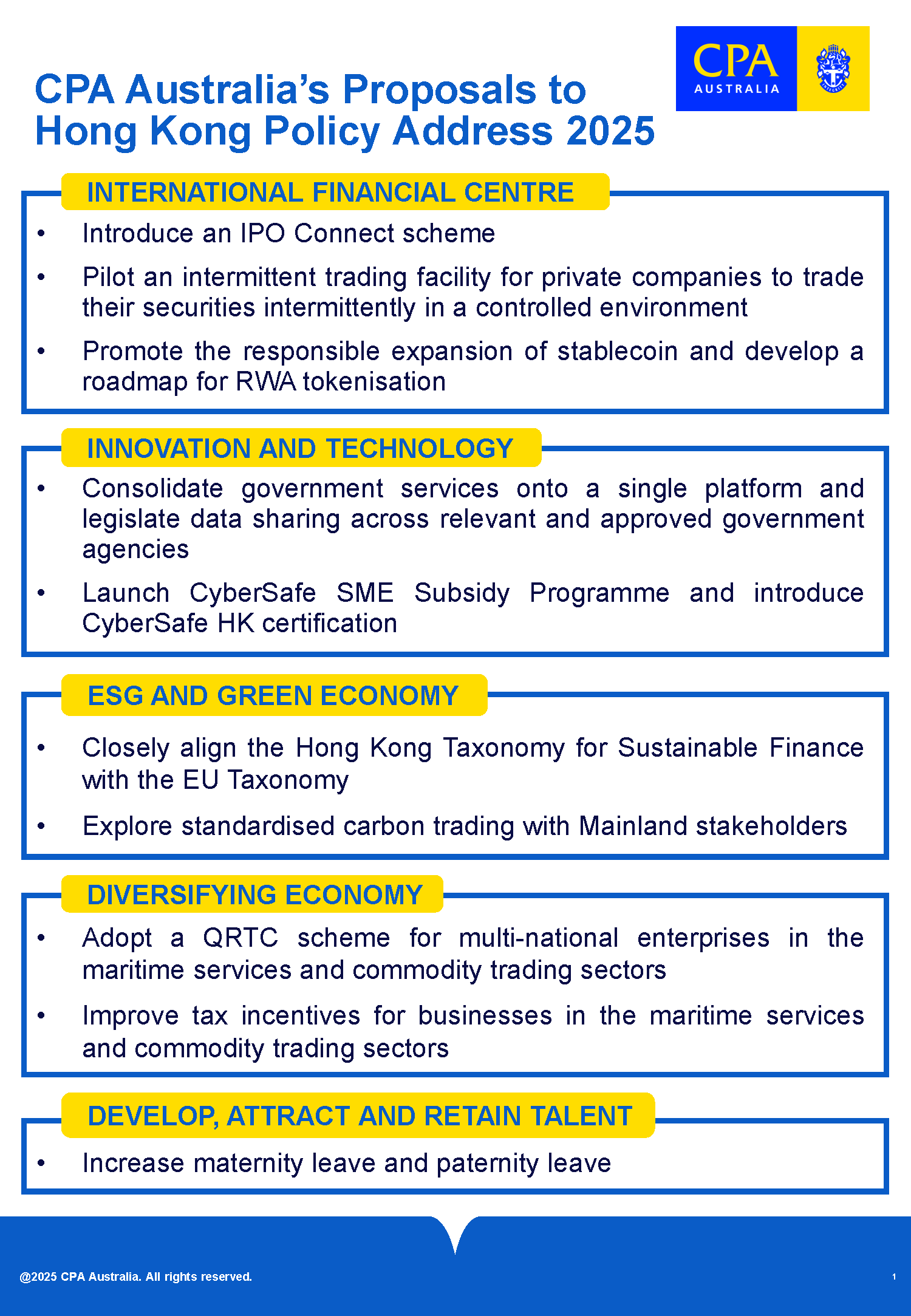

As one of the world's largest professional accounting bodies, CPA Australia has outlined proposed measures across five key areas:

- Reinforcing Hong Kong's role as an international financial centre

- Developing Hong Kong into an international innovation and technology (I&T) hub

- Promoting environmental, social and governance (ESG) and the green economy

- Diversifying the economy

- Developing, attracting and retaining talent.

