Vital Signs. The RBA wants to cut unemployment, and nothing — not even soaring home prices — will stand in its way

- Written by Richard Holden, Professor of Economics, UNSW

Ahead of the definitive official read of the economy from the treasury in the budget on Tuesday[1], the Reserve Bank has given us two special insights into its own thinking in the space of 14 hours.

They suggest that (first) the economy is improving, and (second) the bank is not going to let up on driving that improvement, not for anything — including concern about climbing home prices — until it has pushed unemployment down and wage growth back up to where it believes it should be.

The first insight was in Deputy Governor Guy Debelle’s Shann Memorial Lecture on Thursday night. The second was in Friday’s Statement on Monetary Policy[2][3]

Growth without inflation

The statement emphasised that the although the bank expects economic growth to bounce back fairly strongly, getting inflation back within the bank’s 2-3% target band and getting wages growth up will take much longer

As the statement put it:

despite the stronger outlook for output and the labour market, inflation and wages growth are expected to remain low, picking up only gradually.

On one measure just 1.1%[4], the lowest on record, underlying inflation is to climb to 1.5% over the course of 2021 before gradually climbing to close to 2% by mid 2023.

It’s well short of the bank’s target of 2-3% which is only likely to be achieved with much higher wages growth driven by much deeper inroads into unemployment.

Read more: Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment[5]

Those inroads will be easier to achieve if COVID is firmly under control.

The bank explicitly linked its forecasts of an improving economy to an assumption that Australia’s vaccine rollout accelerates in the second half of the year. It could have added to that (but didn’t) the importance of getting purpose-built quarantine facilities up and running.

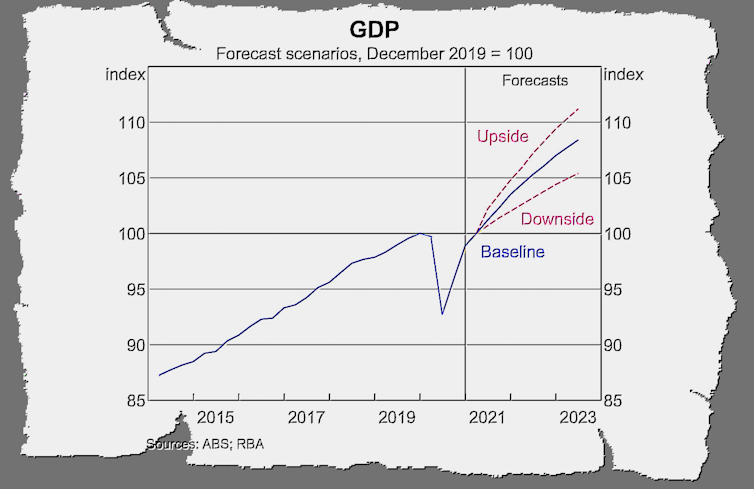

Its baseline forecast has economic growth of 4% in the year to June 2022 and 3% in the year to June 2023.

RBA Statement on Monetary Policy, May 7 2021[6]

But there is a fairly wide range around its downside and upside scenarios.

Economic growth might be as low as 2.5% or as high as 5% in 2022 and as low as 2% and as high as 3% in 2023.

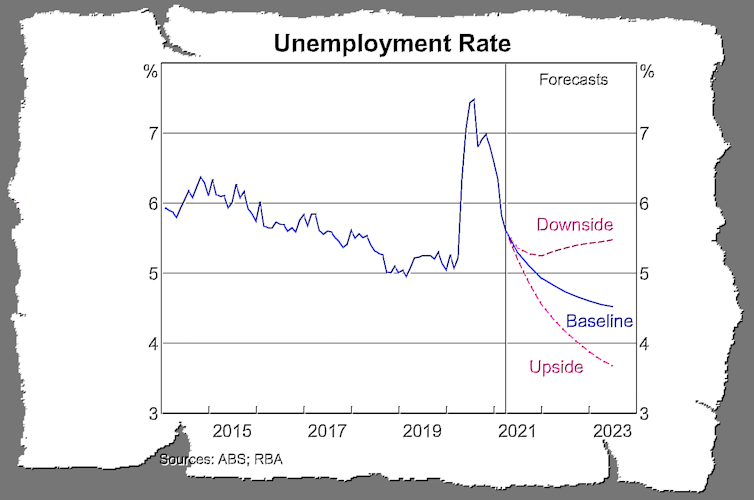

Similarly, the unemployment forecast is somewhere between 4.25% and 5.25% by June 2022 and in a very wide range of 3.75% and 5.5% by June 2023.

