What would it take to get Australians to buy electric cars? Canberra provides a guide

- Written by Yogi Vidyattama, Associate Professor, National Centre for Social and Economic Modelling, University of Canberra

Only 5,532[1] of the 101,233 new cars sold in Australia last month were all-electric.

While that number is an improvement on previous months, it is tiny[2] compared to the 25% to 85% of new cars sold that are all-electric in European nations such as Germany, the Netherlands, Denmark and Norway.

A lot has been written about why that is[3], but less about what an individual state or territory can do to improve it, in the absence of help from the federal government.

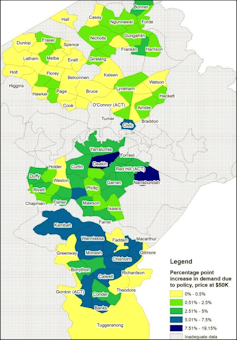

Our team at the National Centre for Social and Economic Modelling, University of Canberra[4] has examined what the Australian Capital Territory[5] (ACT) is doing, and what effect this is having on electric vehicle take-up by price and type of household.

The ACT offers three incentives[6]

a full exemption from stamp duty on purchase

two years free registration

a zero-interest loan of up to A$15,000 for eligible households[7]

We used Australian Bureau of Statistics census and household expenditure data as well as microsimulations based on a survey of vehicle preferences to examine behaviour before and after the changes.

We simulated the decision to buy electric based on a total cost of ownership, which included the value of the vehicle as well as operational costs including petrol, service and repair.

Incentives matter

Our modelling found that with a stamp duty exemption, at an electric vehicle price of A$50,000, around 9%[8] of new vehicles sold would be electric in five years.

The proportion climbs to 11% with zero-interest loan and free registration added.

But even after five years, the proportion of total cars on ACT roads that were electric would be small: just 1.6% with just the stamp duty exemption, and 2.0% with the other measures as well.

This result is much higher than the latest-known proportion of electric vehicles in the ACT, which in 2019 was 0.1%. Nationally, only 23,000[9] (0.011%) of the 20.1 million vehicles registered are electric.

Prices matter

At a much-lower electric vehicle price of $25,000, an extraordinary 23%[10] of new vehicles sold after five years would be electric, provided they were stamp duty exempt.

If there was also a zero-interest loan of $15,000, the proportion would increase to 27%, and with two years free registration as well, to $30%.

As a proportion of the entire car fleet in the ACT, the figures would be 4.1%, 4.8% and 5.3% respectively, depending on those price, loan and registration factors. That would mean much larger demand than at present, but still small enough to mean the infrastructure for maintaining conventional vehicles would be needed for some time.

Income matters

We found that high income households are far more likely to replace their cars within five years and far more likely to switch electric even without incentives – and that for them, the incentives didn’t make much difference.