your guide to the Australian payments that will go to the extra million on welfare

- Written by Peter Whiteford, Professor, Crawford School of Public Policy, Australian National University

This is longer than the usual Conversation article, so allow some time to take it in.

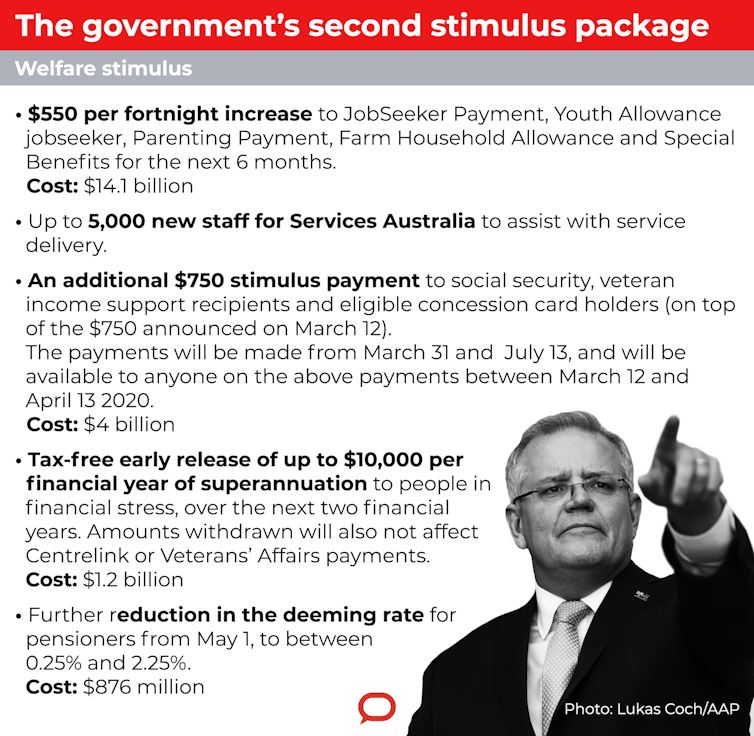

On Sunday, the government announced a second[1] coronavirus economic package.

In addition to further one-off payments, the package includes some of the most significant changes to social security payments Australia has ever seen, even if only on a temporary basis.

The amendments[2] passed by parliament on Monday night expand them further.

The package effectively doubles rates of JobSeeker Payment for most people without children.

Read more: Scalable without limit: how the government plans to get coronavirus support into our hands quickly[3]

The maximum rate for a single recipient without dependants is currently A$565.70 per fortnight. Lone parents and those over 60 who have been on benefit for nine months or more currently get more, while members of couples each get somewhat less.

For the six months from April 27 the government will boost it by A$550 per fortnight through a special time-limited Coronavirus Supplement[4].

Importantly, the extra $550 will go to all current recipients, including those who get less than $565.70 because they have assets or are in part-time work.

It will also go to both existing and new recipients of the Youth Allowance JobSeeker Payment, Parenting Payment, Farm Household Allowance and Special Benefit.

The Conversation

Thanks to Monday night’s amendments[5], it will now also go to full-time students receiving Abstudy, Austudy and Youth Allowance for Students[6].

There are also reports[7] that special payments (and the Coronavirus Supplement) will be made available to temporary visa holders who lose their jobs or suffer significant financial hardship because of the coronavirus.

In addition, the government will no longer need legislation to make further changes to settings, giving the Social Services minister unprecedented powers.

This will give the government the ability to respond flexibly as circumstances change.

One million now, an extra million soon

Roughly 1.3 million existing recipients will receive the supplement, including the 200,000 or so students added on Monday.

To them will be added as many as one million more[8], who are not currently receiving the JobSeeker or any other payment.

Among them will be permanent employees who are stood down or lose their jobs, sole traders, the self-employed, casual workers and contract workers who find themselves meeting the benefit income tests as a result of the coronavirus.

Included are people required to care for people who are affected by the coronavirus.

Accelerated processing

The assets test for JobSeeker Payment, Youth Allowance Jobseeker and Parenting Payment will be waived for the duration of the Coronavirus Supplement.

In addition, the normal one week waiting period will be waived, as will the liquid assets test waiting period (which can be up to 13 weeks).

