are we witnessing the end of Erdoğanomics?

- Written by Cem Soner, Doctoral Researcher in Finance, Bangor University

Is the tide finally turning for Turkey? Three months after the re-election of Recep Tayyip Erdoğan for his third term as president, which many feared[1] would lead to economic chaos, ratings agency Moody’s has indicated[2] that Turkey’s credit rating is on course for an upgrade.

Since the election, Erdoğan has installed[3] a new economic team with a commitment to reintroduce conventional monetary policies after years of a more singular approach. This has yielded some early positive results, with June recording the first current account surplus[4] in 18 months – meaning more money came into the country than went out (mostly due to tourism and lower energy imports).

Meanwhile, Turkey’s stock market[5] has been attracting surging interest from foreign investors, and the cost of insuring[6] against the risk of the government defaulting on its debts has sharply declined. So what’s going on?

The mess

When Erdoğan won the May election, contrary to the opinion polls[7], it extended his tenure as prime minister and then president to almost 20 years. This five-year term is likely to be his last, due to his deteriorating health and constitutional constraints. Thanks to the economic debacle that he created himself, it is also likely to be his most challenging.

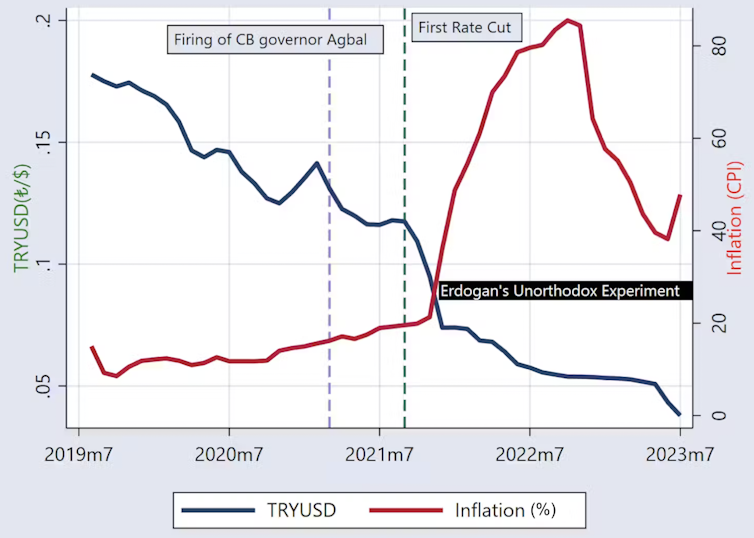

There are two pillars to Erdoğanomics: the “unorthodox” view that high interest rates cause inflation rather than the other way around, and a fixation on keeping rates as low as possible. It became much easier for him to implement after becoming executive president in 2018[8], which gave him much more power.

Central bank governors who have disagreed with Erdoğan’s agenda have been[9] shown the door, most notably Naci Ağbal, who was sacked in March in 2021 after only four months in office. It was the next governor, Şahap Kavcıoğlu, a former MP in the ruling party and columnist in a pro-Erdoğan newspaper, who put Erdoğanomics into overdrive. Turkey experimented with aggressively cutting rates at a time when inflation was already close to 20% and most central banks were tightening.

Official inflation skyrocketed to over 80% and the lira plummeted[10], forcing the central bank to sell substantial foreign exchange reserves[11] to try and shore up the currency. The current account deficit widened to a record level[12] in January and the earthquake[13] in February further worsened the situation.

Turkish inflation and the falling lira

Read more https://theconversation.com/turkey-are-we-witnessing-the-end-of-erdoganomics-211535