Backbase ENGAGE Asia 2024: reinventing the future of banking

Exploring how AI technologies and customer-centric solutions can elevate engagement, accelerate growth, and drive tangible ROE in banking.

HO CHI MINH CITY, VIETNAM - Media OutReach Newswire - 9 September 2024 - Backbase, the global leader in Engagement Banking, will be bringing ENGAGE Asia to Ho Chi Minh City this year.On September 11 and 12, this bustling city will transform into the epicenter of digital banking innovation as Backbase hosts ENGAGE Asia 2024 at the prestigious Le Meridien Saigon hotel. This year's conference, themed "Banking Reinvented," promises to deliver two days of insightful discussions, pioneering achievements, and immersive experiences, setting the stage for the future of customer-centric banking in the Asia Pacific region.

Driving banking transformation and innovation

ENGAGE Asia 2024 will gather over 120 visionary banking leaders, regulators, and tech advisors to explore the transformation of digital banking toward a more customer-focused future. The event features a dynamic agenda, including five customer success stories from Techcombank, EastWest Bank, HDFC Bank, ABBANK, and OCB, showcasing how these banks have innovated to drive ROE, quantify acceleration, lead in humanization, and deliver simplified, intuitive experiences. Additionally, two CXO Asia Panels will highlight insights from top industry banking executives, including Backbase customers BDO Unibank and Chinabank, as they discuss elevating digital engagement and designing banking experiences that cater to the evolving needs of tomorrow’s customers.

With a special focus on AI, sessions such as “Synergizing Success: Architecting AI-Powered Banking Around the Customer with Scalable Differentiation” and "Enhance Customer Value Through AI and Automation" (the latter delivered by Greg Fahy, SVP Technology at Backbase) will delve into how AI technologies are reshaping customer engagement, driving revenue, and enhancing operational efficiency. Attendees will also gain valuable knowledge on leveraging AI for enhancing customer lifetime value, personalized product recommendations, and process optimization, ensuring banks can thrive in an increasingly digital and data-driven landscape.