People already in this waiting period will be given immediate access to payments.

It is also important that the Coronavirus Supplement will be paid automatically. Current recipients will receive the full $550 on top of their regular payment without asking for it.

Services Australia is putting on an extra 5,000 staff to deal with the inflow of new claimants and accelerating claim process[9].

Australia moves up the ranks

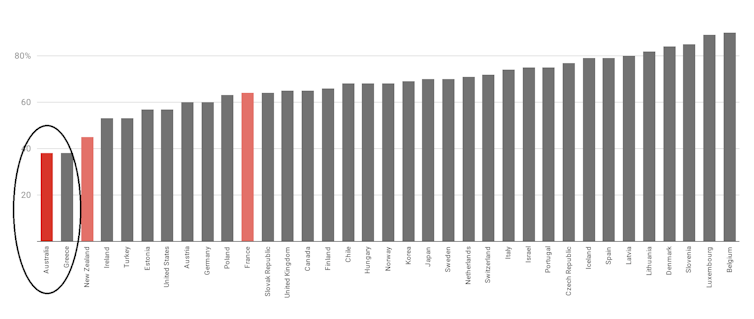

These changes will significantly boost the adequacy of working age social security payments in Australia – at least temporarily.

This chart shows where Australia sat in 2019 compared to other members of the Organisation for Economic Co-operation and Development on replacement rates – the percentage of previous after-tax earnings that an unemployment payment provided to a single unemployed worker who had previously been on two-thirds of the average wage.

Australia is coloured red, and is at the bottom of the pack.

OECD 2019 unemployment income replacement rates

The Conversation

Thanks to Monday night’s amendments[5], it will now also go to full-time students receiving Abstudy, Austudy and Youth Allowance for Students[6].

There are also reports[7] that special payments (and the Coronavirus Supplement) will be made available to temporary visa holders who lose their jobs or suffer significant financial hardship because of the coronavirus.

In addition, the government will no longer need legislation to make further changes to settings, giving the Social Services minister unprecedented powers.

This will give the government the ability to respond flexibly as circumstances change.

One million now, an extra million soon

Roughly 1.3 million existing recipients will receive the supplement, including the 200,000 or so students added on Monday.

To them will be added as many as one million more[8], who are not currently receiving the JobSeeker or any other payment.

Among them will be permanent employees who are stood down or lose their jobs, sole traders, the self-employed, casual workers and contract workers who find themselves meeting the benefit income tests as a result of the coronavirus.

Included are people required to care for people who are affected by the coronavirus.

Accelerated processing

The assets test for JobSeeker Payment, Youth Allowance Jobseeker and Parenting Payment will be waived for the duration of the Coronavirus Supplement.

In addition, the normal one week waiting period will be waived, as will the liquid assets test waiting period (which can be up to 13 weeks).

People already in this waiting period will be given immediate access to payments.

It is also important that the Coronavirus Supplement will be paid automatically. Current recipients will receive the full $550 on top of their regular payment without asking for it.

Services Australia is putting on an extra 5,000 staff to deal with the inflow of new claimants and accelerating claim process[9].

Australia moves up the ranks

These changes will significantly boost the adequacy of working age social security payments in Australia – at least temporarily.

This chart shows where Australia sat in 2019 compared to other members of the Organisation for Economic Co-operation and Development on replacement rates – the percentage of previous after-tax earnings that an unemployment payment provided to a single unemployed worker who had previously been on two-thirds of the average wage.

Australia is coloured red, and is at the bottom of the pack.

OECD 2019 unemployment income replacement rates

Replacement rate during the second month of unemployment for single worker earning two-thirds of average wage, including housing assistance.

Source: OECD, Net replacement rates in unemployment[10]

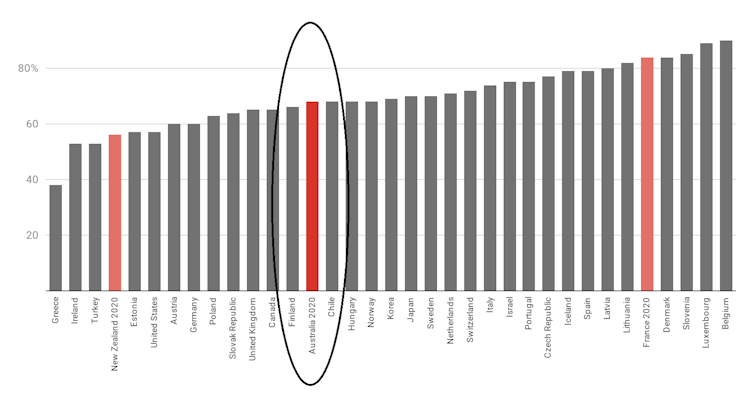

A number of countries[11] have boosted their payments, at least temporarily, in response to the coronavirus.

