'Buy gold, ask questions later'. Octa broker comments on Trump's first 100 days in office

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 8 May 2025 - Donald Trump's rise to the U.S. presidency was marked by a series of bold and unconventional policy proposals that many pundits deemed radical at the time.

Given the length of the campaign and the public nature of his platform, one would think that the market had plenty of time to prepare and price in the potential policy shifts well in advance. However, it turned out that investors were caught off guard by the extent of the upheaval that ensued. Indeed, the first 100 days of Donald Trump's presidency were characterised by extreme volatility and uncertainty for the global financial markets. In this article, Octa broker reviews Trump's policies and analyses their consequences for the global financial markets.

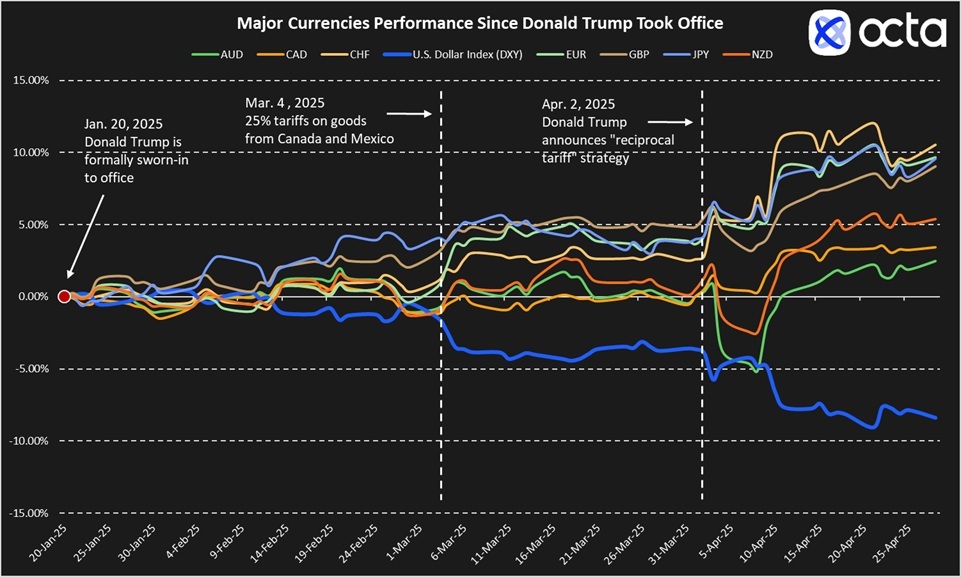

Donald Trump assumed office on 20 January 2025, and market volatility has been rising ever since. Some of Trump's initiatives, particularly his aggressive trade policies, have sent shockwaves through equities, currencies, and commodities, leaving retail forex traders scrambling to adjust. Meanwhile, larger investors struggled to adapt to the rapid pace of proposed reforms and their far-reaching consequences. Overall, the first 100 days of President Trump saw heightened risk aversion and widespread uncertainty, which resulted in sharp fluctuations in asset prices and currency exchange rates as traders reacted to every policy announcement, tweet, and speech from President Trump and his new administration. Below is a list of just a few of the notable days that shook the markets.

Major market-moving events

- 20 January. The U.S. Dollar Index (DXY) dropped by more than 1.20% after news surfaced that the new administration will not immediately impose trade tariffs, prompting a rally in the currencies of some U.S. trading partners: notably, the Mexican peso (MXN), the Euro (EUR) and the Canadian dollar (CAD). It should be noted that prior to the sharp decline, the greenback had been rising almost uninterruptedly since September 2024, almost reaching a three-year high ahead of Trump's inauguration as the market assumed that higher tariffs would spur inflation, prompting the Federal Reserve (Fed) to pursue a more hawkish monetary policy.

