how interest rates helped trigger its collapse and what central bankers should do next

- Written by Charles Read, Fellow in Economics and History at Corpus Christi College, University of Cambridge

A former prime minister of Britain, Harold Wilson, is famous for remarking that a week is a long time in politics[1]. But in the world of finance, it seems everything can change in just two days.

Only 48 hours elapsed between a statement from US-based Silicon Valley Bank (SVB)[2] on March 8 that it was seeking to raise US$2.5 billion (£2 billion) to repair a hole in its balance sheet, and the announcement by US regulator the Federal Deposit Insurance Corporation that the bank had collapsed[3].

At its peak in 2021, SVB was worth US$44 billion[4] and managed over $200 billion in assets. America’s 16th largest deposit-taking institution just a week ago, it has now become the second biggest banking failure in US history. Only the collapse of Washington Mutual[5] during the 2008 global financial crisis was larger.

Although SVB had been ailing for some time, the speed of its collapse took nearly all commentators – as well as its customers, mostly from the tech sector – by surprise. Tech firms around the world have their cash locked up in SVB deposits and were concerned about how they would pay their workers and their bills until government support was announced in the US[6], alongside HSBC’s deal to buy SVB’s UK arm[7].

And it looks like the run on SVB that heralded its collapse – by some metrics the fastest in history – is spreading to other institutions with similar characteristics. On March 12, two days after SVB’s collapse, regulators in New York closed Signature Bank, citing systemic risk[8].

But was what happened to SVB unpredictable, unpreventable and unavoidable? My research suggests not. My latest book about the history of financial crises[9], Calming the Storms: the Carry Trade, the Banking School and British Financial Crises Since 1825, was coincidentally launched the day before SVB failed and describes three situations in which a banking crisis may unfold.

Why SVB collapsed

One potential cause is when changes in interest rates between countries cause movements in capital flows to suddenly start or stop as investors chase better rates. This affects the availability of finance. This is what happened during the 2007 credit crunch that preceded the global financial crisis, but it wasn’t behind SVB’s collapse.

SVB’s failure does tie in with the other two situations I describe in my book.

The first is when interest rates rise rapidly. The cause may be a central bank reacting to a surge of inflation[10], a war[11] or a tight labour market[12]. Indeed, the Federal Reserve, alongside other central banks, has raised rates[13] from a band of 0.25%-0.5% to 4.5%-4.75% over the past 12 months.

Higher rates tighten credit conditions. This makes it harder for financial institutions to finance themselves, while also damaging the value of their existing loans and assets.

Read more: Inflation, unemployment, the housing crisis and a possible recession: Two economists forecast what's ahead in 2023[14]

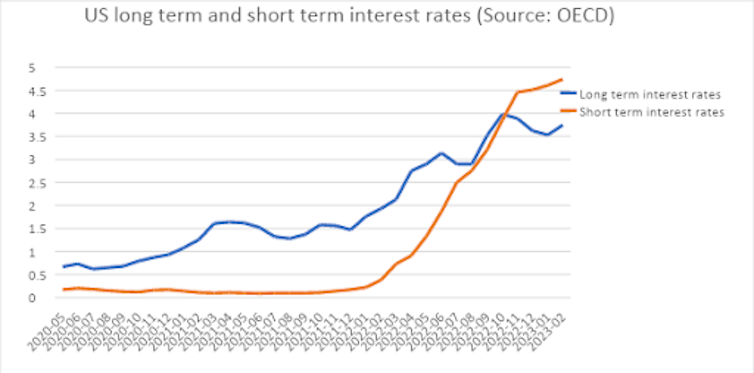

The second is when short-term interest rates rise above long-term rates, as has happened in America over the past few months. During the pandemic, tech startups with spare cash from funding rounds in a world of easy money placed their deposits with SVB. With little demand for loans from this sector, SVB invested most of the money in long-term bonds – mostly mortgage-backed securities and US Treasuries.

In short, SVB was taking funds mainly on short-term deposit and tying them up in long-term investments. Then, over the past few months, short-term rates rose higher than the returns on longer-dated bonds (see chart below). This is because interest rates were soaring, thanks to the Fed’s rate hikes.

US interest rate changes

References

- ^ a week is a long time in politics (en.wiktionary.org)

- ^ a statement from US-based Silicon Valley Bank (SVB) (ir.svb.com)

- ^ the bank had collapsed (www.fdic.gov)

- ^ SVB was worth US$44 billion (www.ft.com)

- ^ the collapse of Washington Mutual (www.reuters.com)

- ^ government support was announced in the US (www.cbsnews.com)

- ^ HSBC’s deal to buy SVB’s UK arm (www.bbc.co.uk)

- ^ citing systemic risk (www.fdic.gov)

- ^ book about the history of financial crises (link.springer.com)

- ^ a surge of inflation (www.bbc.co.uk)

- ^ war (theconversation.com)

- ^ tight labour market (www.aljazeera.com)

- ^ raised rates (www.cnbc.com)

- ^ Inflation, unemployment, the housing crisis and a possible recession: Two economists forecast what's ahead in 2023 (theconversation.com)

- ^ Author provided from OECD data (www.oecd-ilibrary.org)

- ^ dependence on one sector (www.theguardian.com)

- ^ have made the global economy fragile (theconversation.com)

- ^ to quote another past UK prime minister, Harold Macmillan (www.oxfordreference.com)