The chart below shows where Australia and New Zealand and France sit now, compared to the 2019 replacement rates of other countries.

Australia is again coloured red, but has climbed toward the middle of the pack.

OECD unemployment replacement rates and announced increases

Replacement rate during the second month of unemployment for single worker earning two-thirds of average wage, including housing assistance.

Source: OECD, Net replacement rates in unemployment[10]

A number of countries[11] have boosted their payments, at least temporarily, in response to the coronavirus.

The chart below shows where Australia and New Zealand and France sit now, compared to the 2019 replacement rates of other countries.

Australia is again coloured red, but has climbed toward the middle of the pack.

OECD unemployment replacement rates and announced increases

Replacement rate during the second month of unemployment for single worker earning two-thirds of average wage, including housing assistance.

Source: OECD, Net replacement rates in unemployment, government announcements[12]

The charts show that Australia’ short-term earnings replacement rate climbs from 38% to 68%, because the base rate nearly doubles while rent assistance stays the same.

Replacement rates will be lower for higher income workers who lose their jobs and higher for part-time workers and casuals.

It is worth noting that other countries are adopting approaches that differ in where support is being targeted. Denmark, for example, is providing a direct wage supplement to employers of 75% of wages up to a ceiling, on the condition that they do not lay off workers.

Read more:

Coronavirus infecting Australian jobs: vacancy rates down since early February[13]

This is actually less than the current replacement rate of 84% in Denmark, but if it is successful it would effectively mean that Danish workers would continue to receive their normal salary (a 100% “replacement rate”).

It remains to be seen whether that strategy works.

Improvements on delivery

The government has indicated that the stimulus package is “scalable”, meaning that it is possible to increase the amounts even further and to extend their duration.

And the government has already fixed some gaps in its initial plan relating to students and newly arrived residents and temporary visa holders. Permanent residents will be eligible for assistance immediately and not subject to current waiting periods - which can be up to four years.

Without extending benefits to temporary visa holders we would have had what academics Henry Sherrell and Peter Mares[14] warned would be

hundreds of thousands of people who are suddenly unemployed, without access to welfare, and without a method to return to their country of citizenship.

The provisions of the special benefit that will be available to temporary visa holders define[15] severe financial hardship as earning less than the highest special benefit fortnightly payment, being unable to improve that financial position and having limited savings.

There is another group whose status should be clarified urgently - that is people who have applied for permanent residence and are still in that application process. There is a case for treating them as if they had already become permanent residents rather than temporary workers.

The ‘benefit cliff’ remains

A remaining downside with potentially big unintended consequences is the legislated proposal doesn’t yet adjust the spouse income test, excluding many couples where one earner loses their job and leading to a perverse and undesirable “benefit cliff”.

If the recipient’s spouse is working and not receiving a Jobseeker or equivalent payment, then the JobSeeker payment will be reduced by 60 cents for every dollar the partner earns over $994 per fortnight[16].

Read more:

Getting poorer while working harder: The 'cliff effect'[17]

This means that the recipient can receive some JobSeekers Payment – and hence the full $550 per fortnight Coronavirus supplement - until the working partner’s income reaches $1,844 per fortnight. At that point they face the “benefit cliff”[18].

If the working partner has an income of $1840 per fortnight, the recipient gets the full supplement of $550 per fortnight, but if the worker has an income of $1850 a fortnight, the recipient gets nothing. The same cliff faces single people, as well.

But this partner income threshold of $1850 per fortnight ($925/week) is right in the middle of the Australian income distribution.

We calculate that, among two-earner couples aged 25-54, of the primary earners who lose their job, about half will get the Coronavirus Supplement, while of the secondary earners, only somewhere between a quarter and a third will get it.

