How to improve the appeal of franchising for women

- Written by Park Thaichon, Lecturer and Cluster Leader, Relationship Marketing for Impact Research Cluster, Griffith University

The franchise model should represent a business model of choice for women. The format has a lower risk profile, as it offers a level of perceived reassurance that the concept has been tested in the marketplace. It also minimises some of the historical disadvantages women face when entering self-employment.

Yet contrary to the stereotype of women being risk-averse, our research[1] has found many are willing to take risks in business and embrace innovation.

Read more: Senior female bankers don't conform to stereotypes and are just as ready to take risks[2]

We identified another factor that might limit women’s uptake of franchising opportunities. Many remained unaware of key benefits such as support from government and franchisors, which includes initial investment and working capital.

This matters for both the franchising sector and the broader economy. Entrepreneurs are considered a major source of economic growth, and more and more of them are women[3].

Yet a number of factors often constrain women’s choices in business. These include lack of business experience, lack of access to capital and formal and informal business networks, and the need to balance work and family commitments. In fact, women founded only about 25% of start-ups[4] in Australia in 2017.

Risk-taking propensity

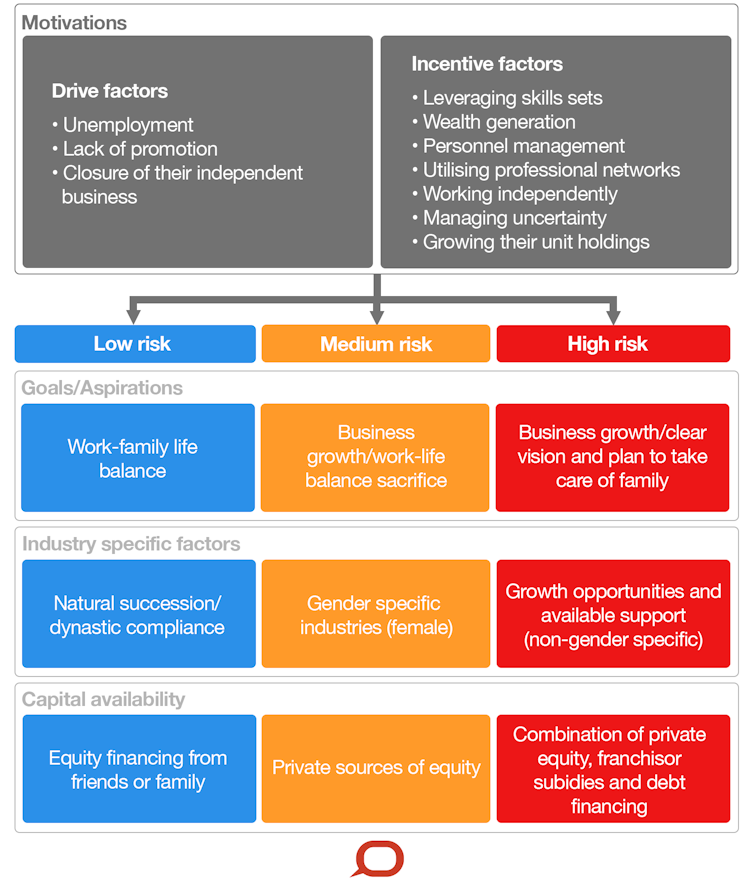

Our research explored the effects of different risk-taking levels among women on their likelihood of adopting a franchise business model. The chart below illustrates influences on the identified risk-taking groups – low, medium and high risk propensity.

Based on Thaichon, P., Weaven, S., Quach, S., Bodey, K., Merrilees, B., & Frazer, L. (2018). Female franchisees; a lost opportunity for franchising sector growth?, Journal of Strategic Marketing, 1-16./The Conversation, CC BY-SA[5]

“Push” influences are external factors stemming from an individual’s lack of control in their working environment. “Pull” influences are internal motivations based on the need to take control of one’s working life. Other factors include work-family life balance, industry sector characteristics and capital availability.

The impacts of these factors on decision-making vary with the three risk categories.

Low risk-taking propensity

“Push” factors are more dominant among women with a low risk-taking propensity. Most of these women go into franchising because of a lack of employment choice and difficulties in finding work.

These women favour business options that reflect minimal risk. Work-family life balance is extremely important to them.

In addition, low-risk female franchisees prefer known industries and those that are less financially intensive. They tend to have difficulty in obtaining finance from third-party sources. Instead, they seek equity financing from family and friends.

Medium risk-taking propensity

Women in the medium-risk group tend to enter franchising in response to a combination of “push” and “pull” motivations. They appear to see becoming self-employed as a way to gain greater control in their working lives and bolster individual prosperity.

Work-life balance, while still important, is less of a concern for this group.

Despite many studies suggesting women select business opportunities to achieve greater work-life balance, our study suggests this may take a back seat as the demands of the business grow. By definition, most medium-sized franchise systems require substantially greater financial, physical and mental inputs from owners than those considered low risk. This further erodes work–life balance and has impacts on desired lifestyle and family outcomes.

Medium-risk-taking women generally sought a combination of private equity and debt or external financial sources to start their franchise.

High risk-taking propensity

Typically, internal motivations most strongly influence high-risk-taking women to go into the franchise business. This is markedly different from the other two groups.

An intrinsic desire to leverage their knowledge and skills to provide job certainty and grow personal wealth “pulls” high-risk-taking individuals towards franchising. Though not totally neglecting work-life balance, the external benefits from working hard likely compensate for reduced family contact or flexibility among these franchisees.

