Like a high-wire act, Victoria's budget is a mix of hard work, luck and optical illusion

- Written by Tom Crowley, Associate, Grattan Institute

Victoria’s budget shows a Treasurer engaged in a high-wire balancing act: ensuring a job-rich economic ‘soft landing’ on one hand, while trying to improve the state’s long-term fiscal position on the other.

The budget partly delivers on both goals but, like any difficult circus act, it is part hard work and skill, part luck, and part optical illusion.

The balancing act

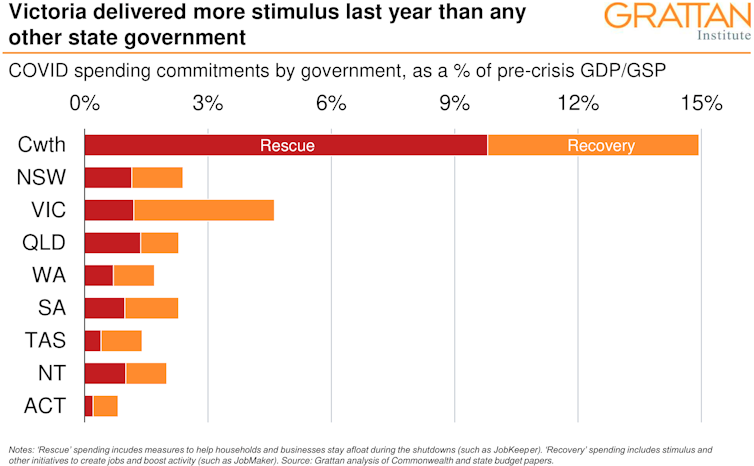

Last year, the brief for federal and state budgets alike was simple: spend to support the economy.

Australia was in the grip of the COVID recession, and nowhere was this more acute than in Victoria.

The economic conditions required[1] targeted and effective stimulus, and Victoria delivered in spades.

This year’s test is a little more complicated.

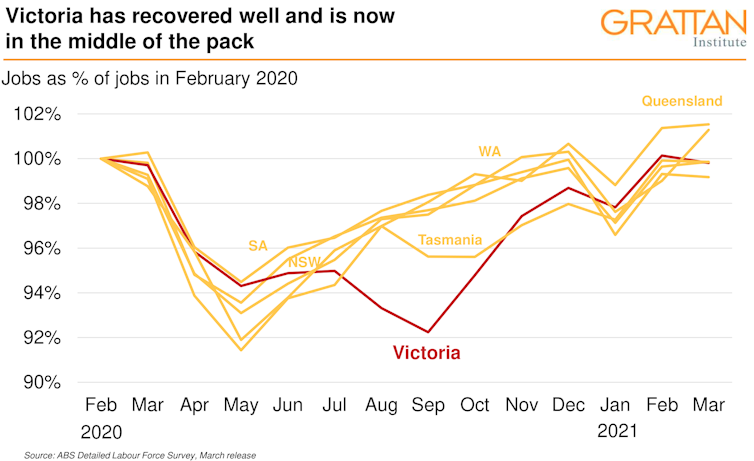

The recovery is going well – Victoria’s jobs have returned to pre-crisis levels, a remarkable turnaround given the hit to the employment from the second lockdown – but unemployment is still elevated.

The challenge for fiscal policy is now to “stick the landing” by quickly getting unemployment as low as possible so wages can grow again.

This year’s test is a little more complicated.

The recovery is going well – Victoria’s jobs have returned to pre-crisis levels, a remarkable turnaround given the hit to the employment from the second lockdown – but unemployment is still elevated.

The challenge for fiscal policy is now to “stick the landing” by quickly getting unemployment as low as possible so wages can grow again.

The federal government made a reasonable attempt at meeting this challenge last week when it delivered a budget focused on creating jobs[2], particularly in the care sector — even if the quality of its spending fell short and the outlook for wages growth remains poor in the short-term.

But the federal government has one big advantage: for the time being at least, the low cost of debt has given it breathing space on the fiscal position.

This is not true to the same extent for Victoria.

Read more:

Fewer hard hats, more soft hearts: budget pivots to women and care[3]

Victoria’s cost of borrowing is still low – the government can borrow for 10 years at an interest rate of less than 2%[4], only slightly higher than the Commonwealth’s.

