Inflation has affected the UK, US and Europe differently – here's what this means for interest rates

- Written by Pietro Galeone, Research fellow, Bocconi University

The Bank of England’s governor has repeatedly warned[1] that it will not cut UK interest rates any time soon[2], even with a recent sharp fall in consumer price inflation.

Like central banks in the US and eurozone, the bank has been sharply increasing its base rate to try to tame a spike in inflation. But this has increased the interest people must pay on loans like mortgages, as well as businesses’ financing costs, leading to an economic slowdown[3].

Inflation has roared back around the world over the past two years after many years of “low-flation”. A period of slow consumer price growth since the mid-2010s had left central banks struggling for ways to stimulate economic activity. But how they have tackled inflation since have diverged in line with the specific issues and items driving price growth in each economy. Understanding these differences could shed light on the likely direction of interest rates in the coming months.

When COVID hit and lockdown measures stopped the economy altogether, price pressures fell even more than they had during the low-flation period. Some inflation gauges even turned negative. The world’s major central banks used more monetary stimulus to keep their economies afloat. The eurozone implemented the pandemic emergency purchase programme (PEPP[4]), while the UK[5] and the US[6] came up with similar measures.

The COVID recession also had a particularly pronounced effect on energy prices – US oil prices even went negative[7] for a few days in March 2020.

But this shock was temporary. As lockdowns eased throughout the western world in the second half of 2020 and into 2021, the economy jumped back quickly. This happened faster and to a greater extent than anyone had anticipated thanks to the stimulus programmes countries enacted.

Diverging fortunes

Of course, since every country didn’t experience this snapback at the same time, global supply chains could not keep up. Production in some countries was still in lockdown, while in others factories were ramping up production as people in recovering countries were starting to buy again. Orders became backlogged and shipments were queued.

These bottlenecks[8] led to shortages and price hikes for many goods – from cars[9] to phones[10] to over-the-counter pain meds and baby formula[11].

Energy prices also shot up again. Crude oil prices reached pre-pandemic levels by the end of 2020[12] and surpassed them throughout 2021. So even before the Russian invasion of Ukraine in February 2022, energy prices and the reopening of the economy were pushing inflation up.

Read more: Russia–Ukraine war has nearly doubled household energy costs worldwide – new study[13]

The outbreak of the war in Ukraine gave energy prices another jolt, of course – especially natural gas in Europe. This led central banks to argue[14] they were fighting global cost-push inflation. This means external factors were pushing up the prices of key goods, leaving central banks with little control.

But a closer look at the figures shows that the inflation stories in the three major economies of the US, UK and eurozone had already started to diverge at this point. Since then, they have become even more different.

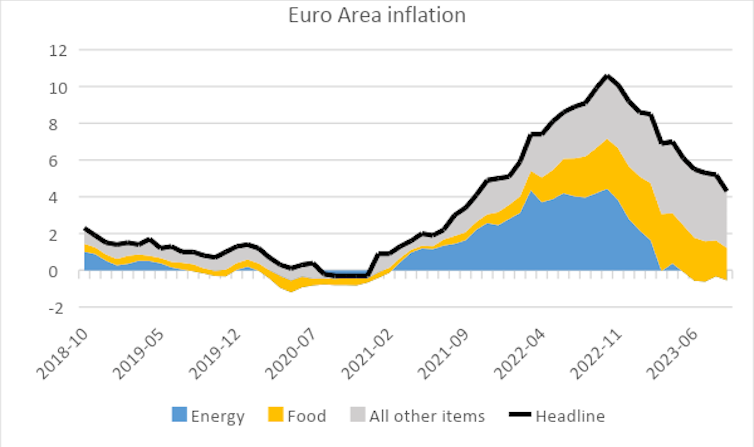

In all three, inflation peaked at close to 10% in the second half of 2022, but the drivers differed. The following charts show the major contributors to overall consumer price inflation in each of these regions were energy, food and then services and other goods.

In the eurozone, inflation was mostly due to higher energy and, later, food prices: