The budget's dirty secret is the hikes in tax rates you're not meant to know about

- Written by Steven Hamilton, Assistant professor, George Washington University

As I mentioned a few days ago, Treasurer Josh Frydenberg and Prime Minister Scott Morrison recycled three pretty big tax ideas[1] in the 2019 budget, each one originally from the 2018 budget but supercharged, and in one case doubled.

The ideas were:

eventually eliminating the 37% bracket to make the tax system flatter;

upsizing the Low and Middle Income Tax Offset to A$1080; and

increasing the value of business investments that may be written off.

Today I’ll deal with the second: the Low and Middle Income Tax Offset, also known as the LMITO or lamington[2].

In last year’s budget it was to be worth up to $530 per person, but this year the government intends to more than double that to $1,080[3]. And they’d do so retrospectively, so that by the time people put in their 2019 tax returns, many will get a tax cut more than twice as big[4] as originally expected.

(As it happens, the operative word is “intends”. In budget week Morrison said the Tax Office would be able to make the changes “administratively[5]” without the need for legislation. He didn’t have time to introduce the leglislation and Labor would broadly support it. Last week in its official pre-election overview of the government’s finances, the public service said no[6]. It would need “the relevant legislation to be passed before the increase to the Low and Middle Income Tax Offset can be provided for the 2018-19 financial year”.)

The idea of the lamington

But let’s examine the idea of the lamington anyway because it does have bipartisan support and will become law and part of the tax scales. On one hand, it will deliver a welcome boost to taxpayers on middle and low (but not the lowest) incomes. On the other hand, it will push up a key marginal tax rate and kill incentives in a way the Treasurer hasn’t yet acknowledged.

The offset is a gift of $530 (soon to be $1080) slipped into the tax returns of everyone who earns between $48,000 and $90,000.

People earning more than $90,000 will get less of the offset as their income climbs, up to an income of $125,000 when it the offset will vanish. Low earners will get $200 (soon to be $255), climbing to the maximum of $530 ($1080) as their income climbs from $37,000 to $48,000. People with an income too low to pay tax won’t have any tax to offset, and so will get nothing.

Described in dollar terms as I just have, it’s easy to understand. You can work out the tax cut you’ll get, and the Coaltion has helpfully prepared tables to let you see[7].

But it is possible to describe the changes in another way, not in dollar terms, but as a new set of marginal rates. And this is where they get interesting, and unattractive.

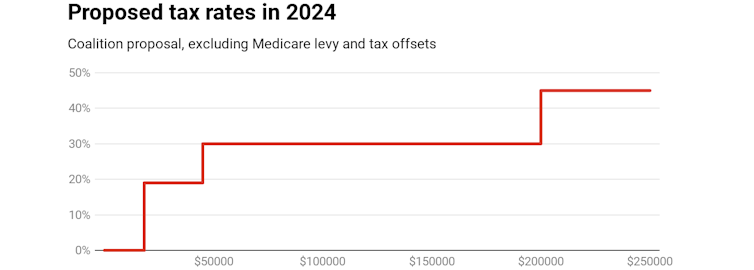

As a longer-term goal, the Coalition says it wants most taxpayers to pay the same unchanging marginal rate of 30% for all incomes between $45,000 and $200,000. It believes that high marginal rates and frequently changing marginal rates sap incentive.

By 2024 it wants the tax scale to look like this:

Commonwealth budget papers[8]

Frydenberg says the lower, flatter scale would incentivise “people to stay in work, to work longer, to work more”.

So you would think he wouldn’t want to make it bumpy, or lift the marginal rate, which is exactly what his LMITO does.

What the lamington does to those rates

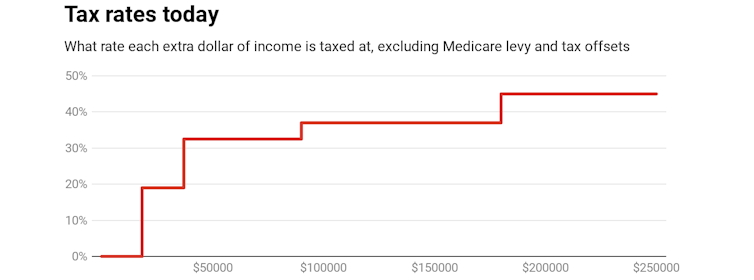

You won’t find the following chart anywhere in the budget papers, but it is what the offsets in this budget and in the last one will do to the tax scale for the next four years before they are replaced by the flatter scale.

First, here’s what we are told the rates look like today:

Commonwealth budget papers[8]

Frydenberg says the lower, flatter scale would incentivise “people to stay in work, to work longer, to work more”.

So you would think he wouldn’t want to make it bumpy, or lift the marginal rate, which is exactly what his LMITO does.

What the lamington does to those rates

You won’t find the following chart anywhere in the budget papers, but it is what the offsets in this budget and in the last one will do to the tax scale for the next four years before they are replaced by the flatter scale.

