Why central banks should stop raising interest rates

- Written by Muhammad Ali Nasir, Associate Professor in Economics, University of Leeds

Mortgage borrowers breathed a sign of relief following a recent pause[1] in the Bank of England’s 14-month campaign of base rate hikes.

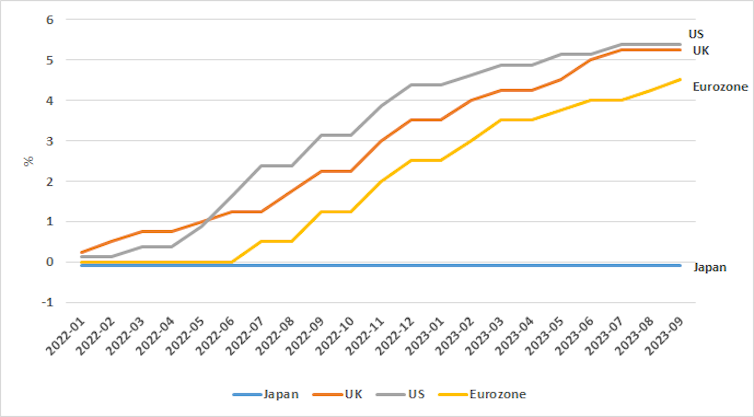

Led by the US Federal Reserve, many of the world’s major central banks[2], including the European Central Bank[3] (ECB) and the Bank of England[4], have been hiking their main rates of interest for more than a year in a bid to slow rapid price inflation[5].

Rising rates

While the ECB increased rates at its September 2023 meeting, the Bank of England has again followed the Fed’s latest decision[7] to pause.

There are two more opportunities[8] for a UK rise before the end of the year and financial markets are expecting[9] rates to go from 5.25% to 5.5%. But the outlook for inflation, recession and the labour market – not to mention how the Fed’s rate changes can affect other economies – indicates that, if rates aren’t cut, the current pause should at least last longer than a couple of months.

The ECB’s latest decision[10] to increase its key interest rate by 0.25% was made despite its expectation that Eurozone inflation will continue to fall. The region faces a unique challenge, however.

Although overall inflation is 5.2%, there is a huge gap between its members – from Spain (2.4%) to Slovakia (9.6%). Differences in inflation and growth indicate incomplete integration[11] of the region, which does not make the ECB’s job of balancing the economy simple.

In other parts of the world, particularly East Asia, inflation has come down very sharply and is expected to remain low. While UK inflation is higher than in the US, Eurozone and Japan, it is also on a downward trajectory[12].

Read more: How the Bank of England's interest rate hikes are filtering through to your finances[13]

Mortgage rates are already high and could stay that way[14], bankruptcies are spiking[15] and there is a very weak[16] economic outlook. The Bank of England will need to tread carefully to ensure that attempts to lower inflation further do not stall the economy[17].

The Fed has the most space to relax monetary policy because the US has experienced a sharper decline in inflation. It is now almost level with Japan, which didn’t even rise interest rates.

Inflation rates are slowing

After the Fed’s last decision in July, its chairman Jerome Powell indicated that US interest rates, which are currently at a 22-year high, would remain high for some time, explaining[19] that “we need to see that inflation is durably down” and that “core inflation is still pretty elevated”.

While “durably down” is a vague measure, core inflation[20] (the change in the price of a basket of goods and services, excluding items prone to price spikes such as energy) has come down significantly[21] in the US. It was well below headline inflation (the overall rate for everything measured by the consumer price index) for most of the last two years.

Core inflation usually moves slower than the more volatile headline rate. But an important point that’s been absent from recent rate discussions is the influence of headline inflation on core inflation. Core and headline inflation tend to converge[22] over time, which implies that when the headline rate decreases it will eventually drag on core inflation, causing overall inflation to slow.

As last year’s high energy prices[23] drop out of yearly inflation calculations, headline and core rates should dip further in most countries, including the UK. And the good news for the UK is that its core inflation is already coming down[24] – even faster, in fact, than the headline rate.

