The budget overlooks the hardest hit in favour of the hardest hats

- Written by Danielle Wood, Chief executive officer, Grattan Institute

The Morrison government seems to think economic stimulus is all about high-viz vests and hard hats. It’s a narrow and dated view of the world of work.

Tuesday night’s budget included several broad measures to support business and jobs, such as its tax write-off for business investments and wage subsidy for employing young people.

These look like sensible measures, albeit ones that bet heavily on business to lead the recovery.

But when it comes to targeted policies for job creation, the 2020 budget is a sea of hard hats.

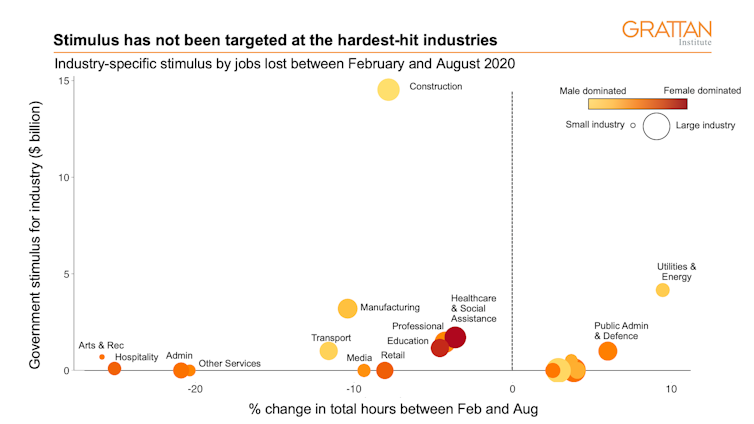

The three sectors with the most targeted support are all bloke-heavy: construction (more than A$10 billion so far through the crisis), energy (A$4 billion), and manufacturing (A$3 billion). There is also an extra A$10 billion for transport projects, another boost to construction jobs in the building phase.

The problem? That doesn’t fit the story of this crisis. Unlike past recessions, the worst fallout in the COVID-19 recession has been in services sectors.

Read more: Budget 2020 at a glance: the cuts, the spends, and that big deficit in 7 charts[1]

Hospitality, the arts and administrative services have all been hit hard. These sectors are dominated by women, which is one reason women’s employment has taken a bigger hit this year.

Yet these sectors received next to nothing in the budget. They are also less likely to benefit from economy-wide supports such as instant asset write-offs because they are the least capital-intensive sectors.

Size reflects the industry share of Gross Value Added for 2019. Industry-specific stimulus excludes stimulus available to all industries, such as JobKeeper. ABS, Grattan analysis of Government announcements to October 2020

Size reflects the industry share of Gross Value Added for 2019. Industry-specific stimulus excludes stimulus available to all industries, such as JobKeeper. ABS, Grattan analysis of Government announcements to October 2020

There are many ways the federal government could have helped these sectors.

Overseas governments, and some state and local governments, have funded vouchers and discounts to encourage people back to restaurants, cafes and regional tourist destinations.

Grants or direct support to help the arts sector revive could provide a desperately needed boost to our creative recovery.

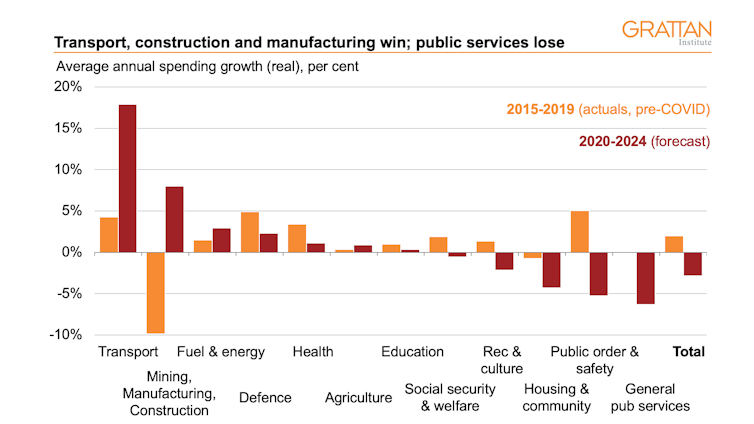

The government could have created many more jobs by directly investing in government services. Services create more jobs than infrastructure per dollar spent, and they have especially high economic multipliers right now.