First, here’s what we are told the rates look like today:

Australian Tax Office[9]

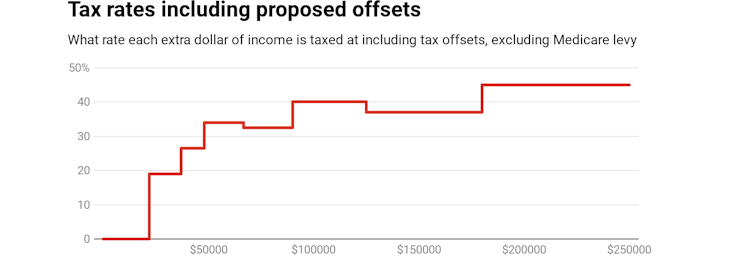

Now, here’s what they will actually be when you take account of the existing Low Income Tax Offset (or LITO) and the promised supersized Low and Middle Income Tax Offset (LMITO) in the budget.

Australian Tax Office[9]

Now, here’s what they will actually be when you take account of the existing Low Income Tax Offset (or LITO) and the promised supersized Low and Middle Income Tax Offset (LMITO) in the budget.

Derived from Commonwealth Budget Paper 2, 2019[10]

The graph is lumpy in part because the LMITO is clawed back at the impressive rate of 3 cents for each extra dollar earned between $90,000 and $125,000.

This means it adds 3 cents to the marginal tax rate in that range, pushing it up from 37 cents to a high 40 cents, before at higher incomes it falls back to 37 for taxpayers earning more than $125,000.

Bizarrely, it means the party that has pledged to abolish the 37% rate because it saps incentive has decided to first boost it to 40% over a substantial range of incomes.

The graph is lumpy further down the income scale for another reason: as the LMITO climbs between $37,000 and $48,000, the separate LITO is is clawed back.

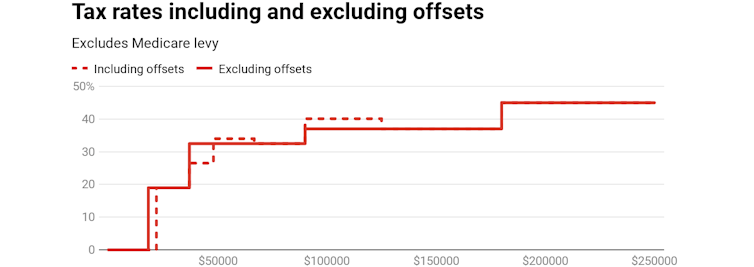

Below are the “including offsets” and “excluding offsets” scales together, to enable you to see the differences. The tax rates people will face are those including offsets.

Derived from Commonwealth Budget Paper 2, 2019[10]

The graph is lumpy in part because the LMITO is clawed back at the impressive rate of 3 cents for each extra dollar earned between $90,000 and $125,000.

This means it adds 3 cents to the marginal tax rate in that range, pushing it up from 37 cents to a high 40 cents, before at higher incomes it falls back to 37 for taxpayers earning more than $125,000.

Bizarrely, it means the party that has pledged to abolish the 37% rate because it saps incentive has decided to first boost it to 40% over a substantial range of incomes.

The graph is lumpy further down the income scale for another reason: as the LMITO climbs between $37,000 and $48,000, the separate LITO is is clawed back.

Below are the “including offsets” and “excluding offsets” scales together, to enable you to see the differences. The tax rates people will face are those including offsets.

Derived from Commonwealth Budget Paper 2, 2019[11]

The graph clarifies the trade-off at the heart of the lamington: it targets tax relief at low and middle earners at the necessary cost of higher rates further up the income scale.

How much of a problem is it? Well, that depends.

It’s a classic example of what economists call the equity-efficiency trade-off.

Arthur Okun, an adviser to US President Lyndon Johnson, described it thusly: redistributing income is like transporting water from one place to another in a leaky bucket[12] – you can do it, but you’d better be prepared to lose some water as you ae doing it.

In much the same way, you can restrict tax cuts to low earners, but that means high earners have to face higher marginal rates which to some degree will shrink economic activity.

The critical question is how much it will shrink economic activity, how leaky is the bucket?

Read more:

Mothers have little to show for extra days of work under new tax changes[13]

It worsens incentives for the roughly 700,000 Australians earning between $90,000 and $125,000. For every additional dollar each of them earns, the government will take away an extra 3 cents. That might not sound like much, but the evidence suggests it will have an effect.

How? Well, the tax rate increase lowers the benefit of generating additional taxable income. And there are a range of ways to avoid generating additional taxable income. The most obvious is working fewer hours, for example by not working overtime or by working fewer days per week. Secondary earners (often women returning to work after maternity leave) are particularly prone to that kind of response.

But it also could mean not going for promotions or pay rises where they take effort, for example by not gaining extra skills or not putting in additional work effort. And, as I found in a recent study[14], it could involve claiming more deductions to put a brake on your taxable income.

What will the lamington cost us?

Relying on data for the Australian tax system, I find that a 3 percentage point increase in the marginal tax rate results in an average reduction in taxable incomes of around 0.6%. For someone earning $125,000 per year, that amounts to a reduction in taxable income of $750 per year, by any of the means described above or others.

