Coface Country and Sector Risk Barometer – Q4 2023: 2024, a pivotal year

HONG KONG SAR - Media OutReach Newswire - 6 February 2024 - After a somewhat turbulent 2023, which ultimately turned out much better than expected, 2024 is shaping up to be as decisive as it is uncertain, both in (geo)political terms, with more than 60 national elections - presidential and/or legislative - and in economic terms, with risks mounting on a still slowing global economy.

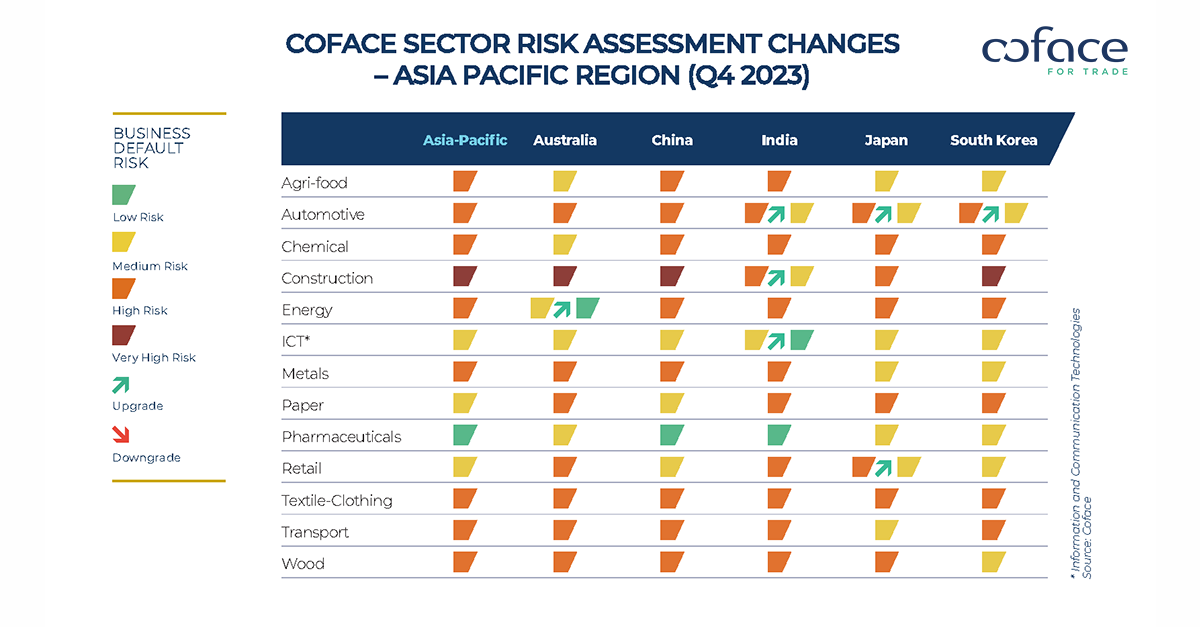

In this context, we have modified 13 country risk assessments (12 upgrades and 1 downgrade) and 22 sector risk assessments (17 upgrades and 5 downgrades), reflecting a significant improvement in the outlook, albeit fragile, in an environment that remains highly unstable and therefore uncertain.

Global growth still bending but not breaking (yet)

For the third consecutive year, growth in the world economy is set to slow to 2.2% in 2024, after 2.6% last year.

While the soft landing appears to be on track in the US, economic activity should continue to decelerate in the first half of the year in the wake of household spending, especially as support from the stockpile of excess savings accumulated during the pandemic, which is now largely depleted, will continue to dwindle.

The Chinese economy, which appeared to have regained its footing in the second half of 2023, ending the year with GDP growth of 5.2%, slightly above the official growth target is stalling at the beginning of this year. The rebound in consumption remains fragile and concerns about the property market correction, the resolution of local government debt and deflationary pressures continue to weigh on private investment and consumer sentiment.

In Europe, (near) stagnation is expected in the first half of the year. The manufacturing industry continues to be penalized by persistently high costs and sluggish external demand.

Inflation and interest rates: an adverse environment for companies

Despite a drop in 2023, and a rather reassuring short-term trend, core inflation is still twice the central bank target in most developed monetary areas. The challenge for 2024 will be to see whether the monetary tightening that has been underway for over 18 months is enough to go the 'last mile' and bring inflation back to 2%. And to keep it there.

Still tight labour markets, with unemployment rates below their structural level, historically high job vacancy rates and sustained wage dynamics, suggest that the battle is not yet won - irrespective of any supply shocks that may occur in the current geopolitical environment.

Regardless, and barring an accident of course, the interest rate environment to which all agents - households, businesses, and governments - have become accustomed over the last fifteen years is now firmly in the past and interest rates should remain at high levels throughout the year in all the advanced economies.

Market expectations of up to 6 rate cuts (of 25 bp[1] each) over the year seem excessive to us, on both sides of the Atlantic. In Europe, despite the weak momentum in activity, core inflationary pressures still above 2% should not allow the ECB - and the Bank of England - to begin monetary easing before, at best, the summer of 2024.

This adverse economic environment will keep companies in a difficult situation. A sharp acceleration in insolvencies is therefore one of the main downside risks to our central scenario, which in many respects is more akin to a ridge than a boulevard.

Emerging economies driving global growth, but still very heterogeneous

In 2024, the emerging countries will be the main drivers of the global economy, contributing 1.7 percentage points to the 2.2% growth in world GDP. Emerging economies will therefore account for three quarters of global growth, the highest since 2013. South-East Asia will once again be one of the most dynamic regions, with growth of 4.6%, after 4% last year.

The poorest and most indebted countries will face greater difficulties. With high interest rates and a dollar set to remain strong, there is every reason to fear a resurgence in sovereign defaults. Some countries are already in default or near default, such as Sri Lanka, Ghana, Ethiopia, Malawi, Pakistan, and Laos.

Escalating tensions in the Red Sea, the cost of maritime transport soars

Instability in the Red Sea region is a major threat to maritime traffic. This trade route provides access to the Suez Canal, the fastest sea route linking Europe (notably Rotterdam or London) to Asia. Around 12% of world trade and 30% of world container traffic passes through it.

Given the threat in the region, most shipping companies are already avoiding the Suez Canal and opting for the Cape of Good Hope, which takes them around the African continent and adds over ten days to the journey time.

For those who continue to use it, security and insurance costs are skyrocketing.

To offset these costs, carriers are redirecting their ships to European and Mediterranean trade routes, which reduces the space available for goods travelling on transpacific and North-South routes, also resulting in higher fares.

Despite increases in freight rates that have more than doubled from Shanghai, and even tripled on some routes to Europe, they are still, on average, below their record levels of early 2022. For the time being, we believe that the inflationary impact will be contained - of the order of 0.1 points of inflation at global level (0.2 points in Europe) and does not seem likely to derail our central scenario.

The issuer is solely responsible for the content of this announcement.

COFACE : FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2022, Coface employed ~4,720 people and registered a turnover of €1.81 billion.