- 1–3 February. In the future, historians may label 1 February as the official start of a global trade war. On this day, Donald Trump imposed a 25% tariff on imports from Canada and Mexico, along with an additional 10% tariff on China. The market's reaction was highly negative. U.S. stock futures slumped in early Asian trading on Monday, 3 February, with Nasdaq futures down 2.35% and S&P 500 futures 1.8% lower. U.S. oil prices jumped more than $2, while gasoline futures jumped more than 3%. Meanwhile, the Canadian dollar and Mexican peso weakened substantially, with USDCAD surging past the 1.47900 mark, a 22-year high, and USDMXN touching a 3-year high as economists warned that both countries were at risk of recession once the tariffs kick in. Later that day, Trump agreed to delay 25% tariffs on Canada and Mexico for a month after both countries agreed to take tougher measures to combat migration.

- 3–5 March. This is when the market began to seriously worry about the health of the global economy and a risk-off sentiment became evident. As fresh 25% tariffs on most imports from Mexico and Canada, along with the 20% tariffs on Chinese goods, were scheduled to take effect on 4 March, investors started to sell-off the greenback and flock into gold (XAUUSD) as well as into alternative safe-haven currencies, such as the Swiss franc (CHF) and the Japanese yen (JPY). In just three trading sessions (from 3–5 March), DXY plunged by more than 3% while the gold price gained more than 2%.

- 6 March. Donald Trump signed an executive order establishing a U.S. cryptocurrency reserve. However, it was unclear how exactly this reserve would work and just how much it would differ from Bitcoin holdings already in place. Many crypto enthusiasts were disappointed, which triggered a five-day downturn in BTCUSD, culminating in Bitcoin briefly dipping below the crucial $80,000 level on 10 March.

- 2 April. The trade war entered the next stage when Trump unveiled his long-promised 'reciprocal' tariffs strategy, essentially imposing import duties on more than a hundred countries. The market route began with equity markets losing billions of dollars in valuation. S&P 500 lost more than 11% in just two days, while DXY dropped to a fresh six-month low.

- 9–11 April. Trade war drama continued to unfold. Financial markets were stunned by President Trump's abrupt reversal on tariffs. Duties on trading partners, which had taken effect less than 24 hours prior, were largely rolled back as the President announced a 90-day freeze on the reciprocal tariffs. However, a 10% blanket tariff was still applied to most nations. In contrast, the trade conflict with China escalated sharply. Following China's 84% retaliatory tariff on U.S. goods, the U.S. increased tariffs on Chinese imports to 125%. This, combined with existing duties, brought the total U.S. tariff burden on Chinese imports to 145%. Kar Yong Ang, a financial market analyst at Octa broker, comments: 'I will remember that day for a long time. Traders were stunned by Trump's sudden U-turn on trade policy and really struggled to make sense of it all. A knee-jerk reaction was to simply buy gold and ask questions later.'

Apart from country-based tariffs, Trump also introduced additional import tariffs on aluminium and steel and ordered a probe into duties on copper imports. Overall, his aggressive trade policies have fueled speculation about the global recession, which explains why gold has been one of the best-performing assets since Trump took office. Kar Yong Ang comments: 'We are dealing with a rather unusual situation. Even a global depression is not out of the question as tariffs may disrupt supply chains, hurting global output while also contributing to stronger inflationary pressure. This will certainly complicate monetary policy decisions. If I were to describe Trump's first 100 days in just two words, it would be "run for safety".' Indeed, Trump's recent public criticism of Jerome Powell, the Fed's Chairman, added more fuel to the fire of nervous investor sentiment.

Overall, the full effect of Trump's policies is yet to materialise, but the potential impact on global trade and the macroeconomy is substantial. The IMF, citing escalating trade tensions, downgraded its 2025 global growth forecast to 2.8% and warned of potential stock market crashes and a 7% contraction in the world economy should trade wars persist. Although Scott Bessent, the U.S. Treasury Secretary, hinted at de-escalating U.S.-China trade tensions, it is clear that investors should still get used to living in a period of heightened volatility and uncertainty. Kar Yong Ang has this advice for an average retail trader: 'Focus more on short-term trades with tight stop-losses as opposed to long-term position-trading, cut exposure to U.S. equities, diversify into gold and other safe-haven currencies like Swiss franc and most importantly, keep your mind clear and be ready to quickly switch from one position to another'.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.