The World Debt Situation Has Become More Unstable, Octa Broker warns

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 30 May 2025 - Traders and investors alike are unnerved by the recent turbulence in the bond markets. After Moody's—a major rating agency—downgraded U.S.

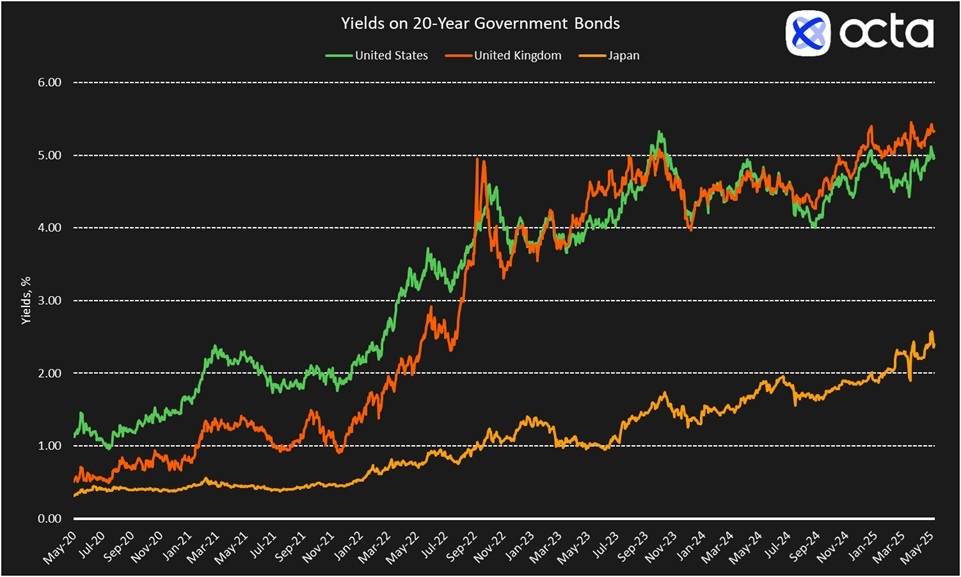

government debt on 16 May, and Japanese long-term bond yields soared to multi-decade highs, some market participants started to fear that the world may be on the verge of a major debt crisis. Meanwhile, the yield on 20-year UK government bonds neared 5.5%, a level not seen in 27 years, as investors grew more worried about the extent of Chancellor Rachel Reeves' borrowing plans. Octa Brokers looks at the potential implications of these developments for global markets.

Ticking Fiscal Bomb

The U.S. mounting national debt has long been the subject of intense debate and concern among economists, policymakers, and the public. Apocalyptic predictions of a U.S. default and dollar collapse are nothing new. They first appeared decades ago and have been surfacing here and there regularly, attracting plenty of followers. However, these predictions have never materialised, while the doomsayers have been dismissed as amateur conspiracy theorists at best and irresponsible alarmists at worst. Still, while we are not inclined to take a grand stance on this issue, we cannot afford to ignore the latest market developments regarding the U.S. debt. Often called a 'ticking fiscal bomb', it has recently started raising fears about the nation's long-term economic stability and potential impact on global markets.

'On current trends, U.S. national debt is projected to reach $37 trillion in two weeks and may reach $40 trillion by the end of the year. This trend cannot continue forever. The Fed’s [Federal Reserve] printing press may have no limit, but market patience does have its limit', says Kar Yong Ang, a financial market analyst at Octa broker.

