Cutting interest rates is just the start. It's about to become much, much easier to borrow

- Written by Warren Hogan, Industry Professor, University of Technology Sydney

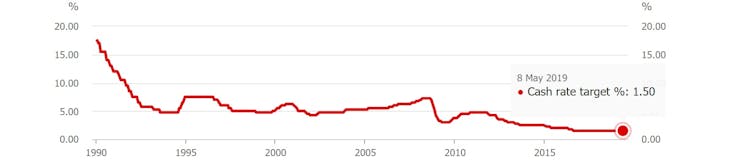

Australia’s lowest ever Reserve Bank cash rate – 1.5% – is about to be consigned to history.

On Tuesday Governor Philip Lowe made it clear he plans to cut it in two weeks’ time. The money market cash rate (from which all other rates derive) will then fall to 1.25%.

After that, if betting in the market is right, he will cut the cash rate to just 1% by Christmas.

Speaking in Brisbane, Lowe said the Reserve Bank board was of the view that[1]:

inflation was likely to remain low relative to the target, and that a decrease in the cash rate would likely be appropriate.

A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target. Given this assessment, at its meeting in two weeks’ time the board would consider the case for lower interest rates.

The bank is forecasting a tick up in economic growth from the present 2.3% to 2.75% by the end of the year and a fairly steady unemployment rate.

But here’s the thing. He was keen to emphasise that those forecasts only applied if he cut rates twice this year – that’s twice, before the end of the year.

Reserve Bank cash rate since 1990

Reserve Bank of Australia[2]

He is planning to do it because the economy is weak, much weaker than his political masters suggested during the election campaign. Consumer spending is “unusually soft”.

Over the past three years, household disposable income has increased at an average rate of just 2¾ per cent. This compares with an average of 6 per cent over the preceding decade.

As this period of weak income growth has persisted, it has become harder for households to dismiss it as just a temporary development – as something that will pass quickly. The lower rate of income growth has also made it harder for households to pay down debt. The end result has been that many people have decided to adjust their spending plans.

The cuts are just the start

It isn’t much good cutting interest rates if mortgage rates don’t follow. That will be up to the banks. But until this week, even if they had passed it on, there would have been so many would-be borrowers it wouldn’t have helped.

That’s because, whatever the interest rate and whatever a would-be borrower’s ability to make payments, banks have generally refused to lend to anyone who couldn’t cope with a rate of 7.25%.

It’s been the doing of the Australian Prudential Regulation Authority – one of the Reserve Bank’s sister organisations. It regulates banks and super funds and other institutions in order to keep the financial system stable.

In December 2014 it directed the institutions it supervises to impose serviceability assessments that incorporated a buffer of at least two percentage points above the loan product rate they were offering and a minimum floor rate of at least 7%[3].

That meant that if new mortgage rates were 5%, as they were at the time, the lenders had to satisfy themselves that the borrower could cope with 7%. As new mortgage rates fell to 4.5% they still had to satisfy themselves that the borrower could cope with 7%.

Banks have needed unreasonably high buffers

APRA’s directive stated that “prudent practice would be to maintain a buffer and floor rate comfortably above these levels”, meaning that in practice most lenders wouldn’t lend to anyone who wasn’t able to cope with the mortgage rate climbing to 7.25%, no matter how unlikely that was becoming.

On Tuesday this week, a few hours before Governor Lowe delivered his speech, it wrote to the institutions again, telling them that[4]

the low interest rate environment is now expected to persist for longer than originally envisaged. This may mean that the gap between actual rates paid and the floor rate may become unnecessarily wide.

It was proposing to remove “reference to a specific 7% floor”.

The required serviceability buffer would climb from 2% to 2.5%, and it would no longer expect lenders to use a rate “comfortably above” that buffer.

Soon, they’ll be able to lend more…

While strictly speaking the letter notified lenders of a one-month consultation period, what it really did was notify them that the changes were about to be implemented.

In recent months most new mortgage rates have been below 4.5%, with some high-quality borrowers able to get rates as low as 3.6%.

The new arrangements will allow banks to assess them on their ability to make payments on a 6% to 7% loan instead of a 7.25% loan.

Should the next two cash rate cuts be passed on, it would allow them to assess lenders on their ability to repay a 5.5% to 6.5% loan.

It would represent a substantial easing of credit standards for new borrowers.

..up to 10% more

My calculations suggest it would increase the borrowing capacity of home buyers by as much as 10%, enough to have a material positive impact on the housing market.

APRA’s move (almost certainly taken in consultation with the Reserve Bank) both makes a cut in the Reserve Banks’s cash rate less imperative and more potent.

As interest rates get lower, further cuts seem to have been losing their ability to get people and businesses spending and borrowing, something the Governor would have been thinking of when he referred in his speech to the “limitations” of relying on just one instrument to boost the economy.

