6 essential reads about digital money and the promise of blockchain

- Written by Eric Smalley, Science + Technology Editor

Super Bowl 2022 was dubbed Crypto Bowl[1] even before the game was played because of the advertising blitz cryptocurrency companies unleashed during the annual televised spectacle. The ads, featuring a bevy of celebrities and gimmicks[2], aimed to convince viewers that cryptocurrencies are the wave of the future.

Preying on FOMO – that is, the fear of missing out – is a classic technique of both advertisers and scam artists, so you would be forgiven for being leery of the cryptocurrency hype[3]. But the story is more complicated than just the latest speculation craze.

Here are six stories from our archive to help you understand how cryptocurrencies work, and the bigger picture of how blockchain is setting the stage for a future in which technology, rather than institutions, guarantees ownership and fosters trust.

1. Digital money

The first question cryptocurrencies prompt is how strings of digital bits that aren’t merely placeholders for national currencies or precious metals can be real money. Who says who owns which pieces of virtual currency, and who determines what the currency is worth? The answer is no one and everyone.

“A bitcoin is as ownable as dollars are when they are deposited in a bank. Skipping the stage of physical, fungible currencies, bitcoins exist by virtue of their representations in a ledger in cyberspace[4],” writes the University at Buffalo’s David Koepsell[5].

“What bitcoin owners own is the debt, just as those who own money in banks own debts that are recorded in bits. They do not own the bits that comprise the information representing that debt, nor the information itself, they own the social object – the money – that those bits represent.”

Read more: Rise of cryptocurrencies like bitcoin begs question: what is money?[6]

This Super Bowl ad delivered a FOMO message: If you’re timid about cryptocurrencies you’ll lose out.2. Under the hood: Blockchain explained

The technology that makes cryptocurrencies possible is blockchain[7], a distributed digital ledger. In short, it’s a form of record keeping in which each record is spread across many computers and encrypted in a way that prevents it from being altered. Everyone can see a record but no one can change it.

“The bitcoin blockchain contains a record of every transaction in the system since its birth. This feature makes it possible to prevent account holders from reneging on transactions, even if their identities remain anonymous. Once in the ledger, a transaction is undeniable,” write Ari Juels[8] and Ittay Eyal[9].

“Blockchains can be enhanced to support not just transactions, but also pieces of code known as smart contracts,” they write. “A smart contract may be viewed as playing the role of a trusted third party: Whatever task it is programmed to do, it will carry out faithfully.”

This capability opens up a wide range of possibilities for organizing life in the digital realm. As enticing as the Super Bowl ads made cryptocurrencies seem, broader uses of blockchain are arguably more significant.

Read more: Blockchains: Focusing on bitcoin misses the real revolution in digital trust[10]

3. Beyond money, part 1: Financial services

Transferring money from party A to party B is just one simple type of financial transaction. Blockchain can be used for all sorts of financial services, including loans, derivatives and insurance. This capability is dubbed decentralized finance[11], or DeFi.

In traditional financial services, everything depends on a financial institution, writes Kevin Werbach[12]. “DeFi turns this arrangement on its head by re-conceiving of financial services as decentralized software applications that operate without ever taking custody of user funds.”

There are also downsides to DeFi. “Even highly mature, highly regulated traditional financial markets experience shocks and crashes because of hidden risks, as the world saw in 2008 when the global economy nearly melted down because of one obscure corner of Wall Street. DeFi makes it easier than ever to create hidden interconnections that have the potential to blow up spectacularly,” he writes.

Read more: What is decentralized finance? An expert on bitcoins and blockchains explains the risks and rewards of DeFi[13]

4. Beyond money, part 2: Art

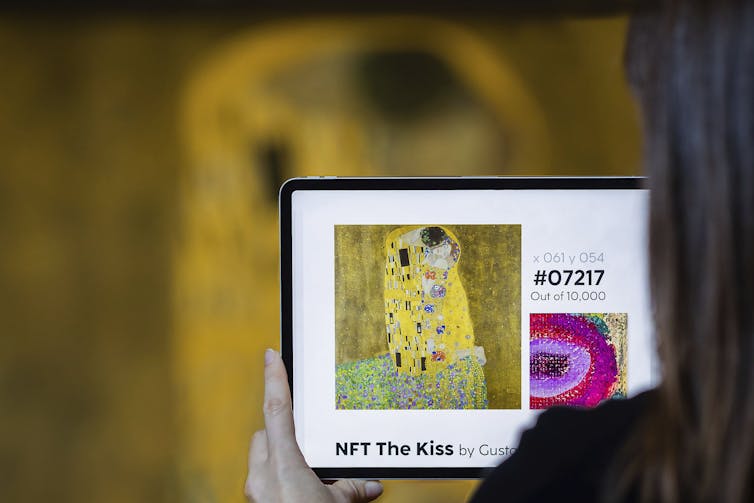

Things get interesting when you create a unique token on a blockchain and attach the token to a digital file – anything from a photo to an audio recording. The result is a file that can be uniquely identified no matter how many copies of it are made, and ownership of the file can be verified. These are nonfungible tokens[14], or NFTs, and they are making it easier for artists to make money from digital works[15] – and providing another vehicle for financial speculation.