A lineup of leading speakers

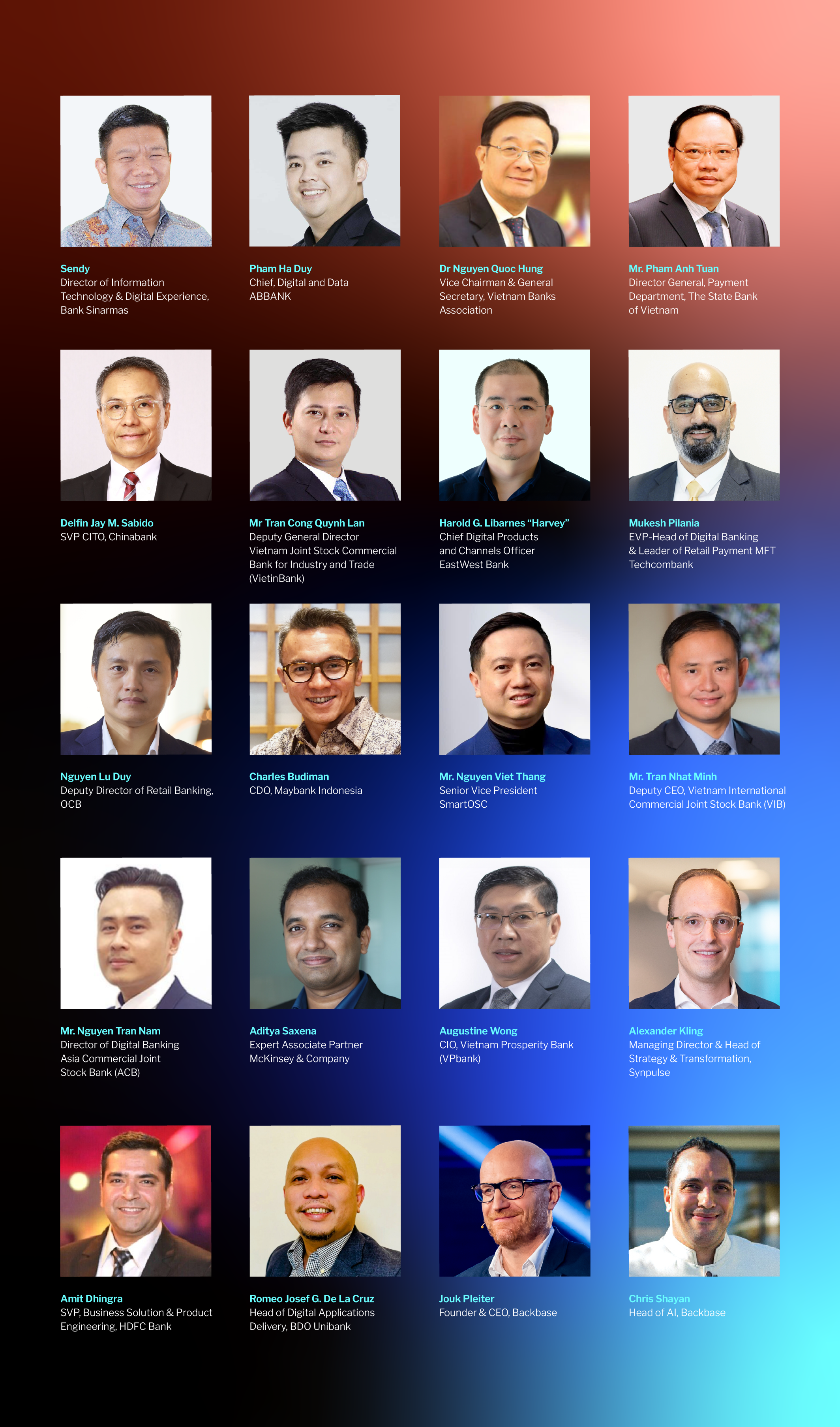

ENGAGE Asia 2024 proudly features an impressive roster of 18 external speakers, including local regulators and C-level executives from top banks across the region.

Regulators

- State Bank of Vietnam

- Vietnam Banks Association (VNBA)

- An Binh Bank (ABBANK)

- Asia Commercial Joint Stock Bank (ACB)

- Bank Sinarmas

- BDO Unibank

- Chinabank

- EastWest Bank

- HDFC Bank

- Maybank Indonesia

- Orient Commercial Joint Stock Bank (OCB)

- Techcombank

- Vietnam Prosperity Bank (VPBank)

- Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank)

- Vietnam International Commercial Joint Stock Bank (VIB)

- McKinsey

- SmartOSC

- Synpulse

These industry leaders will share their expertise and insights on the future of banking:

Celebrating excellence in customer engagement

In the platform era, where banking revolves around the customer and their needs, the Excellence in Customer Engagement Awards 2024 will honor banks that have excelled in digital transformation and customer engagement. This ceremony recognizes the innovation and success stories that have reshaped the banking landscape, setting benchmarks for others to follow. We are celebrating the banking luminaries in Asia who have excelled in customer engagement, demonstrating leadership in this transformative era.

Immersive cultural and networking experiences

Beyond the conference rooms, ENGAGE Asia 2024 embraces the warm hospitality and rich culture of Vietnam, offering delegates a truly immersive experience in Ho Chi Minh City. In the spirit of Asian traditions of relationship-building, we've curated special ENGAGE experiences designed to foster meaningful connections among peers and industry leaders. Attendees will have the opportunity to network while enjoying panoramic views from one of the world's finest sky bars and embarking on a luxurious dinner cruise along the Saigon River. These carefully crafted events, complete with gourmet cuisine and live entertainment, not only facilitate valuable professional connections but also provide a unique opportunity to immerse in the vibrant culture of the host country.

Jouk Pleiter, CEO and Founder of Backbase, emphasizes the significance of the event:

"ENGAGE Asia 2024 is where innovation meets tradition in the heart of Vietnam. We're bringing together the brightest minds in banking to explore AI-driven and customer-centric solutions while fostering meaningful connections. This event isn't just about shaping the future of banking — it's about inspiring a transformation that resonates with the unique spirit of Asian financial services."

For more information and to register, please visit Backbase ENGAGE 2024.

Hashtag: #ENGAGEAsia #Backbase #digitalbanking #engagementbanking #retailbanking #omnichannelbanking #reinventbanking #businessbanking #smebanking #digitalinvesting #AI

https://www.backbase.com

https://www.linkedin.com/company/backbase/

The issuer is solely responsible for the content of this announcement.

Backbase

Backbase is the creator of the Engagement Banking Platform — a unified platform with the customer at the center, empowering banks to accelerate their digital transformation.

From customer onboarding to servicing, loyalty, and loan origination, our single platform — open and frictionless, with ready-to-go apps — improves every aspect of the customer experience. Built from the ground up with the customer at the heart, our Engagement Banking Platform easily plugs into existing core banking systems and comes pre-integrated with the latest fintechs so financial institutions can innovate at scale.

Industry analysts Gartner, Omdia, and IDC continuously recognize Backbase’s category leadership position. Over 120 financial institutions around the world have embraced the Backbase Engagement Banking Platform. In APAC, the customers we serve include ABBANK, BDO Unibank, Chinabank, Bank of the Philippine Islands, EastWest Bank, HDFC Bank, JudoBank, MyState, OCB, Techcombank, Bank Muamalat, and TPBank.

Backbase is a privately funded fintech company, founded in 2003 in Amsterdam (Global HQ), with regional offices in Singapore (APAC HQ), Atlanta (Americas HQ), and operations in Australia, India, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Latin America, and the UK.