Read more:

Their biggest challenge? Avoiding a recession[5]

It would also be up to the government to provide “additional fiscal support” (which means extra spending or tax cuts) including through spending on infrastructure and “policies that support firms expanding, investing and employing people”.

The first of his rate cuts, due in a fortnight, will have more impact than it would have had APRA not acted.

Or perhaps not as much as he would have hoped if the banks, carrying big costs as a result of the misdeeds uncovered in the royal commission, don’t pass it all on.

Reserve Bank of Australia[2]

He is planning to do it because the economy is weak, much weaker than his political masters suggested during the election campaign. Consumer spending is “unusually soft”.

Over the past three years, household disposable income has increased at an average rate of just 2¾ per cent. This compares with an average of 6 per cent over the preceding decade.

As this period of weak income growth has persisted, it has become harder for households to dismiss it as just a temporary development – as something that will pass quickly. The lower rate of income growth has also made it harder for households to pay down debt. The end result has been that many people have decided to adjust their spending plans.

The cuts are just the start

It isn’t much good cutting interest rates if mortgage rates don’t follow. That will be up to the banks. But until this week, even if they had passed it on, there would have been so many would-be borrowers it wouldn’t have helped.

That’s because, whatever the interest rate and whatever a would-be borrower’s ability to make payments, banks have generally refused to lend to anyone who couldn’t cope with a rate of 7.25%.

It’s been the doing of the Australian Prudential Regulation Authority – one of the Reserve Bank’s sister organisations. It regulates banks and super funds and other institutions in order to keep the financial system stable.

In December 2014 it directed the institutions it supervises to impose serviceability assessments that incorporated a buffer of at least two percentage points above the loan product rate they were offering and a minimum floor rate of at least 7%[3].

That meant that if new mortgage rates were 5%, as they were at the time, the lenders had to satisfy themselves that the borrower could cope with 7%. As new mortgage rates fell to 4.5% they still had to satisfy themselves that the borrower could cope with 7%.

Banks have needed unreasonably high buffers

APRA’s directive stated that “prudent practice would be to maintain a buffer and floor rate comfortably above these levels”, meaning that in practice most lenders wouldn’t lend to anyone who wasn’t able to cope with the mortgage rate climbing to 7.25%, no matter how unlikely that was becoming.

On Tuesday this week, a few hours before Governor Lowe delivered his speech, it wrote to the institutions again, telling them that[4]

the low interest rate environment is now expected to persist for longer than originally envisaged. This may mean that the gap between actual rates paid and the floor rate may become unnecessarily wide.

It was proposing to remove “reference to a specific 7% floor”.

The required serviceability buffer would climb from 2% to 2.5%, and it would no longer expect lenders to use a rate “comfortably above” that buffer.

Soon, they’ll be able to lend more…

While strictly speaking the letter notified lenders of a one-month consultation period, what it really did was notify them that the changes were about to be implemented.

In recent months most new mortgage rates have been below 4.5%, with some high-quality borrowers able to get rates as low as 3.6%.

The new arrangements will allow banks to assess them on their ability to make payments on a 6% to 7% loan instead of a 7.25% loan.

Should the next two cash rate cuts be passed on, it would allow them to assess lenders on their ability to repay a 5.5% to 6.5% loan.

It would represent a substantial easing of credit standards for new borrowers.

..up to 10% more

My calculations suggest it would increase the borrowing capacity of home buyers by as much as 10%, enough to have a material positive impact on the housing market.

APRA’s move (almost certainly taken in consultation with the Reserve Bank) both makes a cut in the Reserve Banks’s cash rate less imperative and more potent.

As interest rates get lower, further cuts seem to have been losing their ability to get people and businesses spending and borrowing, something the Governor would have been thinking of when he referred in his speech to the “limitations” of relying on just one instrument to boost the economy.

Read more:

Their biggest challenge? Avoiding a recession[5]

It would also be up to the government to provide “additional fiscal support” (which means extra spending or tax cuts) including through spending on infrastructure and “policies that support firms expanding, investing and employing people”.

The first of his rate cuts, due in a fortnight, will have more impact than it would have had APRA not acted.

Or perhaps not as much as he would have hoped if the banks, carrying big costs as a result of the misdeeds uncovered in the royal commission, don’t pass it all on.

References

- ^ was of the view that (www.rba.gov.au)

- ^ Reserve Bank of Australia (www.rba.gov.au)

- ^ at least 7% (www.apra.gov.au)

- ^ telling them that (www.apra.gov.au)

- ^ Their biggest challenge? Avoiding a recession (theconversation.com)

Authors: Warren Hogan, Industry Professor, University of Technology Sydney