Notes: Excludes expenses for ‘other economic affairs’ (which contains JobKeeper) and ‘other purposes’ (largely GST payments to the states). Total expenses growth is also calculated excluding ‘other purposes’. Source: Budget 2020-21. Source: Budget 2020-21

Notes: Excludes expenses for ‘other economic affairs’ (which contains JobKeeper) and ‘other purposes’ (largely GST payments to the states). Total expenses growth is also calculated excluding ‘other purposes’. Source: Budget 2020-21. Source: Budget 2020-21

The budget initiatives in education, aged care and mental health are welcome, but very small in the scheme of new spending.

Major investments in aged care and education would be a jobs boon and could have provided a more rounded vision for the recovery.

A missed opportunity for women

This week, just before the budget, the federal Minister for Women, Marise Payne, issued a statement[2] saying:

This government recognises that women have been significantly impacted by the COVID-19 pandemic and it is critical that we focus on rebuilding their economic security as a priority.

Yet the government has left the biggest opportunity on the table. Making child care more affordable is the most effective way to reduce the gender gap in working life and retirement – directly supporting jobs and the economic recovery.

Read more: Permanently raising the Child Care Subsidy is an economic opportunity too good to miss[3]

The Grattan Institute has recommended a A$5-billion-a-year package[4] that would make child care significantly cheaper and improve the workforce participation incentives for primary carers (still mainly women).

Instead, women seem to have been relegated in this budget to an afterthought in the form of a A$240 million “support package”, which offers no meaningful economic support.

The Conversation’s Business & Economy editor Peter Martin explains the 2020 budget in three minutes.Poorly targeted stimulus

All of these omissions are even more glaring given the spending on other areas and groups with far less need for support.

Sizeable measures are targeted towards energy, agriculture and defence. Yet all of these sectors have increased their total work hours since March.

Read more: Budget 2020: promising tax breaks, but relying on hope[5]

Another A$3 billion is slated for manufacturing. While that sector has shed jobs during the crisis, it should bounce back more quickly than “social consumption” businesses such as hospitality, retail and personal services.

Construction spending is needed, because a future crunch in the sector is expected as housing construction slows.

But the focus on major transport infrastructure for job creation does not make so much sense. These projects are less jobs-intensive.

Read more: Top economists back boosts to JobSeeker and social housing over tax cuts in pre-budget poll[6]

Also, states such as Victoria already have a big pipeline of large projects, so have little capacity to deliver more.

The A$3 billion for shovel-ready projects focusing on road safety and local roads are better targeted to create jobs. But it has missed the opportunity to deliver a major social housing spend, providing something desperately needed that would also help mitigate the downturn in housing construction.

To achieve its stated objective of getting unemployment well below 6% as quickly as possible, the government should be focusing on stimulating sectors where activity has fallen the most – especially services sectors.

But this budget overlooks the hard hit in favour of the hard hat. The government should check this blind spot quickly. A broad-based recovery depends on it.

References

- ^ Budget 2020 at a glance: the cuts, the spends, and that big deficit in 7 charts (theconversation.com)

- ^ a statement (www.theage.com.au)

- ^ Permanently raising the Child Care Subsidy is an economic opportunity too good to miss (theconversation.com)

- ^ A$5-billion-a-year package (grattan.edu.au)

- ^ Budget 2020: promising tax breaks, but relying on hope (theconversation.com)

- ^ Top economists back boosts to JobSeeker and social housing over tax cuts in pre-budget poll (theconversation.com)

Authors: Danielle Wood, Chief executive officer, Grattan Institute