But credit ratings agency Moody’s recently downgraded[5] the state’s credit rating from AAA to AA1 and cut its outlook to “negative”.

That brings the health of the balance sheet into slightly sharper focus.

And this means a treasurer walking the tightrope of more spending to support the economy while at the same time making sure that he reins in future deficits.

The hard work: taxes and spending are up

For the budget balance, the Victorian government has made some difficult decisions to raise more revenue. The budget includes more than $5 billion in new taxes over the next four years.

The federal government made a reasonable attempt at meeting this challenge last week when it delivered a budget focused on creating jobs[2], particularly in the care sector — even if the quality of its spending fell short and the outlook for wages growth remains poor in the short-term.

But the federal government has one big advantage: for the time being at least, the low cost of debt has given it breathing space on the fiscal position.

This is not true to the same extent for Victoria.

Read more:

Fewer hard hats, more soft hearts: budget pivots to women and care[3]

Victoria’s cost of borrowing is still low – the government can borrow for 10 years at an interest rate of less than 2%[4], only slightly higher than the Commonwealth’s.

But credit ratings agency Moody’s recently downgraded[5] the state’s credit rating from AAA to AA1 and cut its outlook to “negative”.

That brings the health of the balance sheet into slightly sharper focus.

And this means a treasurer walking the tightrope of more spending to support the economy while at the same time making sure that he reins in future deficits.

The hard work: taxes and spending are up

For the budget balance, the Victorian government has made some difficult decisions to raise more revenue. The budget includes more than $5 billion in new taxes over the next four years.

Tim Pallas cuts the deficit while supporting the economy.

JAMES ROSS/AAP

The new property “windfall profits levy[6]” and the increase in land tax are two significant steps forward[7] in building a more efficient tax base, even if the accompanying increase to inefficient stamp duties is a step backward.

And the significant extra spending on mental health is partially offset by a new Mental Health Levy[8] on payroll tax for businesses – 0.5% for payrolls over $10 million and another 0.5% for payrolls over $100 million, raising $2.7 billion over four years.

This will slightly increase the inefficiency of the progressive payroll tax base, but should not be a major drag on growth.

But the overall focus on revenue is warranted.

It carves out a point of difference between Victoria and the federal government, which studiously avoided the “revenue question” in last week’s budget.

To support the economy, the additional revenue from these measures is more than offset by new spending – more than $12 billion over four years.

The centrepiece of the Victorian budget is the mental health package[9]. The government claims it will create 3,000 jobs in the sector in addition to improving the quality and availability of care.

There are also additional skills initiatives and spending on health and child protection services.

The good luck and illusions

The housing market has done its bit for the treasurer’s success delivering a windfall $5 billion over the three forward years, primarily driven by big uplifts in stamp duty and land tax.

The other very helpful change, this time to accounting practices, delivers $6.5 billion over three years in “other administrative variations”.

The removal of the “capital assets charge” is consistent with other states, but it’s a one-off sweetener for the bottom line.

Landing the trick

On the key indicators of performance, things are heading in the right direction, although not as fast as we might hope.

Unemployment is coming down and the numbers look much rosier than the treasury’s previous estimates in November. However, it is still expected to be elevated over the next four years.

Whereas the federal government is forecasting nationwide unemployment of 4.5% in 2024-25, Victoria projects 5.25% by that date, and unemployment above the 2019-20 level of 5.4% for at least two years.

And wages growth for Victorians is expected to be subdued, and will go backwards in real terms in the next financial year.

Read more:

Frydenberg spends the bounty to drive unemployment to new lows[10]

Budget balances have improved by several billion over the next four years, although the government still expects a deficit of $2.5 billion in 2024-25.

Net debt is expected to reach 26.8% of gross state product by 2024-25, with interest costs estimated at 0.8% of gross state product by that date.

