Proptech disruptor unlocks cash for business growth

With an estimated $7 billion tied up in bank guarantees, eGuarantee’s mission is to disrupt the commercial leasing sector and bring a more equitable balance to the tenant-landlord relationship, unlocking value for both parties.

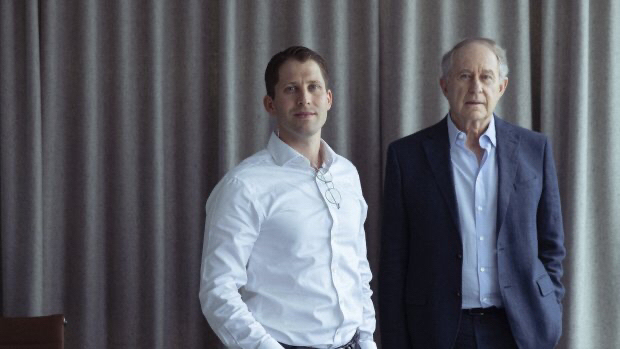

eGuarantee Co-Founder and CEO, Shaun Sergay says the opportunity is clear and the solution is powerful, especially at a time when both business and the economy is relying on access to cash to recover and grow.

“Lease bonds, popular in European and American markets, challenge the status quo in Australia, presenting financial and operational benefits to tenants and landlords. Lease bonds are the cheapest form of non-collateralised credit, sitting on average at five percent less than an unsecured bank overdraft. But the game changer for tenants lies in the ability to redirect a sizable amount of money secured with a bank back into the business,” he said.

“Where bank guarantees require up-front cash or collateral, the company’s lease bond doesn’t. We issue bonds from $20,000 up to $7.5 million, switching to a lease bond can provide businesses with a significant cash flow advantage and can help landlords ease the lease security burden for their tenants and assist in making their tenants more robust through access to increased working capital. With tenants achieving a rate of return on the business’ working capital, greater than the bond fee, making the switch brings a really clear business advantage.”

“Commercial leasing is an industry ripe for innovation, and lease bonds provide an intuitive and efficient digital experience. While bank guarantees can have tenants waiting up to six weeks, lease bonds draw upon an advanced proptech platform to process within 20 minutes, making it one of the most efficient ways to get capital back into businesses to drive growth and profit,” he said.

The local arm of global corporate advisory consultancy, Morrow Sodali recently accessed a lease bond using eGuarantee for its new Pitt Street office. For Managing Director (APAC), Angus Booth the impact was ‘significant to their business growth’, and he believes they’ll be reaping the benefits for a long time to come.

“We recognised that the COVID-19 pandemic offered a unique opportunity to enhance the skillset of our people by hiring great new talent while our competitors were making staff redundant. The lease bond allowed us to unlock $500,000 of working capital which we have invested back into the business and our people to facilitate growth. This contributed to a number of initiatives which have resulted in us more than doubling the headcount in our ESG advisory team, supporting our expansion into new markets such as Seoul, Hong Kong and Japan and making enhancements to our technology platforms, overall improving our ability to meet the evolving needs of our clients in the APAC region,” said Mr Booth.

“Our landlord, Charter Hall, provided the flexibility and support to use the lease bond, and we’re grateful to partner with a landlord who sees the significant and material benefits which will positively impact our business and allow us to grow within their portfolio over time,” concluded Mr Booth.

Co-founder and Executive Chairman of eGuarantee, Cedric Fuchs, a real estate and insurance industry veteran who co-founded property investment giant Charter Hall, believes that lease bonds will revolutionise the leasing landscape.

“It’s the first and only alternative which presents benefits for both tenants and landlords, and brings real value, releasing tenants from traditional bank guarantees, while introducing operational efficiencies by digitising the customer journey, doing away with paper-based processes. eGuarantee operate as exclusive distributor to Assetinsure’s Lease Bond product. Assetinsure, the largest specialist surety provider in Australia, is an APRA regulated entity and operates as agent on behalf of capacity backed by a panel of globally rated AA/A- reinsurers.”

“The way we emerge from this pandemic will be key to our future prosperity and growth. Our first of its kind lease bond offering provides businesses with quick access to existing funds that can help them to get back on their feet, support growth strategies, and empower positive leasing relationships with landlords.”

“The ability to unlock capital currently held up in bank guarantees, presents enormous opportunities for businesses while having the potential to reinvest billions into the Australian economy. With Australia expecting to see a contraction in our next quarter GDP reading, encouraging capital spending will be a critical component in our post-lockdown exit strategy,” said Mr Fuchs.

We’ve also assisted many tenants to convert their bank guarantees mid-lease to lease bonds, which has led to several major landlords initiating deeper discussions around lease bonds and the eGuarantee system adoption.

Mr Fuchs also makes the point of the many advantages for landlords, including the digitisation of landlord portfolios of bank guarantees, agnostic of bank, to provide a full digital experience.

Reference - *OnDeck Australia research

Find out more: https://www.eguarantee.com.au/