The paradox of going contactless is that we're more in love with cash than ever

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

COVID has changed you, right? You use less cash, perhaps a lot less.

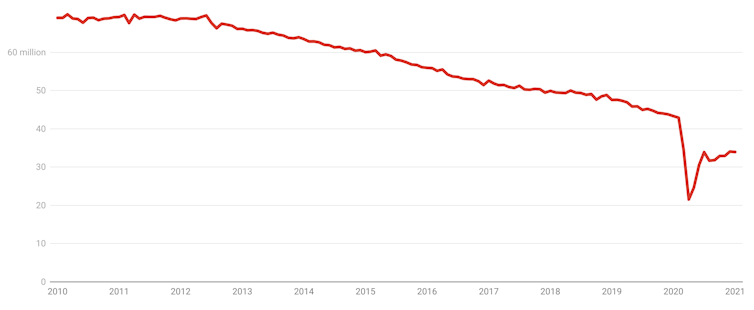

In the first two months of the pandemic, cash withdrawals from automatic teller machines halved[1]. Even now they are down 20%.

So little-used were the main notes traditionally used for small transactions – $5 and $10 notes – that authorities stopped issuing them[2] in the first half of 2020.

The amount of cash banked by retailers dropped by a third between February and May, and according to a new Reserve Bank study[3] is still much lower than it was.

Only 23%[4] of Australians surveyed in October said they had used cash for their most recent face-to-face purchase, down from more than 30% before.

Of those who said they avoided using cash, 28% said it was unhygienic; 45% had come across a business that wouldn’t take it.

The bank estimates only 4%[5] of businesses refused to accept cash outright, although many more did what they could to discourage it.

ATM cash withdrawals using debit cards

Total number each month, seasonally adjusted.

Reserve Bank of Australia[6]

Total number each month, seasonally adjusted.

Reserve Bank of Australia[6]

Cafes and pubs offered contact-free ordering via QR codes[7], shops were given permission to lift the PayWave limit[8] for transactions without a PIN, and banks were given permission to mail out cards to customers who didn’t ask for them[9].

One in five of us holds no cash

If the switch away from using cash seems like something we took in our stride, it’s because we’ve been slinking away from it for years.

Contactless card transactions accounted for a record 50%[10] of in-person sales in 2019, up from 10% in 2013. More than one in five Australians reported they held no cash[11] in their purses and wallets in 2019, up from one in ten in 2013.

Contactless has become ubiquitous.

Square

Contactless has become ubiquitous.

Square

An even bigger 40% said they held no cash outside their wallets.

Toll roads haven’t accepted cash for years. Transport cards such as Myki, Opal and MyWay have grown to the point where they account for 2%[12] of all transactions. Now 5% of face-to-face transactions are done with mobile phones.

The “threshold” below which cash remains the most common means of payment has been falling for decades. In 2019 it was just $4[13], down from $41 in 2007.

It means you would be entitled to think (and entitled to be certain) that we are falling out of love with cash. We need it less than ever.

Yet bizarrely (and this is something even the experts[14] can’t make sense of) we are amassing more of it than ever, even more so during the pandemic.

Yet in aggregate, we are holding more than ever

The value of cash out there somewhere (notes issued in excess of those returned) soared 17%[15] during 2020. In each of the previous ten years, while our use of cash dwindled, our holdings climbed by an average of 5%.

So big was demand for cash during the pandemic that the Reserve Bank opened its “contingency” distribution site twice, in March and in July[16], to get $50 and $100 notes out to banks being asked for them. At the same time the banks held back on returning poor-quality notes in case they needed them.

Read more: Depending on who you are, the benefits of a cashless society are overrated[17]

The paradox is that while many of us are holding absolutely no cash, and many more are holding none outside of their pockets, some are holding bewilderingly large and growing amounts, which they fortified during the recession.

When asked, only one in 200[18] owns up to holding more than $5,000 in cash, but the amounts some of those people are holding must be staggering.

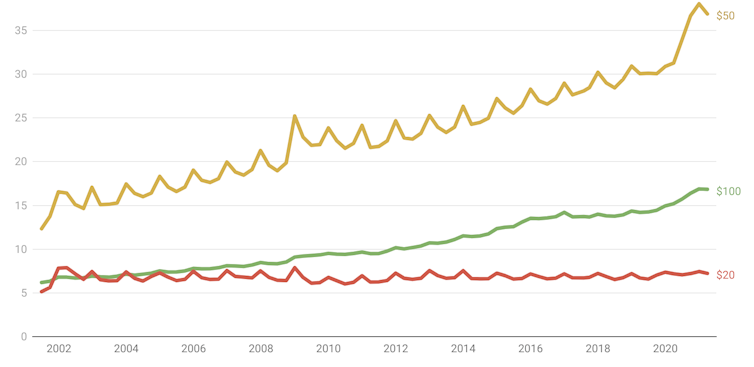

The latest figures show there were 186 million $20 notes out there in circulation at the end of March — about seven[19] for each woman, man and child in the country.