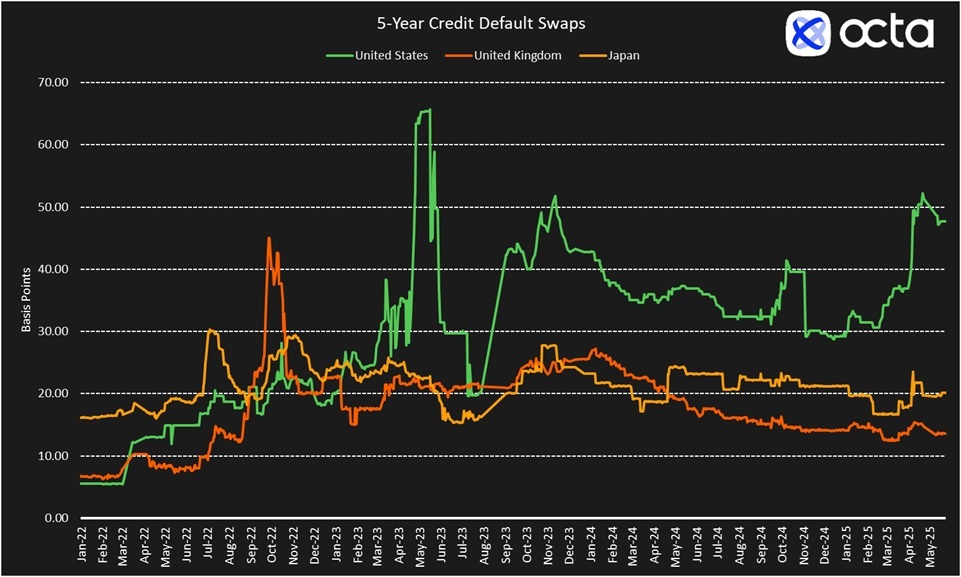

Indeed, the market's perception of risk regarding U.S. government debt has clearly risen. This is evident in the noticeable increase in the cost of insuring exposure to U.S. government debt over the past month. The spreads on U.S. credit default swaps (CDS)—a key measure of default risk—have reached their widest levels since the 2023 debt ceiling crisis in recent weeks (see chart below).

Market stress intensified even more following Moody’s downgrade and the passage of the U.S. President Donald Trump’s 'One Big Beautiful Bill Act' in the House of Representatives. The bill features $3.8 trillion in tax cuts and is widely expected to worsen the federal budget deficit outlook. As a result, investors started to demand higher returns for holding long-term U.S. government bonds, pushing the yields on 20-year notes above the important 5% level on 21 May.

Indeed, the U.S. government actually hit its legal borrowing limit back in January and has been using special procedures to avoid exceeding it and potentially defaulting. However, these measures are expected to run out around late August or early September, at which point the government might be unable to meet all its financial commitments.

Yields of government bonds with the longest maturities have been rising sharply not just in the United States but also in Japan and the United Kingdom (UK) (see chart below). On 20 May, Japan’s 20-year government bond (JGB) auction had its worst results since 2012. The demand was weak, with the bid-to-cover ratio dropping to 2.50, while the lowest accepted price was just ¥98.15, some 2% below the expected price.

'Japan’s auction signals poor liquidity and weak interest in new long-term securities as investors are concerned about excessive profligacy. It seems to me that the BoJ wants to stop buying bonds at the worst possible moment. Who is going to replace it?', rhetorically asks Kar Yong Ang, referring to BoJ plans to taper its massive bond purchase programme.

Indeed, although yields on long-term JGBs have been rising since the COVID pandemic, the trend accelerated after the Bank of Japan (BoJ) moved toward monetary policy normalisation amid rising wage growth and inflation. Policy normalisation implied higher short-term rates and fewer bond purchases. Thus far, BoJ has ended its yield curve control (YCC), raised its benchmark interest rate from -0.1% to 0.5% and even embarked on quantitative tightening (QT). These factors contributed to the consistent increase in Japanese government bond yields. Today, however, the situation is complicated by additional fiscal stimulus, which could result in more government borrowing just as the BoJ prepares to slowly exit the debt markets. The Cabinet already approved a massive ¥21.9 trillion ($142 billion) economic stimulus package back in November 2024. Most recently, it approved an emergency plan to allocate ¥388 billion ($2.7 billion) from reserve funds to assist businesses and households affected by U.S. tariffs.

'Investors are sending a very clear message: if we are the only ones left to finance these spending plans, then we demand higher returns', concludes Kar Yong Ang.

The recent movements in the U.S., Japanese, and UK government bond markets paint a concerning picture of increasing investor unease regarding sovereign debt. From the rising cost of insuring U.S. debt and the poor reception of Japan's long-term bond auction to the near 27-year high in the UK gilt yields, a common thread of heightened risk perception is evident. As Kar Yong Ang of Octa Broker points out, factors like policy uncertainty, fiscal profligacy, and the prospect of central banks reducing their bond purchases are prompting investors to demand greater compensation for lending to governments.

'The problem is not just that governments have an enormous mountain of debt. The real problem is that the market is intricately interconnected. A small trouble in one place can morph into a major crisis elsewhere. What if higher JGB yields lure Japanese capital back home? If they decide to increase their JGB holdings, they may have to sell the U.S. Treasuries and that could be catastrophic given that Japan is a major holder of U.S. debt', says Kar Yong Ang.

Investors should watch the upcoming BoJ meeting scheduled for 17 June. The BoJ will issue its regular policy rate decision and will likely announce its balance sheet reduction plan. According to MacroMicro, markets currently expect a gradual pace—around 6–7% reduction over two years. However, if the BoJ opts to speed up the process, it could put pressure on global markets

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities.

In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.