China's economic interest in the Pacific comes with strings attached

- Written by John Garrick, Senior Lecturer, Business Law, Charles Darwin University

China’s economic expansion into the Pacific Islands region raises critical questions for both the islands and Australia. What happens if infrastructure loans by Chinese banks and authorised state enterprises to vulnerable Pacific Island nations cannot be repaid? What consequences of default can be anticipated? Are there military dimensions?

The Pentagon has warned of the “potential military advantages”[1] flowing from Chinese investments in other countries. China rejects this assertion. But if it does ever want access to foreign ports to support naval deployments in distant waters, it is laying the ground work to get it.

Belt and Road moves on the Pacific Islands

China’s grand plan to more closely link countries across Eurasia and the Indian Ocean through trade deals and infrastructure projects is known as the Silk Road Economic Belt and 21st Century Maritime Silk Road (“Belt and Road”). The plan includes Pacific pathways.

CC BY-ND[2]

Read more:

The Belt and Road Initiative: China's vision for globalisation, Beijing-style[3]

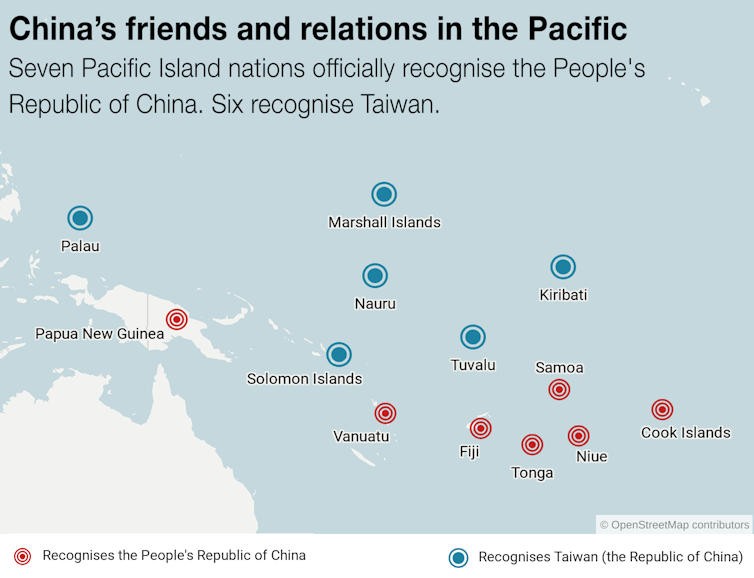

Along with Australia and New Zealand, seven Pacific Islands nations officially recognise the People’s Republic of China (PRC). Another six recognise the Republic of China (Taiwan). China’s strategy is both to counter Taiwan’s influence and further its own interests. It wants Pacific nations to support it in international forums. Vanuatu, for example, was the first country to support China’s claims to island territory in the South China Sea disputed with the Philippines.

CC BY-ND[2]

Read more:

The Belt and Road Initiative: China's vision for globalisation, Beijing-style[3]

Along with Australia and New Zealand, seven Pacific Islands nations officially recognise the People’s Republic of China (PRC). Another six recognise the Republic of China (Taiwan). China’s strategy is both to counter Taiwan’s influence and further its own interests. It wants Pacific nations to support it in international forums. Vanuatu, for example, was the first country to support China’s claims to island territory in the South China Sea disputed with the Philippines.

CC BY-ND[4]

The number of Chinese companies operating in the Pacific region has greatly increased since Xi Jinping came to power in 2012. Trade between China and Pacific Island nations has ballooned to more A$10 billion[5].

While its influence is still not as great as that of the US or even Australia, China’s growing investments cover mines, hydro-electricity projects, fishing, timber, real estate and services. Over the past decade it has also lavished the region with $US1.8 billion ($A2.4 billion) in foreign aid, including $US175,000 worth of quad bikes[6] for Cook Island parliamentarians.

The soft power of money

China argues Chinese investment is “tactful” – that it helps developing nations build needed infrastructure with “no-strings-attached”. It contrasts this to Western aid models that require governance measures and other performance indicators to be in place in relation to aid funding.

But the credit Chinese state banks are extending to impoverished developing nations also looks a lot like a form of “debt colonialism”. The fear is that China is using the loans as leverage to expand its military footprint.

Read more:

Why China's 'debt-book diplomacy' in the Pacific shouldn't ring alarm bells just yet[7]

The Chinese loans typically offer a period of grace before an interest rate of 2-3% over 15-20 years is imposed. In Tonga, for example, China deferred loan repayments for a period after the International Monetary Fund warned[8] it was at risk of debt distress. Repayments started again in 2018, reportedly at a higher rate than before.

Sri Lankan lessons

If Tonga and other Pacific Island nations default, China can enforce contractual conditions[9] as a pretext to advancing wider strategic aims.

This is precisely what happened in Sri Lanka.

The Sri Lankan government had high hopes for the Hambantota Port Development Project, built by China Harbour Engineering Company, one of Beijing’s largest state-owned enterprises, and mostly funded by the state-owned Export–Import Bank of China. When the port failed to generate anticipated revenues, the government ended up owing China at least $US3 billion with no means to pay.

The Chinese then demanded a Chinese company take a dominant equity share in the port. The Sri Lankan government was also forced of hand over 15,000 acres of land[10] around the port for 99 years.

Now China owns an Indian Ocean port strategically placed on one of the busiest shipping routes in the world.

Pacific interests

China has clear military interests in the Pacific. In 2014 Xi Jinping personally visited Fiji[11] to sign memorandums of understanding including for greater military cooperation.