A clutch of 20s, far more 50s and 100s

Chingfoto/Shutterstock

The count of $20 notes seems about right. Some are in tills, some in wallets.

But for $50 notes (the ones many of us don’t hold as often) there are an improbable 37 per person in circulation — 947 million. For $100 notes – the ones some of us never see – it is 17 per person.

There are far more $50 and $100 notes than there used to be. Twenty years ago we had just six[20] $100 notes per person, alongside about as many $20 notes as now.

Our neighbour across the Tasman Sea is like we used to be. New Zealand still has only five[21] $100 notes per person in circulation.

For Australia, “circulation” is scarcely the right word.

Our high-value notes are exchanged so rarely the Reserve Bank’s best guess is that, on average, each $100 note will last 200 years[22] before being returned damaged or worn out; $20 notes are returned every eight years.

Banknotes in circulation per person

Chingfoto/Shutterstock

The count of $20 notes seems about right. Some are in tills, some in wallets.

But for $50 notes (the ones many of us don’t hold as often) there are an improbable 37 per person in circulation — 947 million. For $100 notes – the ones some of us never see – it is 17 per person.

There are far more $50 and $100 notes than there used to be. Twenty years ago we had just six[20] $100 notes per person, alongside about as many $20 notes as now.

Our neighbour across the Tasman Sea is like we used to be. New Zealand still has only five[21] $100 notes per person in circulation.

For Australia, “circulation” is scarcely the right word.

Our high-value notes are exchanged so rarely the Reserve Bank’s best guess is that, on average, each $100 note will last 200 years[22] before being returned damaged or worn out; $20 notes are returned every eight years.

Banknotes in circulation per person

Reserve Bank of Australia, ABS[23]

So big is the mystery about where all the notes are that the Reserve Bank has published a study, Where’s the Money? An Investigation into the Whereabouts and Uses of Australian Banknotes[24].

Crime, tax and means tests

It finds 5-10% are lost. It gets the estimate from the number of paper notes that were never converted to plastic when we switched over in the 1990s.

Up to 15% are kept overseas. The RBA can tell by the way demand for notes changes with the value of the Australian dollar.

Only a few percent are used to store the proceeds of crime. Criminals “convert a large share of their cash profits into other assets”.

Read more:

Limiting cash to $10,000 is more dangerous than you might think[25]

Interestingly, where criminals do store cash, the chemical residues left at the site of drug busts suggests it is as $50 rather than $100 notes.

The rest is hoarding, both in case something goes wrong with the banking system (which explains the spike during COVID) and what appears to be an especially Australian desire to avoid tax and things such as the age pension assets test.

New Zealand doesn’t have[26] a pension assets test.

Reserve Bank of Australia, ABS[23]

So big is the mystery about where all the notes are that the Reserve Bank has published a study, Where’s the Money? An Investigation into the Whereabouts and Uses of Australian Banknotes[24].

Crime, tax and means tests

It finds 5-10% are lost. It gets the estimate from the number of paper notes that were never converted to plastic when we switched over in the 1990s.

Up to 15% are kept overseas. The RBA can tell by the way demand for notes changes with the value of the Australian dollar.

Only a few percent are used to store the proceeds of crime. Criminals “convert a large share of their cash profits into other assets”.

Read more:

Limiting cash to $10,000 is more dangerous than you might think[25]

Interestingly, where criminals do store cash, the chemical residues left at the site of drug busts suggests it is as $50 rather than $100 notes.

The rest is hoarding, both in case something goes wrong with the banking system (which explains the spike during COVID) and what appears to be an especially Australian desire to avoid tax and things such as the age pension assets test.

New Zealand doesn’t have[26] a pension assets test.

References

- ^ halved (www.rba.gov.au)

- ^ stopped issuing them (www.rba.gov.au)

- ^ study (www.rba.gov.au)

- ^ 23% (www.rba.gov.au)

- ^ 4% (www.rba.gov.au)

- ^ Reserve Bank of Australia (www.rba.gov.au)

- ^ QR codes (www.smh.com.au)

- ^ PayWave limit (www.auspaynet.com.au)

- ^ didn’t ask for them (www.rba.gov.au)

- ^ 50% (www.rba.gov.au)

- ^ no cash (www.rba.gov.au)

- ^ 2% (www.rba.gov.au)

- ^ $4 (www.rba.gov.au)

- ^ experts (treasury.gov.au)

- ^ 17% (www.rba.gov.au)

- ^ March and in July (www.rba.gov.au)

- ^ Depending on who you are, the benefits of a cashless society are overrated (theconversation.com)

- ^ one in 200 (www.rba.gov.au)

- ^ seven (www.rba.gov.au)

- ^ six (www.rba.gov.au)

- ^ five (www.rbnz.govt.nz)

- ^ 200 years (www.rba.gov.au)

- ^ Reserve Bank of Australia, ABS (www.rba.gov.au)

- ^ Where’s the Money? An Investigation into the Whereabouts and Uses of Australian Banknotes (www.rba.gov.au)

- ^ Limiting cash to $10,000 is more dangerous than you might think (theconversation.com)

- ^ doesn’t have (www.govt.nz)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University