“NFTs are frequently used to sell a wide range of virtual collectibles, including NBA virtual trading cards, music, digital images, video clips and even virtual real estate in Decentraland, a virtual world,” writes Arizona State University’s Dragan Boscovic[17].

“The NFT market is likely to grow further because any piece of digital information can easily be ‘minted’ into an NFT, a highly efficient way of managing and securing digital assets.”

Read more: How nonfungible tokens work and where they get their value – a cryptocurrency expert explains NFTs[18]

5. Beyond money, part 3: Organizations

In addition to mediating financial transactions, smart contracts can be used to set up and run organizations. Decentralized autonomous organizations[19], or DAOs, use the contracts to allow participants to weigh in on decisions and automate organizational functions, writes Sean Stein Smith[20].

“In most, if not all, instances of for-profit DAOs – or even DAOs organized for a specific one-time purpose, such as attempting to purchase an original copy of the U.S. Constitution[21] – cash or appreciated property that is contributed to the organization is exchanged for governance tokens. The tokens essentially represent a fractional form of collective ownership,” he writes.

Read more: Cryptocurrency-funded groups called DAOs are becoming charities – here are some issues to watch[22]

6. Beyond money, part 4: The metaverse

You could view the metaverse as the mother of all distributed autonomous organizations. The metaverse is a concept defining an interconnected set of virtual environments that could be a future iteration of the internet. Blockchain is what will make the interconnection possible[23].

“As people move between virtual worlds – say from Decentraland’s virtual environments to Microsoft’s – they’ll want to bring their stuff with them. If two virtual worlds are interoperable, the blockchain will authenticate proof of ownership of your digital goods in both virtual worlds,” write Michigan State University’s Rabindra Ratan[24] and Dar Meshi[25].

Blockchain could even manage how people behave in the metaverse by making it possible to assign denizens reputation scores. “If you act like a toxic misinformation-spreading troll, you may damage your reputation and potentially have your sphere of influence reduced by the system. This could create an incentive for people to behave well in the metaverse,” they write.

Read more: The metaverse is money and crypto is king – why you'll be on a blockchain when you're virtual-world hopping[26]

Editor’s note: This story is a roundup of articles from The Conversation’s archives.

References

- ^ Crypto Bowl (fortune.com)

- ^ featuring a bevy of celebrities and gimmicks (gizmodo.com)

- ^ cryptocurrency hype (www.theguardian.com)

- ^ representations in a ledger in cyberspace (theconversation.com)

- ^ David Koepsell (scholar.google.com)

- ^ Rise of cryptocurrencies like bitcoin begs question: what is money? (theconversation.com)

- ^ blockchain (theconversation.com)

- ^ Ari Juels (scholar.google.com)

- ^ Ittay Eyal (scholar.google.com)

- ^ Blockchains: Focusing on bitcoin misses the real revolution in digital trust (theconversation.com)

- ^ decentralized finance (theconversation.com)

- ^ Kevin Werbach (scholar.google.com)

- ^ What is decentralized finance? An expert on bitcoins and blockchains explains the risks and rewards of DeFi (theconversation.com)

- ^ nonfungible tokens (theconversation.com)

- ^ to make money from digital works (www.nbcnews.com)

- ^ Ouriel Morgensztern/Austria's Galerie Belvedere/news aktuell via AP Images (newsroom.ap.org)

- ^ Dragan Boscovic (scholar.google.com)

- ^ How nonfungible tokens work and where they get their value – a cryptocurrency expert explains NFTs (theconversation.com)

- ^ Decentralized autonomous organizations (theconversation.com)

- ^ Sean Stein Smith (scholar.google.com)

- ^ attempting to purchase an original copy of the U.S. Constitution (www.theverge.com)

- ^ Cryptocurrency-funded groups called DAOs are becoming charities – here are some issues to watch (theconversation.com)

- ^ make the interconnection possible (theconversation.com)

- ^ Rabindra Ratan (scholar.google.com)

- ^ Dar Meshi (scholar.google.com)

- ^ The metaverse is money and crypto is king – why you'll be on a blockchain when you're virtual-world hopping (theconversation.com)