High-risk-taking women franchise owners tend to value innovation. They are willing to enter unfamiliar industries in which they have less direct experience.

These women, like the medium-risk cohort, were also proficient in financing operations from a combination of equity and debt sources as well as government grants and franchisor-provided assistance.

Read more:

What's going wrong with Australia's franchises?[6]

So what does this mean for the sector?

Individual characteristics as well as one’s willingness to take risks appear to influence a woman’s likelihood of engaging in self-employment. But understanding the risk-taking propensities of female franchisees may help franchisors recruit this valuable business segment.

Although entrepreneurship research has suggested women have lower self-confidence or self-efficacy and higher risk aversion than men, we found many women have a medium to high propensity to take risks in business operations. The high-risk group also embraced innovation, in contrast to traditional views of franchisees as “reproducers” not “innovators”. This represents a solid departure from limiting gender stereotypes.

A majority of female franchisees appear to know about the main benefits of franchising. These relate mainly to initial and ongoing training and support, prominent branding, and opportunities to work within a proven business system.

However, many remained unaware of key benefits such as assistance from governments and franchisors. In fact, many hadn’t known that franchisors provided investment and working capital support. This knowledge might have changed the size of their initial investment and encouraged them to enter franchising earlier.

This suggests franchisors need to overcome this lack of information. Marketing campaigns explaining relevant franchise opportunities may increase participation by women.

Read more:

It really pays for franchisees to do their due diligence – here's how[7]

Based on Thaichon, P., Weaven, S., Quach, S., Bodey, K., Merrilees, B., & Frazer, L. (2018). Female franchisees; a lost opportunity for franchising sector growth?, Journal of Strategic Marketing, 1-16./The Conversation, CC BY-SA[5]

“Push” influences are external factors stemming from an individual’s lack of control in their working environment. “Pull” influences are internal motivations based on the need to take control of one’s working life. Other factors include work-family life balance, industry sector characteristics and capital availability.

The impacts of these factors on decision-making vary with the three risk categories.

Low risk-taking propensity

“Push” factors are more dominant among women with a low risk-taking propensity. Most of these women go into franchising because of a lack of employment choice and difficulties in finding work.

These women favour business options that reflect minimal risk. Work-family life balance is extremely important to them.

In addition, low-risk female franchisees prefer known industries and those that are less financially intensive. They tend to have difficulty in obtaining finance from third-party sources. Instead, they seek equity financing from family and friends.

Medium risk-taking propensity

Women in the medium-risk group tend to enter franchising in response to a combination of “push” and “pull” motivations. They appear to see becoming self-employed as a way to gain greater control in their working lives and bolster individual prosperity.

Work-life balance, while still important, is less of a concern for this group.

Despite many studies suggesting women select business opportunities to achieve greater work-life balance, our study suggests this may take a back seat as the demands of the business grow. By definition, most medium-sized franchise systems require substantially greater financial, physical and mental inputs from owners than those considered low risk. This further erodes work–life balance and has impacts on desired lifestyle and family outcomes.

Medium-risk-taking women generally sought a combination of private equity and debt or external financial sources to start their franchise.

High risk-taking propensity

Typically, internal motivations most strongly influence high-risk-taking women to go into the franchise business. This is markedly different from the other two groups.

An intrinsic desire to leverage their knowledge and skills to provide job certainty and grow personal wealth “pulls” high-risk-taking individuals towards franchising. Though not totally neglecting work-life balance, the external benefits from working hard likely compensate for reduced family contact or flexibility among these franchisees.

High-risk-taking women franchise owners tend to value innovation. They are willing to enter unfamiliar industries in which they have less direct experience.

These women, like the medium-risk cohort, were also proficient in financing operations from a combination of equity and debt sources as well as government grants and franchisor-provided assistance.

Read more:

What's going wrong with Australia's franchises?[6]

So what does this mean for the sector?

Individual characteristics as well as one’s willingness to take risks appear to influence a woman’s likelihood of engaging in self-employment. But understanding the risk-taking propensities of female franchisees may help franchisors recruit this valuable business segment.

Although entrepreneurship research has suggested women have lower self-confidence or self-efficacy and higher risk aversion than men, we found many women have a medium to high propensity to take risks in business operations. The high-risk group also embraced innovation, in contrast to traditional views of franchisees as “reproducers” not “innovators”. This represents a solid departure from limiting gender stereotypes.

A majority of female franchisees appear to know about the main benefits of franchising. These relate mainly to initial and ongoing training and support, prominent branding, and opportunities to work within a proven business system.

However, many remained unaware of key benefits such as assistance from governments and franchisors. In fact, many hadn’t known that franchisors provided investment and working capital support. This knowledge might have changed the size of their initial investment and encouraged them to enter franchising earlier.

This suggests franchisors need to overcome this lack of information. Marketing campaigns explaining relevant franchise opportunities may increase participation by women.

Read more:

It really pays for franchisees to do their due diligence – here's how[7]

References

- ^ our research (www.tandfonline.com)

- ^ Senior female bankers don't conform to stereotypes and are just as ready to take risks (theconversation.com)

- ^ more and more of them are women (www.afr.com)

- ^ women founded only about 25% of start-ups (www.startupmuster.com)

- ^ CC BY-SA (creativecommons.org)

- ^ What's going wrong with Australia's franchises? (theconversation.com)

- ^ It really pays for franchisees to do their due diligence – here's how (theconversation.com)

Authors: Park Thaichon, Lecturer and Cluster Leader, Relationship Marketing for Impact Research Cluster, Griffith University

Read more http://theconversation.com/how-to-improve-the-appeal-of-franchising-for-women-100167