There's a vital way to reduce it that everyone overlooks – raise productivity

- Written by David McMillan, Professor in Finance, University of Stirling

Inflation has become one of the great issues of our times. The UK’s is the highest in the G7, weighing in at 9% a year[1] according to the most recent figures on consumer price inflation.

When you look at the other common measure for prices, retail price inflation[2], which adds mortgage rates into the equation and is also calculated a little differently, it is even higher at 11%. This is important because RPI is used for raising prices across a range of items, from train tickets and mobile phone contracts to student loans.

The question of why inflation is so high is well rehearsed. The initial impetus came from greater demand, but it is being further fuelled by supply issues.

What caused high inflation

On the demand side, quantitative easing (QE) during the pandemic – in which central banks “created money” to help prop up the economy – has increased the amount of money in the system by over 20%[3].

When lockdown ended, this helped to ensure that there was pent-up demand for goods and services: retail sales[4] rose by over 20% year on year in May 2021, for instance, and hit another peak of nearly 10% in January 2022. At the same time, demand from firms helped to drive huge price increases in key industrial commodities such as copper[5] and steel[6]. Also, oil prices[7] rose by approximately 67% in 2021 and another 20% in 2022 to date.

Heightened demand has collided with constraints on the global supply chain from social distancing, self-isolation rules and renewed lockdowns in China[8] (even the Ever Given getting stuck[9]). As a result, the cost of shipping goods[10] is around 35% higher than the pre-pandemic high (and over 700% higher than its low). And all of this is before discussing the war in Ukraine[11].

The response by the Bank of England has been to increase the headline rate of interest[12] from 0.1% to 1%, and to stop QE. Tightening monetary policy affects demand as the interest due on many debt repayments is rising and the cost of borrowing is going up. As a result, the GfK UK consumer confidence index[13] is sitting at -40, a historically low level (when the number is positive, it means consumer confidence is high).

This combination of higher interest rates and higher prices has increased the likelihood of a recession. In part, this is because increasing interest rates discourages businesses from investing. But there’s also another problem with discouraging investment: it’s part of the long-term solution to our inflation problem.

Productivity and investment

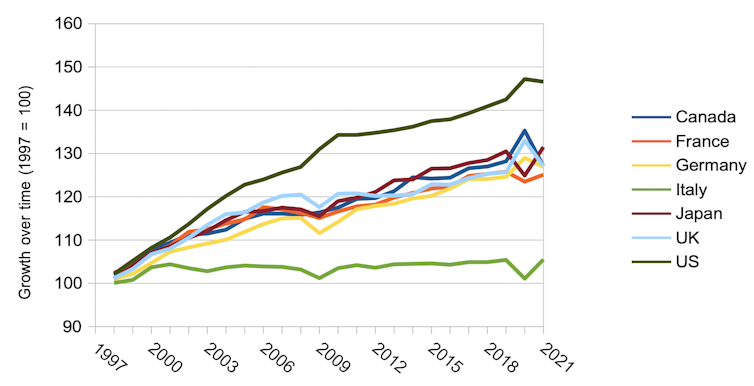

This is linked to the UK’s long-term problem with productivity: in other words, how much each worker produces. The UK productivity rate is growing, which you would expect as technology brings improvements, but the growth is less than that of key international competitors like the US, Germany and France.

While the rate of growth has returned to pre-pandemic levels after plunging during the lockdowns, it is still slower than in the years before the global financial crisis of 2007-09. A PwC report from 2019[14] highlights that annual growth in UK productivity was 2% for the ten years to 2008 and 0.6% for the ten years after, with a productivity gap[15] of approximately 10% to Germany and over 30% to the US.

G7 productivity growth, 1997-2021