Wage watch and recession outlook

Another reason for central bank caution about further monetary tightening is the weakening labour market outlook. In the US, wage growth has slowed[25] significantly and job vacancies have declined[26]. The latter means that companies will have less need to use high wages to attract candidates. Meanwhile, lower wage growth leaves people with less money to spend, helping to slow price inflation.

In the UK, real wages have barely left negative territory[27]. Since the beginning of last year, wages were contracting in real terms as inflation remained a lot higher than pay increases.

In both cases, this also implies that the much-feared wage-price[28] spiral hasn’t happened.

Of course, using rate rises to slow inflation is a difficult balancing act: hike too much and central banks choke the economy altogether. This is what the US Fed shall be worried about following the appearance of “yield curve inversion[29]” in US bonds.

This is when there is a surge in demand for long-term government bonds versus short-term. An inversion is thought to indicate[30] an upcoming recession because it shows investors are worried about the economy.

Read more: Fed hopes for ‘soft landing’ for the US economy, but history suggests it won’t be able to prevent a recession[31]

This is probably why the Fed hasn’t pressed ahead with further tightening at this time. The UK is now seeing similar signs, with economic growth expressed as monthly real GDP[32] estimated to have fallen by 0.5% in July 2023.

Following the Fed’s lead

Fed decisions have global consequences. Research shows its monetary policy decisions have spillover effects[34] on the rest of the world in terms of the impact of a rate rise on exchange rates and the long-term cost of borrowing.

If the Bank of England, the ECB and other central banks overreact to these spillover effects on their own economies, they may over-tighten monetary policy (that is, raise rates too high) and trigger a recession.

Central banks seem to have been in a race to the top when it comes to rate rises. The US has been setting the pace so it might be time for Fed-led tightening cycle to stop because elevated interest rates are not helping the global economy.

References

- ^ a recent pause (www.bbc.co.uk)

- ^ major central banks (www.bis.org)

- ^ European Central Bank (www.ecb.europa.eu)

- ^ Bank of England (www.bankofengland.co.uk)

- ^ rapid price inflation (data.oecd.org)

- ^ Bank for International Settlements (BIS) (www.bis.org)

- ^ the Fed’s latest decision (www.reuters.com)

- ^ two more opportunities (www.bankofengland.co.uk)

- ^ financial markets are expecting (www.bankofengland.co.uk)

- ^ ECB’s latest decision (www.ecb.europa.eu)

- ^ incomplete integration (link.springer.com)

- ^ on a downward trajectory (www.ons.gov.uk)

- ^ How the Bank of England's interest rate hikes are filtering through to your finances (theconversation.com)

- ^ and could stay that way (theconversation.com)

- ^ spiking (theconversation.com)

- ^ very weak (www.ons.gov.uk)

- ^ stall the economy (www.theguardian.com)

- ^ OECD (data.oecd.org)

- ^ remain high for some time, explaining (www.youtube.com)

- ^ core inflation (www.investopedia.com)

- ^ has come down significantly (www.whitehouse.gov)

- ^ tend to converge (www.frbsf.org)

- ^ high energy prices (fred.stlouisfed.org)

- ^ is already coming down (www.ons.gov.uk)

- ^ slowed (www.atlantafed.org)

- ^ declined (fred.stlouisfed.org)

- ^ barely left negative territory (www.ons.gov.uk)

- ^ wage-price (www.bis.org)

- ^ inversion (www.bloomberg.com)

- ^ indicate (www.reuters.com)

- ^ Fed hopes for ‘soft landing’ for the US economy, but history suggests it won’t be able to prevent a recession (theconversation.com)

- ^ monthly real GDP (www.ons.gov.uk)

- ^ William Barton/Shutterstock (www.shutterstock.com)

- ^ spillover effects (www.federalreserve.gov)

Read more https://theconversation.com/why-central-banks-should-stop-raising-interest-rates-213916