Australian intelligence sources allege China has been secretly negotiating to build a military base in Vanuatu[12]. Both nations deny this. Such a base would give China a foothold for operations to coerce Australia and outflank the US and its base on Guam.

China’s “soft power” is being better resourced to influence foreign nations.

Its moves in the Pacific means the geopolitics of the region are hardening up.

Read more:

Fears about China's influence are a rerun of attitudes to Japan 80 years ago[13]

Globally, China’s rise has profound implications for international law and trade.

China naturally prefers bilateral relationships to leverage its power and advance its interests. It has steered away from multilateral dispute resolution, especially since the South China Sea arbitration, which ruled unanimously in favour of the Philippines. It has simply ignored the verdict and gone ahead turning the disputed rocky shoals into military outposts.

If China can ignore the legitimate claims of the Philippines, it can ignore the rights of the smaller and more fragile Pacific Island nations. Its actions flag its challenge to the international order Australia has long championed – one based on rule of law and political and economic liberalism.

Its influence is unlikely to promote democratic principles. Those holding those principles dear need to help the Pacific Island nations resist the lure of soft-power “incentives” promised with no strings attached.

There are definitely strings attached.

CC BY-ND[4]

The number of Chinese companies operating in the Pacific region has greatly increased since Xi Jinping came to power in 2012. Trade between China and Pacific Island nations has ballooned to more A$10 billion[5].

While its influence is still not as great as that of the US or even Australia, China’s growing investments cover mines, hydro-electricity projects, fishing, timber, real estate and services. Over the past decade it has also lavished the region with $US1.8 billion ($A2.4 billion) in foreign aid, including $US175,000 worth of quad bikes[6] for Cook Island parliamentarians.

The soft power of money

China argues Chinese investment is “tactful” – that it helps developing nations build needed infrastructure with “no-strings-attached”. It contrasts this to Western aid models that require governance measures and other performance indicators to be in place in relation to aid funding.

But the credit Chinese state banks are extending to impoverished developing nations also looks a lot like a form of “debt colonialism”. The fear is that China is using the loans as leverage to expand its military footprint.

Read more:

Why China's 'debt-book diplomacy' in the Pacific shouldn't ring alarm bells just yet[7]

The Chinese loans typically offer a period of grace before an interest rate of 2-3% over 15-20 years is imposed. In Tonga, for example, China deferred loan repayments for a period after the International Monetary Fund warned[8] it was at risk of debt distress. Repayments started again in 2018, reportedly at a higher rate than before.

Sri Lankan lessons

If Tonga and other Pacific Island nations default, China can enforce contractual conditions[9] as a pretext to advancing wider strategic aims.

This is precisely what happened in Sri Lanka.

The Sri Lankan government had high hopes for the Hambantota Port Development Project, built by China Harbour Engineering Company, one of Beijing’s largest state-owned enterprises, and mostly funded by the state-owned Export–Import Bank of China. When the port failed to generate anticipated revenues, the government ended up owing China at least $US3 billion with no means to pay.

The Chinese then demanded a Chinese company take a dominant equity share in the port. The Sri Lankan government was also forced of hand over 15,000 acres of land[10] around the port for 99 years.

Now China owns an Indian Ocean port strategically placed on one of the busiest shipping routes in the world.

Pacific interests

China has clear military interests in the Pacific. In 2014 Xi Jinping personally visited Fiji[11] to sign memorandums of understanding including for greater military cooperation.

Australian intelligence sources allege China has been secretly negotiating to build a military base in Vanuatu[12]. Both nations deny this. Such a base would give China a foothold for operations to coerce Australia and outflank the US and its base on Guam.

China’s “soft power” is being better resourced to influence foreign nations.

Its moves in the Pacific means the geopolitics of the region are hardening up.

Read more:

Fears about China's influence are a rerun of attitudes to Japan 80 years ago[13]

Globally, China’s rise has profound implications for international law and trade.

China naturally prefers bilateral relationships to leverage its power and advance its interests. It has steered away from multilateral dispute resolution, especially since the South China Sea arbitration, which ruled unanimously in favour of the Philippines. It has simply ignored the verdict and gone ahead turning the disputed rocky shoals into military outposts.

If China can ignore the legitimate claims of the Philippines, it can ignore the rights of the smaller and more fragile Pacific Island nations. Its actions flag its challenge to the international order Australia has long championed – one based on rule of law and political and economic liberalism.

Its influence is unlikely to promote democratic principles. Those holding those principles dear need to help the Pacific Island nations resist the lure of soft-power “incentives” promised with no strings attached.

There are definitely strings attached.

References

- ^ “potential military advantages” (news.usni.org)

- ^ CC BY-ND (creativecommons.org)

- ^ The Belt and Road Initiative: China's vision for globalisation, Beijing-style (theconversation.com)

- ^ CC BY-ND (creativecommons.org)

- ^ to more A$10 billion (www.abc.net.au)

- ^ $US175,000 worth of quad bikes (www.abc.net.au)

- ^ Why China's 'debt-book diplomacy' in the Pacific shouldn't ring alarm bells just yet (theconversation.com)

- ^ International Monetary Fund warned (www.imf.org)

- ^ can enforce contractual conditions (www.thetimes.co.uk)

- ^ 15,000 acres of land (www.nytimes.com)

- ^ Xi Jinping personally visited Fiji (www.abc.net.au)

- ^ a military base in Vanuatu (www.smh.com.au)

- ^ Fears about China's influence are a rerun of attitudes to Japan 80 years ago (theconversation.com)

Authors: John Garrick, Senior Lecturer, Business Law, Charles Darwin University