If we assume the average affected person earns in the middle of the relevant range, that implies an aggregate reduction in taxable income of almost half a billion dollars a year from the 3 percentage point tax increase. That means around $300 million less in consumption and saving and around $200 million less in income tax revenue, all because of LMITO.

That half a billion per year is the real, measurable, and unavoidable cost of targeting the Coalition’s tax break. When economists talk about “distortions” or “deadweight losses” created by tax increases, that’s what they mean. It is the cost of fairness. Whether that cost is worth paying is an open question. The government has evidently decided that it is. And now we can decide at the ballot box, ideally armed with proper information.

But it is of concern that the presentation of the policy – while politically attractive – obscures the genuine increases in marginal tax rates the Coalition’s changes will bring about, and thereby their real economic costs.

Eliminating most offsets and concessions, as recommended by the Henry Tax Review in 2010[15], would do the tax system good. And it do all of us good by making it easier to see what we are being asked to vote for come election time.

Read more:

A simpler tax system should spark joy. Sadly, the one in this budget doesn’t[16]

Derived from Commonwealth Budget Paper 2, 2019[11]

The graph clarifies the trade-off at the heart of the lamington: it targets tax relief at low and middle earners at the necessary cost of higher rates further up the income scale.

How much of a problem is it? Well, that depends.

It’s a classic example of what economists call the equity-efficiency trade-off.

Arthur Okun, an adviser to US President Lyndon Johnson, described it thusly: redistributing income is like transporting water from one place to another in a leaky bucket[12] – you can do it, but you’d better be prepared to lose some water as you ae doing it.

In much the same way, you can restrict tax cuts to low earners, but that means high earners have to face higher marginal rates which to some degree will shrink economic activity.

The critical question is how much it will shrink economic activity, how leaky is the bucket?

Read more:

Mothers have little to show for extra days of work under new tax changes[13]

It worsens incentives for the roughly 700,000 Australians earning between $90,000 and $125,000. For every additional dollar each of them earns, the government will take away an extra 3 cents. That might not sound like much, but the evidence suggests it will have an effect.

How? Well, the tax rate increase lowers the benefit of generating additional taxable income. And there are a range of ways to avoid generating additional taxable income. The most obvious is working fewer hours, for example by not working overtime or by working fewer days per week. Secondary earners (often women returning to work after maternity leave) are particularly prone to that kind of response.

But it also could mean not going for promotions or pay rises where they take effort, for example by not gaining extra skills or not putting in additional work effort. And, as I found in a recent study[14], it could involve claiming more deductions to put a brake on your taxable income.

What will the lamington cost us?

Relying on data for the Australian tax system, I find that a 3 percentage point increase in the marginal tax rate results in an average reduction in taxable incomes of around 0.6%. For someone earning $125,000 per year, that amounts to a reduction in taxable income of $750 per year, by any of the means described above or others.

If we assume the average affected person earns in the middle of the relevant range, that implies an aggregate reduction in taxable income of almost half a billion dollars a year from the 3 percentage point tax increase. That means around $300 million less in consumption and saving and around $200 million less in income tax revenue, all because of LMITO.

That half a billion per year is the real, measurable, and unavoidable cost of targeting the Coalition’s tax break. When economists talk about “distortions” or “deadweight losses” created by tax increases, that’s what they mean. It is the cost of fairness. Whether that cost is worth paying is an open question. The government has evidently decided that it is. And now we can decide at the ballot box, ideally armed with proper information.

But it is of concern that the presentation of the policy – while politically attractive – obscures the genuine increases in marginal tax rates the Coalition’s changes will bring about, and thereby their real economic costs.

Eliminating most offsets and concessions, as recommended by the Henry Tax Review in 2010[15], would do the tax system good. And it do all of us good by making it easier to see what we are being asked to vote for come election time.

Read more:

A simpler tax system should spark joy. Sadly, the one in this budget doesn’t[16]

References

- ^ three pretty big tax ideas (theconversation.com)

- ^ lamington (theconversation.com)

- ^ $1,080 (budget.gov.au)

- ^ twice as big (theconversation.com)

- ^ administratively (thenewdaily.com.au)

- ^ said no (theconversation.com)

- ^ tables to let you see (budget.gov.au)

- ^ Commonwealth budget papers (budget.gov.au)

- ^ Australian Tax Office (www.ato.gov.au)

- ^ Derived from Commonwealth Budget Paper 2, 2019 (www.budget.gov.au)

- ^ Derived from Commonwealth Budget Paper 2, 2019 (www.budget.gov.au)

- ^ leaky bucket (bre.is)

- ^ Mothers have little to show for extra days of work under new tax changes (theconversation.com)

- ^ recent study (static1.squarespace.com)

- ^ recommended by the Henry Tax Review in 2010 (taxreview.treasury.gov.au)

- ^ A simpler tax system should spark joy. Sadly, the one in this budget doesn’t (theconversation.com)

Authors: Steven Hamilton, Assistant professor, George Washington University