RBA Statement on Monetary Policy, May 7 2021[6]

But there is a fairly wide range around its downside and upside scenarios.

Economic growth might be as low as 2.5% or as high as 5% in 2022 and as low as 2% and as high as 3% in 2023.

Similarly, the unemployment forecast is somewhere between 4.25% and 5.25% by June 2022 and in a very wide range of 3.75% and 5.5% by June 2023.

RBA Statement on Monetary Policy, May 7 2021[7]

These forecasts produce below-target inflation forecasts of between 1.5% and 2% in June 2022 and 1.5% to 2.25% in June 2023.

What the bank will do to help drive the upside scenario, and what else will need to happen, was laid out by Debelle in Thursday night’s Shann Memorial Lecture[8].

The Debelle Doctrine

Adjectives like “seminal” are bandied about liberally these days, but for me, Debelle’s speech on Monetary Policy During COVID[9] was a masterpiece.

He began by outlining the suite of measures the bank introduced from the beginning of the pandemic in March 2020. They involved

cutting the cash rate to a record low of 0.25% and then cutting it again to 0.1%

undertaking to not increase the cash rate target until the bank is confident that inflation will be sustainably within the 2–3% target band

cutting the rate paid on private banks’ exchange settlement balances with the bank to 0.1% and then to 0.0%

buying enough three-year government bonds to target a yield of 0.25%, later 0.1%[10]

guaranteeing to buy $5 billion of five-year and ten-year state and Commonwealth week-in week-out whatever the economic circumstances[11]

buying bonds as needed to address the “dysfunction” in the bond market

offering banks cheap lending finance through a new term funding facility[12]

ensuring that the financial system has sufficient liquidity

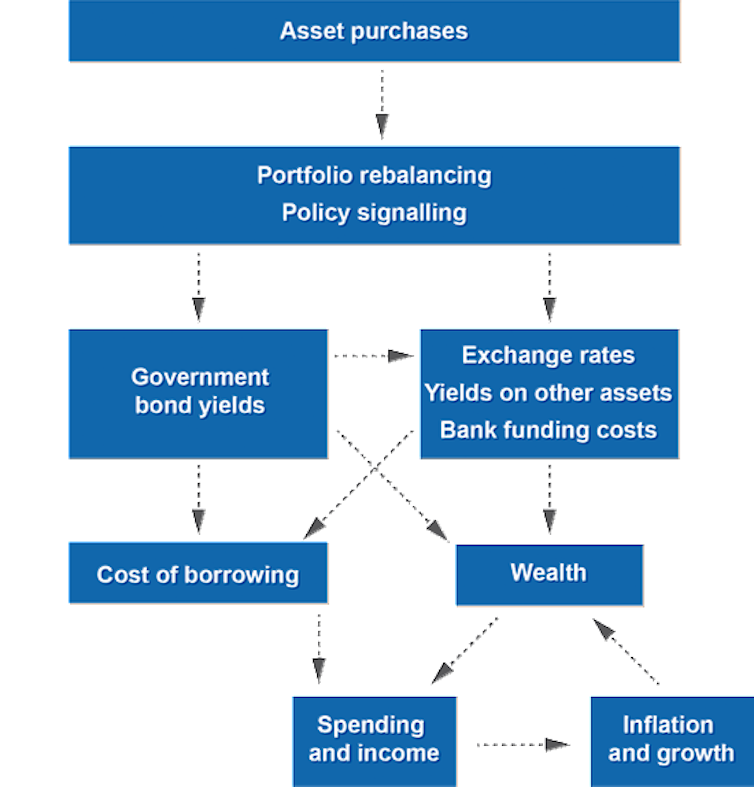

Debelle methodically described how each of these measures are likely to flow through into economic activity.

Read more:

Exclusive. Top economists back budget push for an unemployment rate beginning with '4'[13]

That is, he articulated what economists call the “transmission mechanism” — how the measures work.

As an example, the following chart he provided summarises the transmission mechanism for bond purchases.

RBA Statement on Monetary Policy, May 7 2021[7]

These forecasts produce below-target inflation forecasts of between 1.5% and 2% in June 2022 and 1.5% to 2.25% in June 2023.

What the bank will do to help drive the upside scenario, and what else will need to happen, was laid out by Debelle in Thursday night’s Shann Memorial Lecture[8].

