Gold's road to $3,000: expert analysis by global broker Octa

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 5 December 2024 - Gold has been valued for its stability when the financial fires are raging. That stable nature was underscored in 2024 when its price shot upward, gaining over $700 per ounce.

This amounted to a 34% increase since January. The vibrant price increase has gotten traders and investors all jazzed up again about gold, with the most pressing question among them being: could gold exceed the $3,000 price point by 2025? Kar Yong Ang, a financial market analyst at Octa broker, delves into the topic.

Inflation, interest rates, and geopolitics

Inflation and interest rates influence gold prices. When inflation soars, investors tend to buy gold to protect their purchasing power. They view it as a much safer investment than stocks or bonds because stocks are prone to sudden price drops, and bonds can lose value when interest rates rise due to high inflation. Historically, though, when real interest rates (which are inflation-adjusted) have declined, gold has just soared. As some would say, 'There is no better buy'.

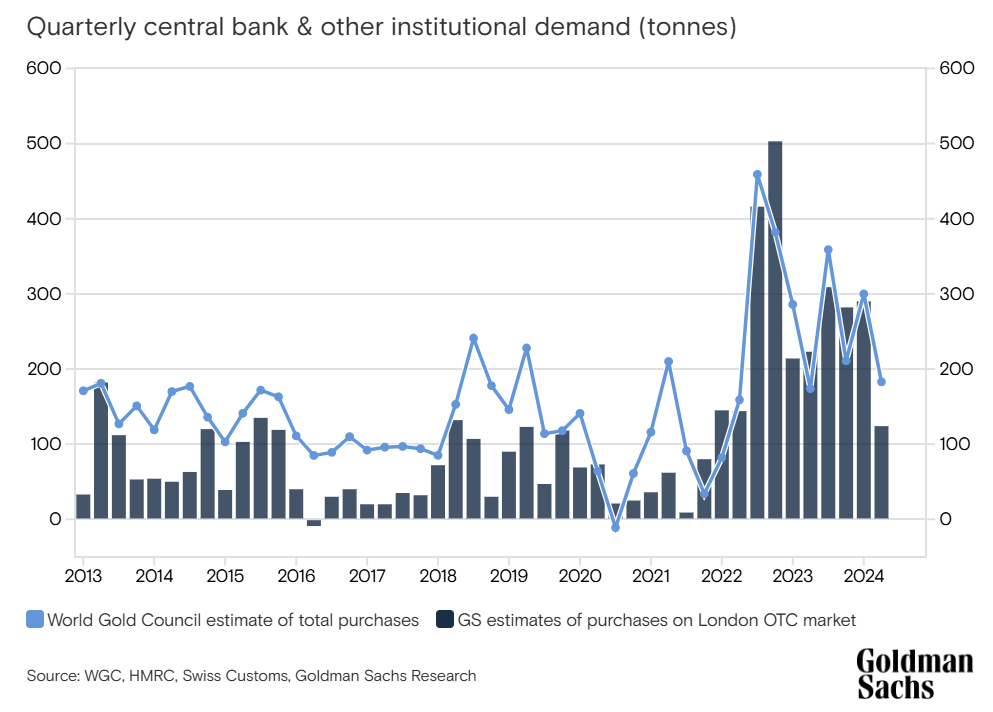

By 2024, the percentage of overall reserves held in gold by central banks had reached 10%, a significant climb from the 3% level recorded just 10 years earlier. Although we are still in an era where most reserve currencies are fiat (for example, paper with little intrinsic value), an increasing number of central banks seem to believe that holding gold adds an element of prudence to their reserve diversification strategy. Emerging economies, especially in Asia, are seeing their central banks take on an increasingly important role in the gold market. China (which now holds 5% of its reserves in gold), along with India, has emerged as one of the preeminent buyers of gold.

Moreover, the central banks of the emerging economies have, since 2022, stepped up their pace of gold buying. The catalyst for this last development was the unprecedented freezing of Russian assets, which prompted multiple nations to reconsider the makeup of their reserves.

Furthermore, the global shift towards a more sustainable economy, including investment in renewable energy and green technologies, is driving limited demand for certain commodities, such as precious metals that include gold. Gold plays an important role in clean energy technologies, including solar panels and electronics for energy-efficient systems. This increased demand for technological gold is exacerbated by growing concerns about the lack of resources necessary for the green transition.

Moreover, geopolitical tensions and economic uncertainty further underscore the attractiveness of gold as a safe asset, attracting investors seeking relief amid rapid changes in global markets. The Ukraine conflict, strained US-China relations, and unrest in the Middle East have sent investors scurrying to safe-haven assets. And when it comes to safe havens, gold is a time-tested destination. Its record of price stability in an unstable world at present stands in stark contrast to the behaviour of the stock market and other assets. An instance of this is China's recent accumulation of gold, which now makes up 5% of its foreign exchange reserves. This is yet another sign of a shift towards resilience in a global economy fraught with uncertainty.

Technical analysis: key levels to watch

According to the technical analysis, the asset's price is still in the uptrend, even on a high timeframe. The long-term bullish trend also hasn't changed for a bearish one. The $3,000 target, which aligns with the 4.236 Fibonacci extension level, is pretty real. However, this level may be too ambitious for the moment of publication.

Prospects for 2025 – factors shaping gold's future

According to the Chief Economists' Survey from the World Economic Forum, economists are uncertain about global economic stability. 54% of respondents forecast a steady outlook and 37% project further deterioration. Future fiscal policies targeting climate adaptation, a shifting demographic landscape, and ramped-up defence spending are set to push inflation upwards. All these look to gold as an inflation hedge; however, it's not just private investors: central banks are in on the gold thing, too. They are expected to keep topping up their gold reserves and, in the face of all these other demands, are likely to maintain long-term demand.

So will gold hit the $3,000-per-ounce price in 2025? The scenario seems very possible. However, for the asset's price to reach a rather ambitious target, favourable market conditions are required. They include both macroeconomic and geopolitical factors. For example, the re-election of Donald Trump introduces additional variables into the equation. Trump's geopolitical stance, particularly regarding global trade and conflict resolution, could influence investor sentiment and safe-haven demand. If his promises regarding the resolution of numerous conflicts are fulfilled, investors may partially abandon safe-haven assets for the riskier ones.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.