(These are rough estimates based on Bureau of Statistics income survey estimates of the personal income distributions).

Read more:

Job guarantees, basic income can save us from COVID-19 depression[19]

Given that in most couples the secondary earner is female, the different treatment has the potential to discriminate against women.

One way to eliminate the cliff would be to integrate the Coronavirus Supplement more properly into the income support system, so that people with spouse income above these cutoffs would continue to receive a reduced payment.

The government has asked for power to fix this issue via regulation, but has not yet announced how it will address it.

The scale of the challenge

An extra one million[20] recipients (the treasurer’s estimate) would mean that the share of the working age population receiving income support climbed from 14.2% to 18.7%, an increase of 4.5 percentage points, which is bigger than the 3.5 and 3.8 percentage point increases during Australia’s two previous post-war recessions in the early 1980s and early 1990s.

In both of these earlier recessions, the unemployment rate shot up from under 7% to near 10% or higher within a year. The current increase will take place in the next six months, rather than over a full year.

Not all the effect will directly be in the unemployment rate. Some will be in the non-participation rate as people decide to neither work nor look for work.

The best measure to watch to track the labour market will be the reduction in hours worked.

Read more:

The case for Endgame C: stop almost everything, restart when coronavirus is gone[21]

International experience also suggests that it will be substantial. Service Canada[22] is reported to have received more than 500,000 applications for Employment Insurance in the past week, 20 times the number recorded in the same week a year ago and equivalent to about 2.5% of the labour force. Similar trends have appeared in the United States[23].

In Australia, we are already seeing the payment system struggling under the load of new applications[24].

Ultimately, the key goal of our economic response to the coronavirus must be to share the economic costs.

The government has made an excellent start in the package announced on Sunday and extended on Monday.

But we have to be prepared to ramp it up and expand support so that everyone living in Australia is adequately supported and the burden of the crisis is shared fairly.

Replacement rate during the second month of unemployment for single worker earning two-thirds of average wage, including housing assistance.

Source: OECD, Net replacement rates in unemployment, government announcements[12]

The charts show that Australia’ short-term earnings replacement rate climbs from 38% to 68%, because the base rate nearly doubles while rent assistance stays the same.

Replacement rates will be lower for higher income workers who lose their jobs and higher for part-time workers and casuals.

It is worth noting that other countries are adopting approaches that differ in where support is being targeted. Denmark, for example, is providing a direct wage supplement to employers of 75% of wages up to a ceiling, on the condition that they do not lay off workers.

Read more:

Coronavirus infecting Australian jobs: vacancy rates down since early February[13]

This is actually less than the current replacement rate of 84% in Denmark, but if it is successful it would effectively mean that Danish workers would continue to receive their normal salary (a 100% “replacement rate”).

It remains to be seen whether that strategy works.

Improvements on delivery

The government has indicated that the stimulus package is “scalable”, meaning that it is possible to increase the amounts even further and to extend their duration.

And the government has already fixed some gaps in its initial plan relating to students and newly arrived residents and temporary visa holders. Permanent residents will be eligible for assistance immediately and not subject to current waiting periods - which can be up to four years.

Without extending benefits to temporary visa holders we would have had what academics Henry Sherrell and Peter Mares[14] warned would be

hundreds of thousands of people who are suddenly unemployed, without access to welfare, and without a method to return to their country of citizenship.

The provisions of the special benefit that will be available to temporary visa holders define[15] severe financial hardship as earning less than the highest special benefit fortnightly payment, being unable to improve that financial position and having limited savings.

There is another group whose status should be clarified urgently - that is people who have applied for permanent residence and are still in that application process. There is a case for treating them as if they had already become permanent residents rather than temporary workers.

The ‘benefit cliff’ remains

A remaining downside with potentially big unintended consequences is the legislated proposal doesn’t yet adjust the spouse income test, excluding many couples where one earner loses their job and leading to a perverse and undesirable “benefit cliff”.

If the recipient’s spouse is working and not receiving a Jobseeker or equivalent payment, then the JobSeeker payment will be reduced by 60 cents for every dollar the partner earns over $994 per fortnight[16].

