Oil market dynamics and future trends with global broker Octa

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 21 November 2024 - As a critical resource in the global economy, oil is integral not only to the energy sector but also to industries such as transportation, manufacturing, and agriculture.

Changes in its prices impact inflation rates, production costs, and global trade. For instance, oil price increases can accelerate global inflation. This effect ripples through various sectors, with higher transportation and production costs driving up prices for goods and services worldwide. Kar Yong Ang, a financial market analyst at Octa Broker, deciphers current oil market trends, elucidating the economic and trading implications for market participants to consider.

Current state of the oil market

In 2024, the global oil market faces an intricate balance of supply and demand, with production hovering around 101.5 million barrels per day, closely mirroring daily consumption. OPEC+, primarily responding to concerns over weak demand due to slowing economic growth in major markets, recently implemented production cuts aimed at reducing volatility. Unlike previous measures driven by supply shortages, this strategic adjustment seeks to stabilise prices amid shifts in market sentiment and to offset demand uncertainties from countries like China. Furthermore, sanctions affecting Russian oil exports have introduced additional market opacity due to shadow fleet operations.

Macroeconomic activity in major oil consumers, including the U.S. and China, continues to drive global demand trends. Studies suggest a 1% global GDP rise generally correlates with an approximate 0.8% increase in oil demand, underscoring how economic performance directly influences energy consumption. In recent months, U.S. demand has shown a moderate decline due to inflation and high interest rates, which have impacted consumer spending. China’s demand has been tempered by a stabilising growth rate, signalling a softening in oil demand from Asia's largest economy.

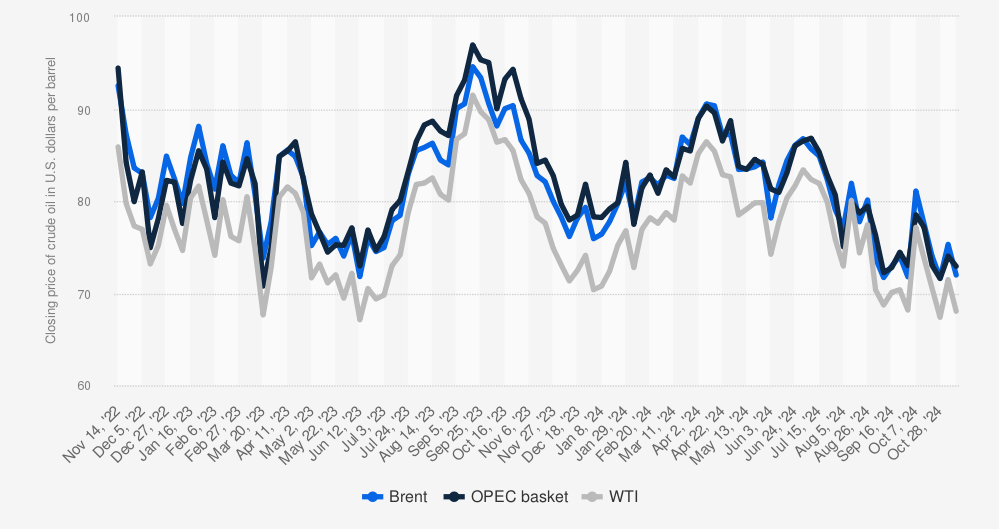

Last autumn price peaks have given way to a more recent stabilisation, with oil prices now ranging between $70 and $75 per barrel. As of middle November 2024, Brent crude was trading around $71.97, while West Texas Intermediate (WTI) stood at $68.04 per barrel. This recent dip from the previous week reflects the market’s sensitivity to both demand forecasts and ongoing geopolitical factors.

Factors that affect the oil market

Political tensions in oil-producing regions play a significant role in shaping global oil prices. For example, recent sanctions on Russia have limited its oil export capabilities, impacting around 4 million barrels per day, or roughly 5% of global supply. Additionally, production cuts by OPEC+ have introduced further supply restrictions to stabilise prices. Such geopolitical decisions highlight the importance of political stability in the oil sector.

In the U.S., recent political shifts could lead to policy changes impacting domestic oil production. Donald Trump’s re-election signals a potential return to deregulation, favouring domestic production growth. His prior administration expanded U.S. oil output to a record high of 13 million barrels per day in 2019, and similar policies could drive further supply increases. Higher U.S. production, however, could introduce more supply into the global market, likely exerting downward pressure on prices and potentially increasing market volatility.

Technological advancements and a shift towards renewable energy are gradually reducing the reliance on traditional oil. The International Energy Agency (IEA) projects that by 2040, renewable sources could meet over 40% of global energy demand, as countries aim to cut carbon emissions in line with climate goals. Despite these shifts, oil is expected to remain essential for sectors like aviation and heavy manufacturing, although overall demand may see a decline in the coming decades.

Future prospects of the oil market

OPEC+ production decisions, global economic recovery trends, and seasonal demand patterns will likely influence short-term oil market dynamics. Seasonal heating demand during the winter months typically drives prices upward, especially in colder regions. Emerging markets, particularly in Asia, are anticipated to see steady growth in oil demand as industrial activity expands. This short-term demand increase could provide upward pressure on prices, balancing out some of the recent supply constraints.

In the long term, the oil market faces a transformative shift as renewable energy adoption accelerates. With governments worldwide investing heavily in sustainable energy infrastructure, global oil demand is projected to decline gradually over the next two decades. According to the IEA, global oil consumption could decrease by as much as 25% by 2040 as electric vehicle adoption and green technology become mainstream. This energy transition poses both challenges and opportunities for the oil sector, requiring adaptation to shifting consumer demands.

Trump’s victory could significantly influence oil market dynamics through policies that favour the oil and gas sector. His administration previously prioritised energy independence, implementing deregulation policies that boosted domestic production. A return to such policies could lead to increased U.S. output, potentially intensifying competition in the global market and affecting price stability. Additionally, shifts in foreign policy could reshape trade relations with major oil-producing nations, impacting global oil flows.

Oil remains a critical asset within the global economy, influencing inflation, production costs, and economic stability. At the same time, the asset's price is affected by geopolitical stability, OPEC decisions, technological advances, environmental policies, global supply and demand, as well as the US dollar strength since the price of oil is commonly denominated in US dollars. Traders and investors should monitor these factors to be aware of recent market trends and to be able to identify potential price movements more carefully.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.