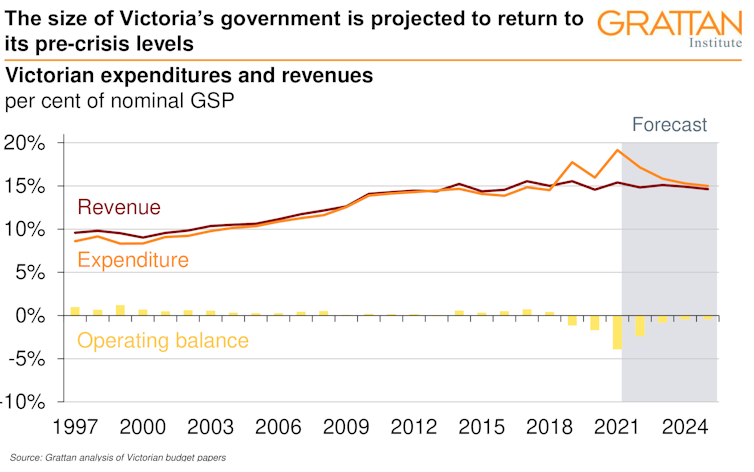

The result by the end of the four year projections period is a return to the size of government before the crisis – albeit a level that was high by historical standards.

Tim Pallas cuts the deficit while supporting the economy.

JAMES ROSS/AAP

The new property “windfall profits levy[6]” and the increase in land tax are two significant steps forward[7] in building a more efficient tax base, even if the accompanying increase to inefficient stamp duties is a step backward.

And the significant extra spending on mental health is partially offset by a new Mental Health Levy[8] on payroll tax for businesses – 0.5% for payrolls over $10 million and another 0.5% for payrolls over $100 million, raising $2.7 billion over four years.

This will slightly increase the inefficiency of the progressive payroll tax base, but should not be a major drag on growth.

But the overall focus on revenue is warranted.

It carves out a point of difference between Victoria and the federal government, which studiously avoided the “revenue question” in last week’s budget.

To support the economy, the additional revenue from these measures is more than offset by new spending – more than $12 billion over four years.

The centrepiece of the Victorian budget is the mental health package[9]. The government claims it will create 3,000 jobs in the sector in addition to improving the quality and availability of care.

There are also additional skills initiatives and spending on health and child protection services.

The good luck and illusions

The housing market has done its bit for the treasurer’s success delivering a windfall $5 billion over the three forward years, primarily driven by big uplifts in stamp duty and land tax.

The other very helpful change, this time to accounting practices, delivers $6.5 billion over three years in “other administrative variations”.

The removal of the “capital assets charge” is consistent with other states, but it’s a one-off sweetener for the bottom line.

Landing the trick

On the key indicators of performance, things are heading in the right direction, although not as fast as we might hope.

Unemployment is coming down and the numbers look much rosier than the treasury’s previous estimates in November. However, it is still expected to be elevated over the next four years.

Whereas the federal government is forecasting nationwide unemployment of 4.5% in 2024-25, Victoria projects 5.25% by that date, and unemployment above the 2019-20 level of 5.4% for at least two years.

And wages growth for Victorians is expected to be subdued, and will go backwards in real terms in the next financial year.

Read more:

Frydenberg spends the bounty to drive unemployment to new lows[10]

Budget balances have improved by several billion over the next four years, although the government still expects a deficit of $2.5 billion in 2024-25.

Net debt is expected to reach 26.8% of gross state product by 2024-25, with interest costs estimated at 0.8% of gross state product by that date.

The result by the end of the four year projections period is a return to the size of government before the crisis – albeit a level that was high by historical standards.

There’s no playbook for state treasurers coming out of a pandemic recession.

Victoria’s treasurer Tim Pallas is trying to walk the tightrope of strong recovery and fiscal responsibility.

It looks as if he’s pulled it off without too many major stumbles, with a bit of help from the stronger than expected recovery, the housing market, and a change in accounting standards.

There’s no playbook for state treasurers coming out of a pandemic recession.

Victoria’s treasurer Tim Pallas is trying to walk the tightrope of strong recovery and fiscal responsibility.

It looks as if he’s pulled it off without too many major stumbles, with a bit of help from the stronger than expected recovery, the housing market, and a change in accounting standards.

References

- ^ required (grattan.edu.au)

- ^ creating jobs (theconversation.com)

- ^ Fewer hard hats, more soft hearts: budget pivots to women and care (theconversation.com)

- ^ less than 2% (www.tcv.vic.gov.au)

- ^ downgraded (7news.com.au)

- ^ windfall profits levy (www.theage.com.au)

- ^ steps forward (www.afr.com)

- ^ Mental Health Levy (www.sro.vic.gov.au)

- ^ mental health package (www.budget.vic.gov.au)

- ^ Frydenberg spends the bounty to drive unemployment to new lows (theconversation.com)

Authors: Tom Crowley, Associate, Grattan Institute