Read more:

Getting poorer while working harder: The 'cliff effect'[17]

This means that the recipient can receive some JobSeekers Payment – and hence the full $550 per fortnight Coronavirus supplement - until the working partner’s income reaches $1,844 per fortnight. At that point they face the “benefit cliff”[18].

If the working partner has an income of $1840 per fortnight, the recipient gets the full supplement of $550 per fortnight, but if the worker has an income of $1850 a fortnight, the recipient gets nothing. The same cliff faces single people, as well.

But this partner income threshold of $1850 per fortnight ($925/week) is right in the middle of the Australian income distribution.

We calculate that, among two-earner couples aged 25-54, of the primary earners who lose their job, about half will get the Coronavirus Supplement, while of the secondary earners, only somewhere between a quarter and a third will get it.

(These are rough estimates based on Bureau of Statistics income survey estimates of the personal income distributions).

Read more:

Job guarantees, basic income can save us from COVID-19 depression[19]

Given that in most couples the secondary earner is female, the different treatment has the potential to discriminate against women.

One way to eliminate the cliff would be to integrate the Coronavirus Supplement more properly into the income support system, so that people with spouse income above these cutoffs would continue to receive a reduced payment.

The government has asked for power to fix this issue via regulation, but has not yet announced how it will address it.

The scale of the challenge

An extra one million[20] recipients (the treasurer’s estimate) would mean that the share of the working age population receiving income support climbed from 14.2% to 18.7%, an increase of 4.5 percentage points, which is bigger than the 3.5 and 3.8 percentage point increases during Australia’s two previous post-war recessions in the early 1980s and early 1990s.

In both of these earlier recessions, the unemployment rate shot up from under 7% to near 10% or higher within a year. The current increase will take place in the next six months, rather than over a full year.

Not all the effect will directly be in the unemployment rate. Some will be in the non-participation rate as people decide to neither work nor look for work.

The best measure to watch to track the labour market will be the reduction in hours worked.

Read more:

The case for Endgame C: stop almost everything, restart when coronavirus is gone[21]

International experience also suggests that it will be substantial. Service Canada[22] is reported to have received more than 500,000 applications for Employment Insurance in the past week, 20 times the number recorded in the same week a year ago and equivalent to about 2.5% of the labour force. Similar trends have appeared in the United States[23].

In Australia, we are already seeing the payment system struggling under the load of new applications[24].

Ultimately, the key goal of our economic response to the coronavirus must be to share the economic costs.

The government has made an excellent start in the package announced on Sunday and extended on Monday.

But we have to be prepared to ramp it up and expand support so that everyone living in Australia is adequately supported and the burden of the crisis is shared fairly.

References

- ^ second (treasury.gov.au)

- ^ amendments (twitter.com)

- ^ Scalable without limit: how the government plans to get coronavirus support into our hands quickly (theconversation.com)

- ^ Coronavirus Supplement (treasury.gov.au)

- ^ amendments (www.smh.com.au)

- ^ full-time students receiving Abstudy, Austudy and Youth Allowance for Students (www.anneruston.com.au)

- ^ reports (www.theaustralian.com.au)

- ^ one million more (www.aph.gov.au)

- ^ accelerating claim process (treasury.gov.au)

- ^ Source: OECD, Net replacement rates in unemployment (stats.oecd.org)

- ^ number of countries (insidestory.org.au)

- ^ Source: OECD, Net replacement rates in unemployment, government announcements (stats.oecd.org)

- ^ Coronavirus infecting Australian jobs: vacancy rates down since early February (theconversation.com)

- ^ Henry Sherrell and Peter Mares (insidestory.org.au)

- ^ define (www.servicesaustralia.gov.au)

- ^ 60 cents for every dollar the partner earns over $994 per fortnight (www.servicesaustralia.gov.au)

- ^ Getting poorer while working harder: The 'cliff effect' (theconversation.com)

- ^ “benefit cliff” (theconversation.com)

- ^ Job guarantees, basic income can save us from COVID-19 depression (theconversation.com)

- ^ one million (www.aph.gov.au)

- ^ The case for Endgame C: stop almost everything, restart when coronavirus is gone (theconversation.com)

- ^ Service Canada (www.bloomberg.com)

- ^ United States (www.theguardian.com)

- ^ the load of new applications (twitter.com)

Authors: Peter Whiteford, Professor, Crawford School of Public Policy, Australian National University