CPA Australia recommends the HKSAR Government considers introducing a Qualified Refundable Tax Credit (QRTC) scheme for multi-national enterprises in the maritime services and commodity trading sectors. A QRTC provides a more flexible and effective incentive structure that can help to boost these sectors.

"A QRTC would allow Hong Kong to better compete for multinational investment and reinforce its position as a premier international trade centre and shipping centre," Ms Wong said. "We also propose expanding the scope of the half-rate tax concessionary regime for commodity trading to include the captive commodities traders serving group companies outside Hong Kong and include the financial commodity transactions, such as derivatives trading."

Low-altitude economy is another area that CPA Australia supports to diversify the economy, for its potential to transform logistics, mobility, and urban planning.

Ms Wong added: "Hong Kong can lead in low-altitude innovation by establishing demonstration zones, collaborating with the Greater Bay Area on cross-border channels, and attracting global talent to this emerging sector. With strong research capabilities and a growing commitment to innovation and technology implementation – evidenced by the establishment of government-led Regulatory Sandbox pilot projects, Hong Kong is well-positioned to translate innovation into practical applications."

An efficient and effective government process to deliver public services, and a green environment for sustainable development are crucial factors to do business, as well as to attract enterprises and investments to Hong Kong. Therefore, CPA Australia proposes a suite of initiatives including the promotion of a robust e-government framework.

Mr Cyrus Cheung, Deputy Divisional President of CPA Australia in Greater China 2025 said: "We suggest the Government considers modernising operations and implements a 'tell us once' compliance model for individual and business data access in a secure and convenient manner. For example, we propose introducing legislation to allow data sharing across relevant and approved government agencies, and to establish an integrated platform that enhances data management across governmental departments. To simplify the processes of public services, we also suggest the Government reduces its reliance on in-person authentication where appropriate, and consolidates government services onto a single platform, such as iAM Smart, which allows online authentication across different services."

Mr Cheung also emphasised the importance of sustainable development in shaping Hong Kong's future. He called for better alignment of the Hong Kong Taxonomy for Sustainable Finance with the international standards to attract investment in green projects.

"Energy policy is core in our sustainability goals. The taxonomy should reflect the role of various forms of low-carbon energy in supporting Hong Kong's transition to a net-zero economy," he said. "We also encourage the government to develop a standardised carbon trading framework and explore the Carbon Connect initiative to strengthen Hong Kong's leadership position in green finance."

Hong Kong's sound financial system and free flow of capital continue to underpin strong investment inflows, and the city is poised to return to its position as the world's top IPO market in 2025, Mr Kelvin Leung, Deputy Divisional President of CPA Australia in Greater China 2025, said. "Despite global uncertainties and trade tensions, Hong Kong's capital market remained resilient, drawing more family offices to setup in the city and reinforcing its role as a preferred venue for fund raisings.

"Investors choose Hong Kong for investment and wealth management because we are globally connected, rule-of-law based and responsive to market needs. We should be more proactive in promoting Hong Kong as a dual listing destination for overseas companies, and we encourage the Government and relevant regulators to explore the feasibility of an "IPO Connect" mechanism, to meet growing mainland investor demand for access to global assets."

To increase private market liquidity, CPA Australia suggests piloting an intermittent trading facility for private companies in a controlled environment. "This would offer growth-stage companies a stepping stone toward future public listings, supported by clear eligibility, proportionate disclosure and robust settlement safeguards,," Leung said.

Mr Leung also highlighted opportunities in digital assets, "It is a notable step for Hong Kong to launch the 'LEAP' framework to develop a trusted and innovative digital-assets ecosystem. We welcome the Government's move to promote the responsible expansion of stablecoins under a fit-for-purpose regulatory regime. The Government should also consider a clear roadmap for real-world asset (RWA) tokenisation that balances innovation with strong investor protection."

CPA Australia has also proposed recommendations on strengthening SME cybersecurity such as to launch a CyberSafe SME Subsidy Programme and introduce a CyberSafe HK certification. We also suggest initiatives such as increasing maternity and paternity leave similar to other developed economies, to attract and retain talent.

Hashtag: #CPAAustralia

The issuer is solely responsible for the content of this announcement.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with nearly 175,000 members in over 100 countries and regions, including more than 22,500 members in Greater China. CPA Australia is celebrating its 70th anniversary in Hong Kong this year. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on issues affecting the accounting profession and the public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au