The Debelle Doctrine

Adjectives like “seminal” are bandied about liberally these days, but for me, Debelle’s speech on Monetary Policy During COVID[9] was a masterpiece.

He began by outlining the suite of measures the bank introduced from the beginning of the pandemic in March 2020. They involved

cutting the cash rate to a record low of 0.25% and then cutting it again to 0.1%

undertaking to not increase the cash rate target until the bank is confident that inflation will be sustainably within the 2–3% target band

cutting the rate paid on private banks’ exchange settlement balances with the bank to 0.1% and then to 0.0%

buying enough three-year government bonds to target a yield of 0.25%, later 0.1%[10]

guaranteeing to buy $5 billion of five-year and ten-year state and Commonwealth week-in week-out whatever the economic circumstances[11]

buying bonds as needed to address the “dysfunction” in the bond market

offering banks cheap lending finance through a new term funding facility[12]

ensuring that the financial system has sufficient liquidity

Debelle methodically described how each of these measures are likely to flow through into economic activity.

Read more:

Exclusive. Top economists back budget push for an unemployment rate beginning with '4'[13]

That is, he articulated what economists call the “transmission mechanism” — how the measures work.

As an example, the following chart he provided summarises the transmission mechanism for bond purchases.

And then he delivered the setup for the punchline.

The tools the bank is using might affect all sorts of things, including house prices. But the bank plans to focus on just one thing — getting unemployment down until it gets inflation back up to its target band.

Then the punchline itself: the bank will do this even if it leads to higher house prices

there are a number of tools that can be used to address the issue. But I do not think that monetary policy is one of the tools. Monetary policy is focussed on supporting the economic recovery and achieving its goals in terms of employment and inflation

It was important to remember that while housing prices may not rise as fast without low interest rates, unemployment would definitely be materially higher without low interest rates.

Unemployment has serious consequences.

What it all means

The Debelle Doctrine is that the bank will focus on a narrow range of objectives, and will not be timid about using the tools in its arsenal to achieve them.

This may not be a seismic shift, but it is significant.

It gives the bank a much clearer focus; it gives others a much better way to judge how it is performing; and it makes clear that if the government is concerned about rising house prices, it’ll have to do something itself (perhaps by tightening the tax rules governing capital gains and negative gearing).

Debelle produced a clear, precise, and authoritative statement of what the Reserve Bank can, should, and will do.

In a word, it was gubernatorial.

And then he delivered the setup for the punchline.

The tools the bank is using might affect all sorts of things, including house prices. But the bank plans to focus on just one thing — getting unemployment down until it gets inflation back up to its target band.

Then the punchline itself: the bank will do this even if it leads to higher house prices

there are a number of tools that can be used to address the issue. But I do not think that monetary policy is one of the tools. Monetary policy is focussed on supporting the economic recovery and achieving its goals in terms of employment and inflation

It was important to remember that while housing prices may not rise as fast without low interest rates, unemployment would definitely be materially higher without low interest rates.

Unemployment has serious consequences.

What it all means

The Debelle Doctrine is that the bank will focus on a narrow range of objectives, and will not be timid about using the tools in its arsenal to achieve them.

This may not be a seismic shift, but it is significant.

It gives the bank a much clearer focus; it gives others a much better way to judge how it is performing; and it makes clear that if the government is concerned about rising house prices, it’ll have to do something itself (perhaps by tightening the tax rules governing capital gains and negative gearing).

Debelle produced a clear, precise, and authoritative statement of what the Reserve Bank can, should, and will do.

In a word, it was gubernatorial.

References

- ^ Tuesday (budget.gov.au)

- ^ Shann Memorial Lecture (www.rba.gov.au)

- ^ Statement on Monetary Policy (www.rba.gov.au)

- ^ 1.1% (www.abs.gov.au)

- ^ Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment (theconversation.com)

- ^ RBA Statement on Monetary Policy, May 7 2021 (www.rba.gov.au)

- ^ RBA Statement on Monetary Policy, May 7 2021 (www.rba.gov.au)

- ^ Shann Memorial Lecture (www.rba.gov.au)

- ^ Monetary Policy During COVID (www.rba.gov.au)

- ^ 0.1% (theconversation.com)

- ^ whatever the economic circumstances (theconversation.com)

- ^ term funding facility (www.rba.gov.au)

- ^ Exclusive. Top economists back budget push for an unemployment rate beginning with '4' (theconversation.com)

Authors: Richard Holden, Professor of Economics, UNSW