Residential Prices Further Corrected in Q3, Transaction Numbers Fell by 22% Q-O-Q as Interest Rates Rise, Market Could Stabilize in Q4, Focusing on Primary Sales

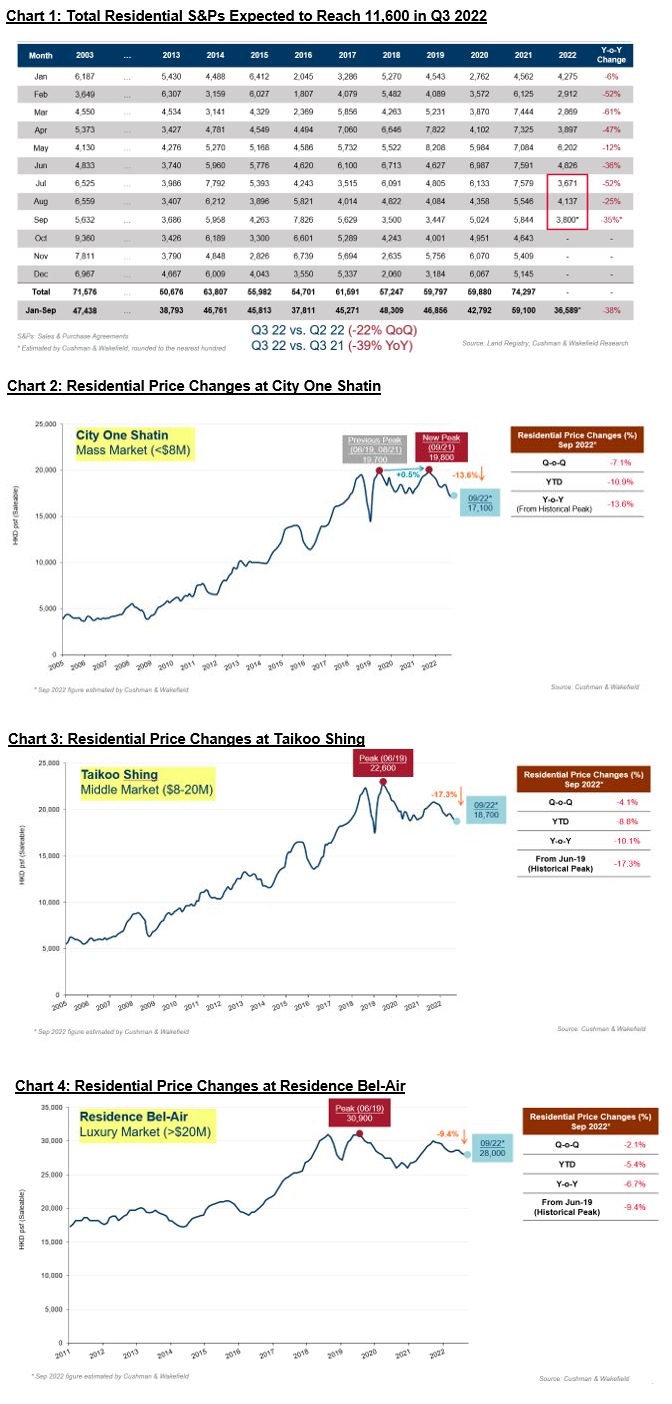

- Interest rate hikes and pandemic uncertainties slowed the secondary market in Q3, with transactions for the quarter expected to reach 11,600 deals, a fall of 22% q-o-q

- Home prices further declined across market segments in Q3, with mass and middle markets expected to experience more notable corrections

- A trend-down in COVID cases from September could see home prices bottom out and stabilize in Q4, although 2022 full-year transactions are still expected to drop by 35% y-o-y

HONG KONG SAR - Media OutReach - 15 September 2022 - Global real estate services firm Cushman & Wakefield announced its Q3 2022 Hong Kong Residential Market Review and Outlook today. Given the local epidemic situation, global economic instability, and interest rate hike cycle, home buyers turned cautious and held a wait-and-see attitude, exerting downward pressure on prices. Residential market momentum has moderated, and we now expect residential transaction numbers to drop 22% q-o-q to record approximately 11,600 deals in Q3 (Chart 1).

Rosanna Tang, Executive Director, Head of Research, Hong Kong, Cushman & Wakefield, commented: "The pace of economic recovery has been slower than anticipated, given the heightened numbers of daily COVID cases and the uncertain border reopening timeline. These factors, coupled with rising interest rates in Hong Kong, have hindered secondary sales in the residential market. Meanwhile, the primary market has been relatively more active, with developers launching new flats with competitive pricing in the Q3 period. We believe the primary market will remain the focus over the next few months, supported by solid pent-up housing needs from young families, first-time buyers and home upgraders. Regarding residential property prices, elevated borrowing costs from a rising HIBOR could prompt some sellers to become more flexible and offer greater bargaining room. Hence, we believe that home prices are still facing downward pressure in the near-term."

Edgar Lai, Senior Director, Valuation and Advisory, Hong Kong, Cushman & Wakefield shared: "The latest government figures indicate that overall residential prices have recorded a decline for the year-to-date, falling 4.5% in the first seven months. We have seen price corrections across multiple market segments. At City One Shatin, a proxy for smaller lump sum units, prices experienced a more notable drop of 7.1% q-o-q (Chart 2), while Taikoo Shing, representing the mid-price market, fell by 4.1% q-o-q (Chart 3). Meanwhile, prices in the luxury segment, such as Residence Bel-Air, held up relatively well with a more modest 2.1% decline q-o-q, as luxury property owners have stronger holding power and are less impacted by the external market."

Commenting on the market outlook, Edgar Lai added: "Compared with the peak last year, prices of some properties have already slipped 5-10%. Whilst COVID cases are expected to peak in September, we believe that home prices could potentially bottom out in September or October this year, and stabilize in the fourth quarter, bringing the full-year residential price change into a range of -5% to -8% y-o-y. On the supply side, the potential primary supply pipeline could reach over 10,000 units, many of which are in large-scale developments in key districts including Kai Tak, Tuen Mun, and Tin Shui Wai. Improvement in the economic environment and market sentiment in the next few months would further support the gradual recovery of transaction volume, backed by considerable demand from end-users. Overall, given the high base of last year, residential transaction volume is expected to drop by 35% y-o-y in 2022."

Rosanna Tang concluded: "Looking at the near-term future, home buyers may still face a combination of risk factors, including the interest rate hike and continuing economic uncertainties. However, we are pleased to see the new government leadership gradually relaxing the quarantine measures, and we believe it will give a boost to the residential market when details of the border reopening are further announced. We are also looking forward to the first Policy Address to be delivered by the new Chief Executive this October, which we hope will bring some positive messages, support and sentiment to the residential market."

Please click here to download photos.

Photo caption:

Left: Rosanna Tang, Executive Director, Head of Research, Hong Kong, Cushman & Wakefield

Right: Edgar Lai, Senior Director, Valuation and Advisory, Hong Kong, Cushman & Wakefield

Hashtag: #Cushman&Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 23 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.hk or follow us on LinkedIn ( https://www.linkedin.com/company/cushman-&-wakefield-greater-china).